Bank Reconcilement

Bank Reconciliation

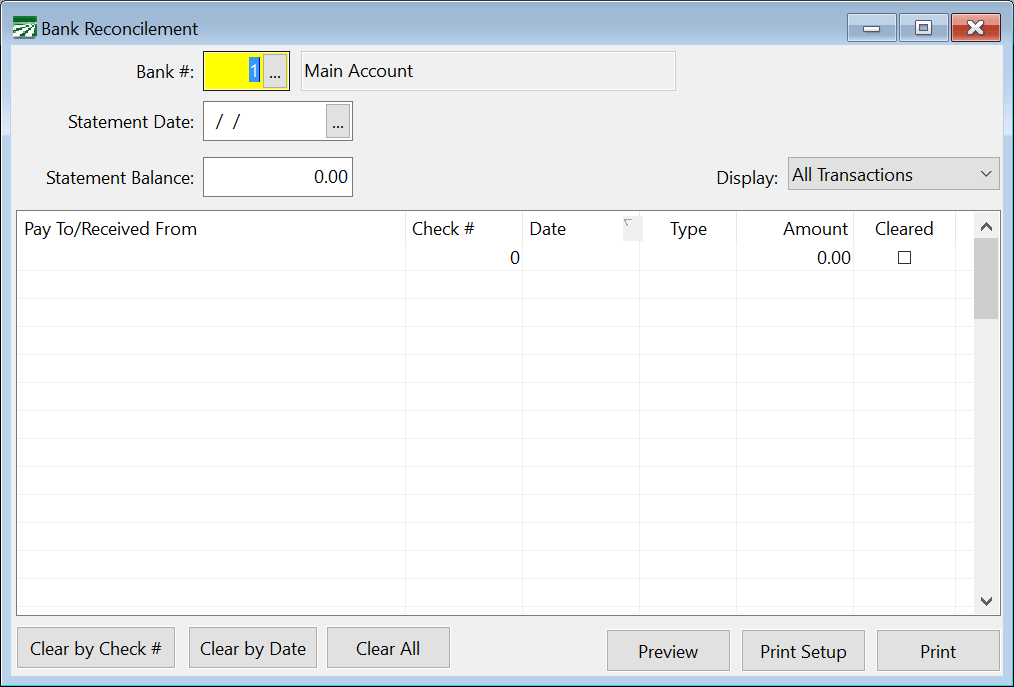

You can quickly and easily reconcile your bank statement to the transactions you have entered. This is done in the Bank Reconcilement window, seen below.

Go to Payables > Bank Reconcilement.

Bank #

Select the bank account you want to reconcile. Press [F4] or click on the lookup button to get a selection list.

Statement Date

Enter the statement date here. The grid will display transactions only up to this date.

Statement Balance

Enter the ending bank balance on your statement.

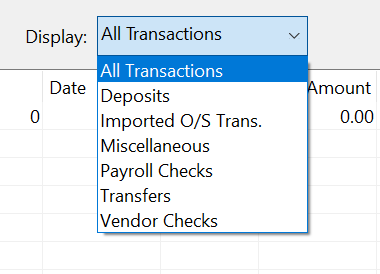

Display

Use this to filter the type of transactions that are displayed. This is very useful if your statement lists transactions in different categories (e.g. Deposits, Checks, Electronic Transactions, etc.).

Note Select Imported O/S Trans. to view outstanding transactions that have been imported from another accounting system.

Vendor Checks

Once you enter the statement date, transactions will be listed in the grid. The rightmost column has a checkbox to indicate whether or not a transaction has cleared. To mark a transaction as cleared, select the box in the right column.

The statement date is recorded on each transaction as each one is checked off. This enables the program to print a report listing all transactions that you cleared for a particular statement. This report is the Cleared Transactions Report, access from the popup menu. (See Special Options below.)

