Federal EEO-1 / California Payroll Employee Report

EEO-1 Reporting

EEO-1 Component 1 Data Reporting

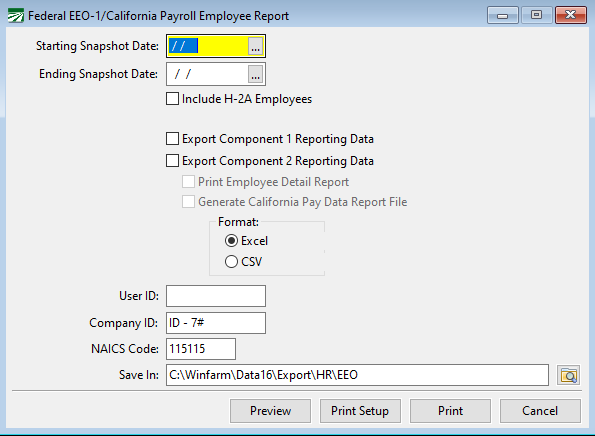

If you are required to file the EEO-1 report, the Federal EEO-1/California Payroll Employee Report window will generate all of the information for that report. You can then use that information to fill out and file your EEO-1.

Go to Reports > Federal EEO-1/California Payroll Employee Report.

To use this report, follow these steps:

-

In the Starting Snapshot Date and Ending Snapshot Date entries, enter the starting and ending check dates for the year you want to print.

-

Click Preview. This will generate a preview of the EEO-1 Employment Information Report and open the Edit Employee EEO Status window. The bottom half of the report will list employees within the snapshot period who are missing information (i.e. Job Category or Race).

-

In the Edit Employee EEO Status window, missing information will be listed as Not Defined. That information can be quickly edited within this window. As you enter the EEO status for an employee, that employee will disappear from the grid. Once the status is entered for every employee file, the grid will be empty. For more information, see See Topic:

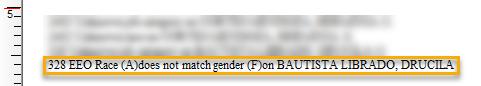

Note When updating an employee's Race, be careful to select the correct gender (e.g. Hispanic Male or Hispanic Female).

-

When you are done, exit the window and click Preview again. Review the report to see if any errors exist. For example, there may be a conflict between the gender selected in the Edit Employee EEO Status window and the gender selected in the Employee File (see image below). Depending on where the error is, make the needed corrections. Then preview the report once more to ensure there are no more errors.

-

Once all corrections have been made, you are ready to upload the report to the EEOC. This can be done one of two ways:

-

Manual Entry: After logging into the EEOC website, manually enter the totals listed at the bottom of the EEO-1 Employee Information Report.

-

File Upload: While still in the Federal EEO-1/California Payroll Employee window, enter your snapshot period.

-

Select Export Component 1 Reporting Data.

-

Format: Select either Excel or CSV.

-

Company ID: Enter the seven digit code for your specific company; this code is provided by the EEOC.

-

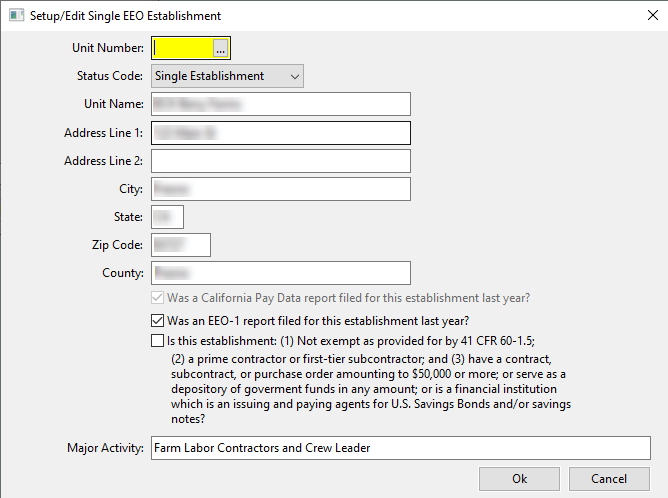

Save In: The program will automatically name the file and save it in the location indicated here. Then click Preview; this will open the Setup/Edit Single EEO Establishment window.

-

Unit Number: Enter the same seven digit code that was entered for your Company ID.

-

Status Code: At this time, the program can only do the Single Establishment option. If you have a Multi-Establishment, please contact Datatech Support for additional assistance.

-

Ensure your company address is listed correctly.

-

Click Ok. The file is then exported to the location indicated in the Save In entry. Navigate back to this location when you are ready to upload the file to the EEOC website.

CA Payroll Employee Report

CA Pay Data Reporting has two reports:

You will have to file either one or both reports depending on how many employees or hired workers you had during the year. If you are a Labor Contractor, you will have to send this information to your growers. If you have over 100 employees, you will also have to file the California Payroll Employee Report.