Overtime Premium Report

The Overtime Premium Report can be used to calculate the number of overtime hours each employee should be paid, calculate the employees’ Regular Rate of Pay, and create overtime premium line items in the Daily Payroll file to pay employees the overtime/double-time premium amounts.

Note Regulations for paying overtime may vary from one state to another and may vary for employees that are covered under different wage orders. It is your responsibility to know what regulations cover the specific situations for your company. The purpose of this report is to handle situations where employees are paid different rates (including mixed piecework and hourly worked) within the same pay period and are supposed to be paid overtime wages based on a weighted average (the “regular rate of pay”) of their wages.

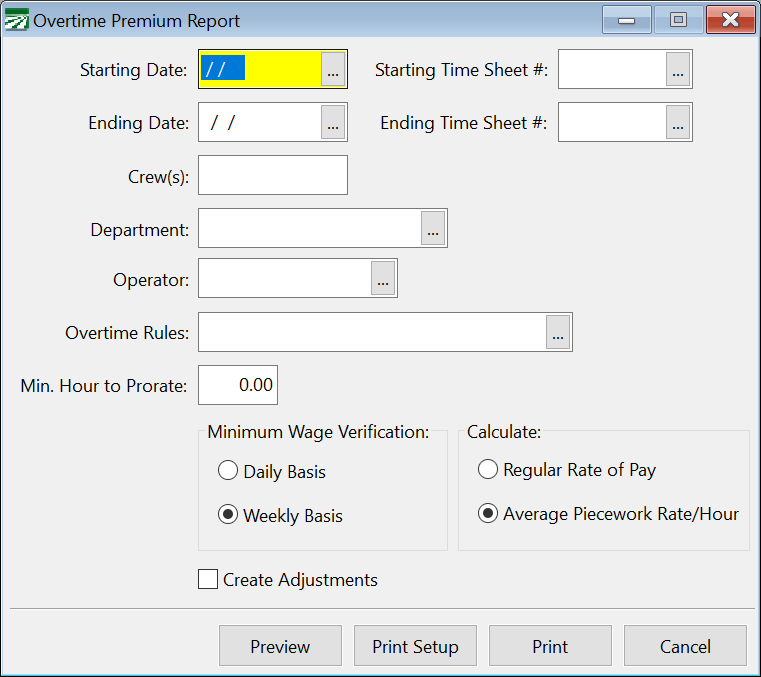

Go to Payroll > Daily Payroll Entry > Overtime Premium Report. (You can also use the right-click menu on the Daily Payroll Entry window under Reports.)

To run this report, you select which Daily Payroll entries will be included on the report and which Overtime Rules to apply.

Starting Date/Ending Date

Enter the date range for the entries to include on the report.

Starting Time Sheet #/Ending Time Sheet #

If you use time sheet numbers, you can select a time sheet number or range of time sheet numbers to include on the report. If you have employees that are covered under different overtime rules, assigning different time sheet numbers for those groups of employees may be one way you can keep their entries separated and apply different rules to their wages.

Crew(s)/Crew ID

If you are using numeric crew numbers, enter one or more crew numbers to include on the report. You can list individual crew numbers separated by commas and/or a range of crew numbers using a dash.

If you are using alphanumeric crew numbers, you can select a single crew ID to print the report for.

Department

If you assign employees to departments, you can use this selection to include employees that are assigned to a single department. Leave this selection blank to include all employees.

Operator

You can print the report for the Daily Payroll entries made by an individual operator, or leave this blank to include all entries in the Daily Payroll file.

Overtime Rules

Select the Overtime Rules to apply for this report. You can set up different overtime rules using the option on the Payroll > Setup menu.

Min. Hour to Prorate

Enter a minimum number of hours to use for the report to decide whether or not to create an overtime premium line. Since the total overtime is pro-rated across all line items for each day (see below for more information and examples), you can enter a minimum number of hours to keep the report from generating overtime premium lines for breaks, travel time, safety meetings or other short periods of time that the employee is being paid for.

Minimum Wage Verification

Select whether you want the report to calculate minimum wage adjustments for each day in the pay period, or a single adjustment for the entire pay period.