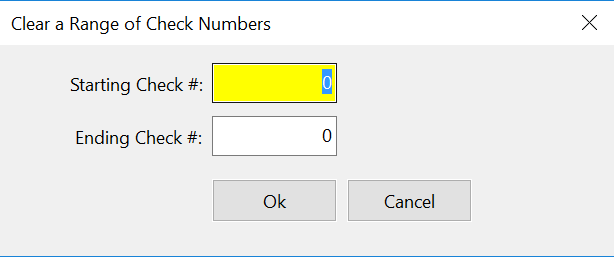

Clearing Transactions by Check #

You can clear a block of checks by clicking on the Clear by Check # button at the bottom left of the window. When you click on this button, a window will appear for you to enter the starting and ending check #'s:

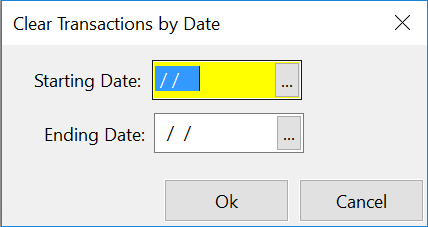

Clearing Transactions by Date

You can clear a block of transactions within a date range by clicking on Clear by Date. This will open the following window:

If your bank statement lists checks in check number order, and marks checks that are out of sequence with an asterisk, then you should be able to easily tell what the starting and ending check numbers are to clear.

Clearing All Displayed Transactions

The Clear All button will mark all transactions currently displayed as cleared. For instance, you might display deposits only and then click on this button to clear all deposits.

Bank Reconcilement Report

When you have finished clearing transactions, click on the Preview or Print buttons.

The Bank Reconcilement Report shows the ending balance from your bank statement, the outstanding transactions, the reconciled bank balance, your book balance, and the difference between the reconciled bank balance and your book balance.

The difference should be zero if everything has been done correctly. Bank Reconcilement Tips have been compiled if you are having trouble reconciling.

We recommend keeping a printed copy of your bank reconcilement report each month.

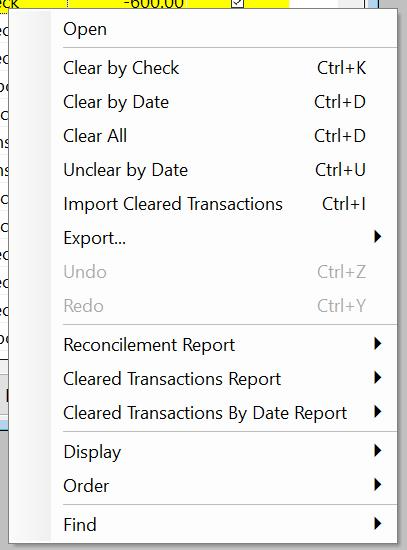

Bank Reconcilement Right-Click Menu

You can right-click on any item within the Bank Reconcilement grid to activate a pop-up menu with additional options.

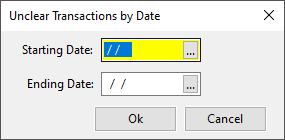

Unclear by Date

Select this option to unclear a previously cleared block of transactions within a date range. When this option is selected, a window will open where you can enter the date range for the transactions you want to unclear. See the image below.

Import Cleared Transactions

Select this option to import a file containing a list of transactions that have cleared. You may be able to download a file from your bank through their online banking features. The file must be a comma separated value text file, and the first line of the file should be a header with specific names for each column that tell the program what data appears in each column.

The columns names understood by the program include (names must match the spelling/case exactly:

-

Date; DATE: Transaction Date

-

Customer Reference; Check #; Serial Number; CHECK NO.: Check Number

-

Amount; AMOUNT: Amount in dollars

-

Cleared Date; Posted Date: Date posted to your bank account

The file must contain at a minimum a check number and amount field for it to match up the transaction listed in the file with the transactions posted to the bank account.

If the program is unable to match any transactions in the import file with existing transactions, a report will be generated listing the transactions that couldn’t be matched up. You will need to determine if these transactions are missing and need to be entered.

Export

Select this option to export either Cleared Transactions or Outstanding Transactions to an Excel spreadsheet.

Finding a Check #

On the popup menu, select the Find option, then select Check #. The keyboard shortcut for this is [Ctrl]+[H]. Enter the check number you want to jump to and press [Enter] or click on the Ok button. If the check number is not found, the program will let you know, otherwise the check will be highlighted.

Finding an Amount

On the popup menu, select the Find option, then select Amount. The keyboard shortcut for this is [Ctrl]+[H]. Enter the amount you want to find, select the direction to look (relative to the currently highlighted line) and press [Enter]. The program will tell you if no transaction are found for that amount, otherwise it will highlight the transaction.

Cleared Transactions Report

This report can be printed instead of or in addition to the Bank Reconcilement Report. It will group transactions together by type, and provide totals for each type of transaction. If you are having trouble reconciling your bank statement, this report may be helpful because you can print it out and compare the transactions listed on it to your bank statement.

From the popup menu, you can select this report and either print it or preview it.

Incomplete/Unfinalized Transactions

Under certain conditions it is possible to start a check or miscellaneous charge entry and not finish it. In these cases, a cash in bank entry is created but it is not posted to the General Ledger because the expense side of the transaction is either not entered or not in balance with the transaction amount.

The Bank Reconcilement Report will print a message if it finds any unfinalized transactions and list the details. In some situations, you might need to delete the unfinalized transaction. For instance, if a check entry was started and not finished, then the check was entered later and printed. In this scenario you may have two transactions with the same check number, one is in balance and one is not. The entry that is not in balance will need to be deleted.

In other cases, you may need to complete the unfinalized transaction. For instance, if you started entering an electronic/ACH transaction but did not finish it, the cash in bank entry will not be posted to the General Ledger, it will not be deducted from your bank account, and it will not appear as an available transaction to clear on the Bank Reconcilement window. Entering the expense information for the transaction will get it finalized and posted to the General Ledger and then you will be able to check it off as a cleared transaction for your bank reconcilement.

Sometimes it can be tricky to find the unfinalized transaction. In the situation where you have two transactions under the same check number, simply typing in that check number on the check entry window may always result in the balanced entry being displayed. You may need to use the lookup button on the Check # entry to select the other transaction that is not finalized.

For a miscellaneous charge, there is normally no check number, so the best way to find the unfinalized transaction is to use the lookup and search by transaction date. To search by date, click on the lookup button on the Trans # entry, click on the Date column heading to put the lookup list in date order, and then start typing in a date to get the search box to appear.

Bank Reconcilement Tips

1) If you have several months to reconcile, start with the oldest month first.

2) Before starting the reconcilement, enter any bank charges or interest into the checkbook.

3) If your report does not reconcile after clearing all checks, deposits, and misc. transactions, view the totals at the bottom of the reconcilement report. This will give you the total of cleared deposits, checks, and other transactions. You can use these figures to compare to your bank statements totals.

4) The Cleared Transactions Report will show the individual transactions that you have cleared, along with the totals by category. When you clear a transaction, the date tied to that transaction is the current statement date you are in when you clear. The Cleared Transaction Report will show transactions you have marked ‘Cleared’ while on that particular statement date. You can use this as a check against the bank statement to make sure you have not missed anything or cleared something that should not be cleared.

5) Have you deleted and re-entered any checks that were cleared on a previous bank statement? A check that was cleared and deleted loses the ‘cleared’ status because there is no record of the check when it is deleted. If it is subsequently re-entered, the new entry is considered outstanding until it is cleared. It is usually best to edit an existing check entry to make corrections. However, if it is necessary to delete and re-enter a check, you should be aware of the impact this has on the bank reconcilement.

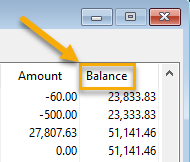

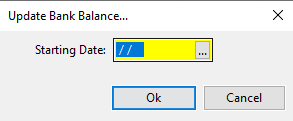

6) Make sure the bank balance is correct. The system will automatically keep the bank balance updated. However, it is possible for the bank balance to be incorrect if there is an unexpected error. To update the bank balance, go to Payables > Checkbook and click on the Balance column heading in the Checkbook Register window. This will open the Update Bank Balance…window. Enter a date equal to or prior to the last month you have reconciled.

7) Verify that the ending balance in the Checkbook Register matches the balance shown on your last Bank Reconcilement Report. If not, a transaction in the past may have been edited, deleted, or added and is affecting your bank balance. In this case, the problem is not in the current month that you are reconciling but is somewhere in the past.

8) Review and compare your old bank reconcilement reports to the current balances in the system. You can even go back to a prior month in the reconcilement window and put in the balance from that prior statement without undoing anything for the current statement. If you preview that prior month and it still balances, that will be your indication the problem is in the current month you are reconciling.

If you find that prior month is out of balance, work back by month to find out when the reconcilement still balances and then you will know something changed in the following month.