When calculating the regular rate of pay, the report will determine if any employees did not make minimum wage, and create adjustment lines in the Daily Payroll file for those employees.

At this time, the report does not calculate or generate any adjustments for guaranteed hourly rate piecework wages. If you need this capability, contact Datatech Customer Support.

Create Adjustments

Leave this box deselected to print a report that just shows the overtime hours, regular rate of pay, and overtime premium amounts without actually creating any line items. When you are

Overtime Premium Report Examples

Using the Overtime Premium method of paying overtime is different from using different wage types to pay overtime rates. When an employee is being paid on an hourly basis, you may enter “RH” lines to pay regular hourly rates up to the daily or weekly limit. If the employee exceeds those limits, then you enter “OT” or “DT” lines to pay overtime and double-time rates.

To use the Overtime Premium method to pay overtime, enter all time using the regular wage types: RH, PW, BH, IP, etc. Do not use the hourly overtime or piecework overtime wage types. Once you have entered all of the time/pieces, you can run the Overtime Premium Report to apply a set of overtime rules to the Daily Payroll Entries.

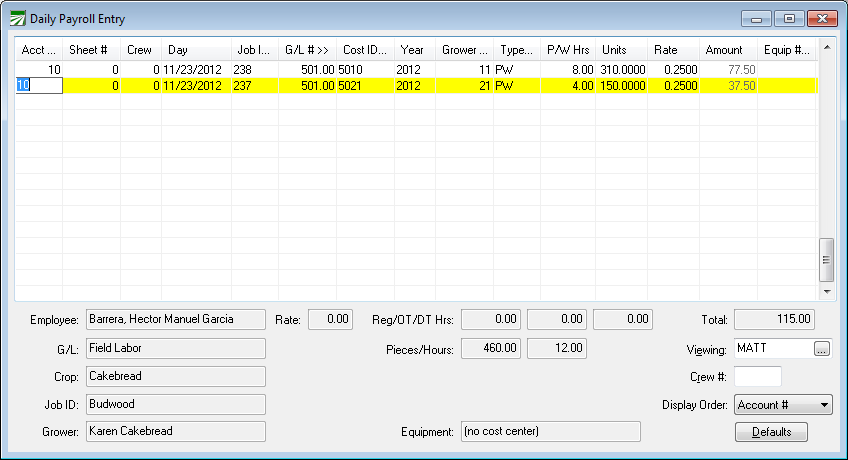

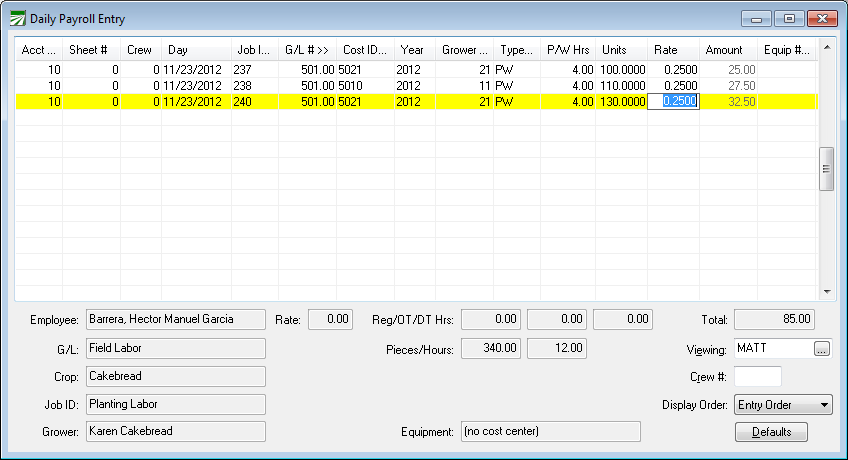

The Overtime Premium Report will calculate the total overtime for the pay period and for each day. Overtime Premium lines are created for each day and allocated across all line items (different Job ID’s, Crop ID’s, etc) for each day on a pro-rated basis. Some examples are helpful in understanding exactly what this means. Consider the following simple examples:

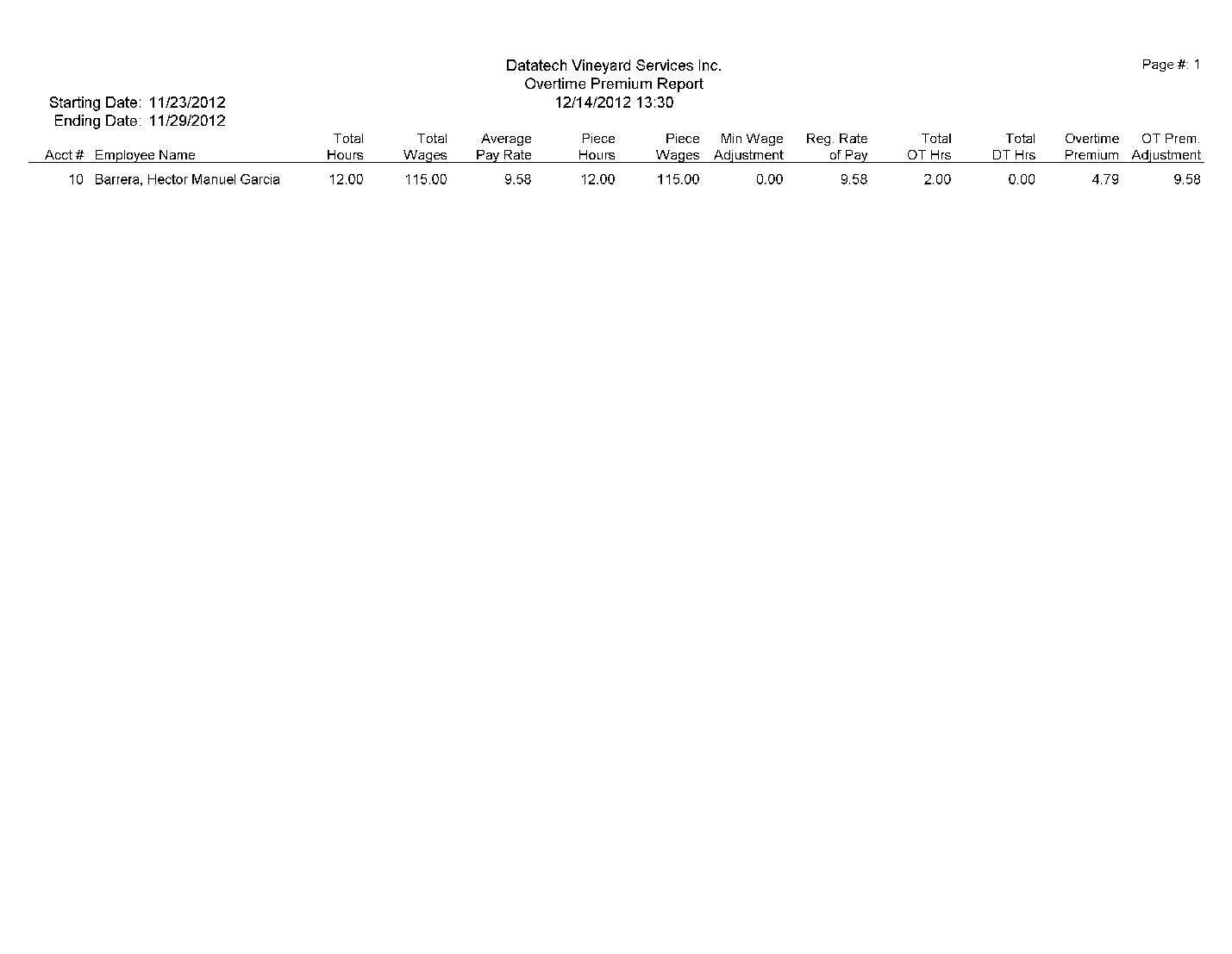

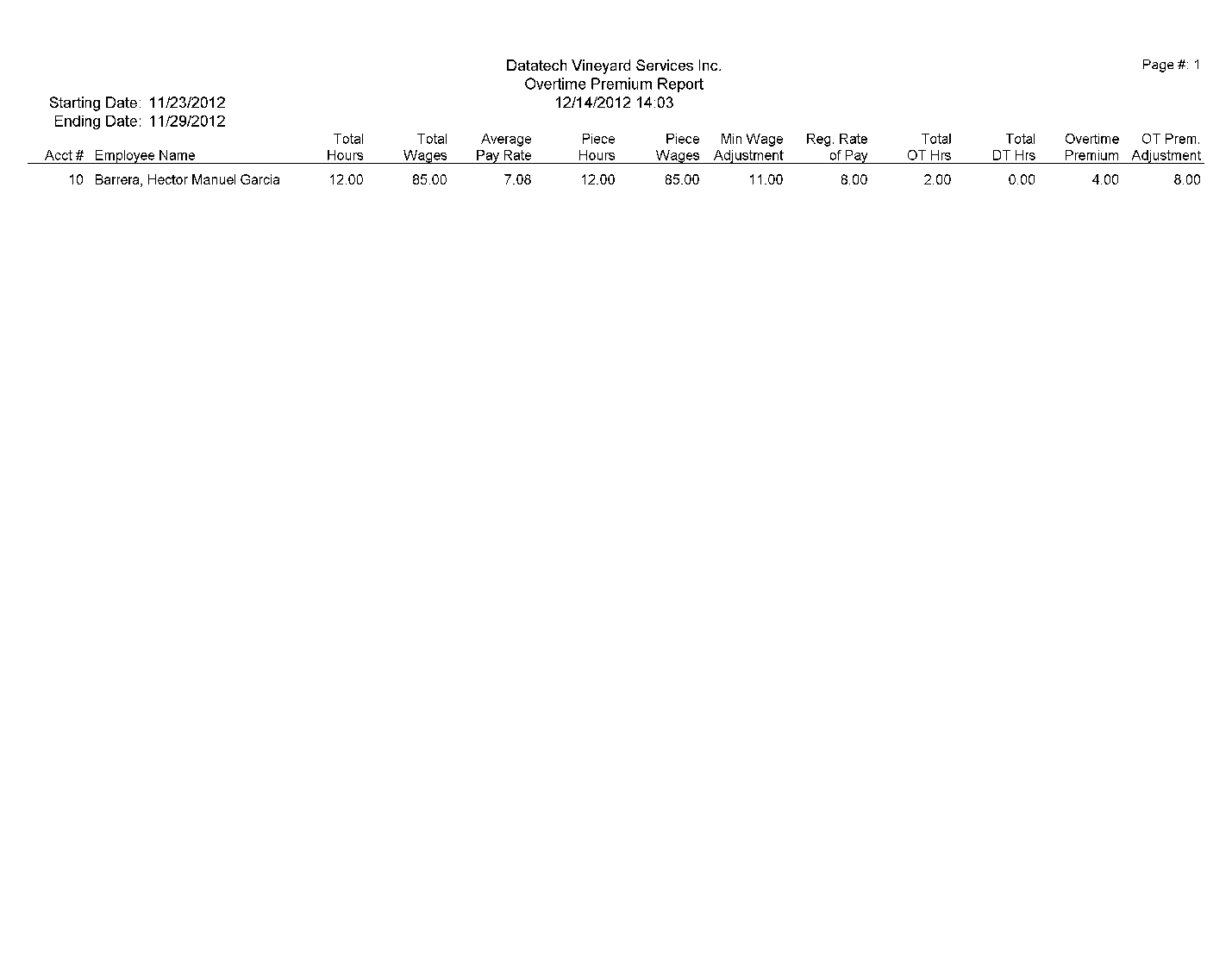

In total, the employee shown above worked 12 hours in one day for two different Growers, Crop ID’s and Job ID’s, with different piece rates and effective hourly rates on each line. There is a 10 hour limit before paying overtime for field labor, so when the Overtime Premium Report is run, it shows two hours of overtime should be paid to the employee:

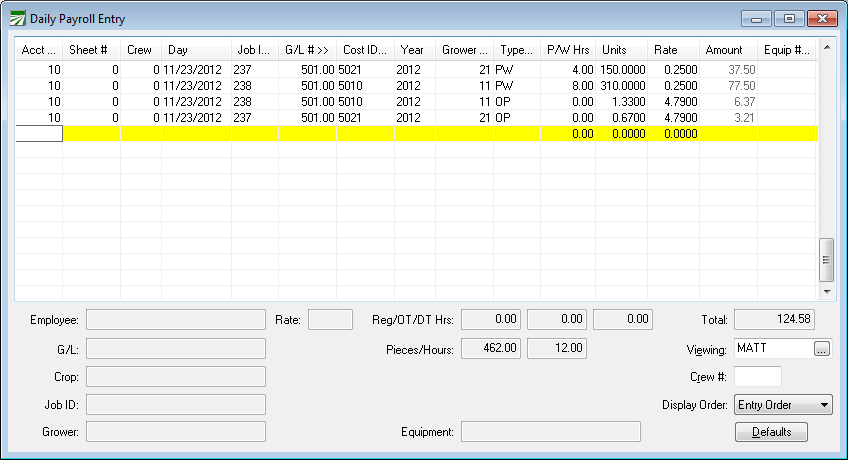

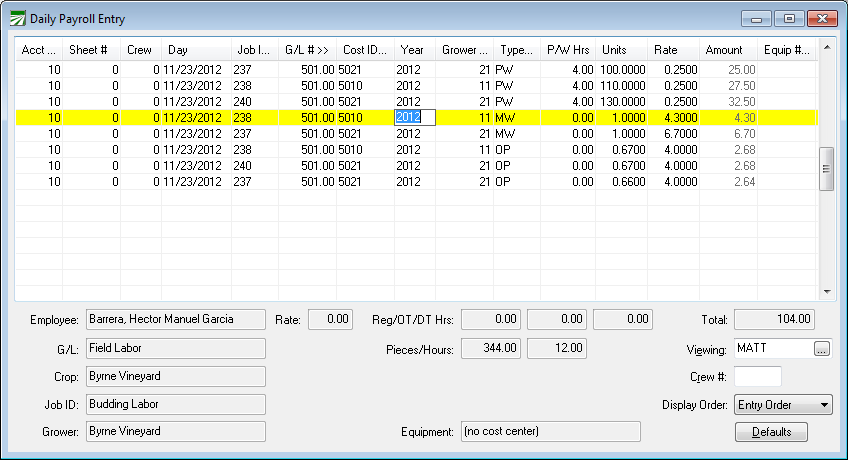

The Regular Rate of Pay is calculated at 9.58 (this is the average pay the employee received in that pay period). After running the Overtime Premium Report with the Create Adjustments box checked, the Daily Payroll file contains the following entries:

Two line items are created, one for each of the original line items paying the employee for the “half-time” portion of the two overtime hours that he is due. The pay rate for these lines is $4.79/hour, which is half of the Regular Rate of Pay calculated on the report.

Why create two line items? Since the start and stop times are not entered, the program has no way of knowing which crop/job/grower “should” be charged for the overtime. Therefore it allocates the overtime hours proportionally based on the hours worked on each line item.

To calculate the regular rate of pay, the program generates lines to bring the employee’s wages up to minimum wage.

Note Since tips are voluntarily left by the customer and are not being provided by the employer, they are not considered as part of the regular rate of pay when calculating overtime.

The program does a similar proportional allocation when it generates minimum wage adjustment lines, but it is based on the dollar amount that the employee is short of minimum wage on each line. Consider the following example:

On the first two lines, the employee did not make minimum wage (4 hours at $8/hour = $32). Since the employee worked 12 hours, at minimum wage, he would make $104 total for the day (10 hours @ $8/hour plus 2 hours @ $12/hour). To calculate the employee’s Regular Rate of Pay, the Overtime Premium Report needs to factor in the minimum wage adjustments as shown below:

For a total of twelve hours, the employee should make a total of $96, plus the overtime premium of $8 (2 hours @ $4/hour) for a total of $104. The report shows that the total piecework wages are $85, so the minimum wage adjustments will total $11.

On the Daily Payroll window, you will see two minimum wage adjustment lines and three overtime premium lines:

Why only two minimum wage adjustment lines? Since the third piecework line was not short at all, no adjustment is created for that line. Only the first two lines need to have minimum wage made up. The first line is short by $7, and the second by $4.5. Since the third line item is $.50 over the minimum wage, the net adjustment amount that is needed for this day is $11 ($7.00+$4.50-$0.50).

The adjustment is allocated proportionally based on how short each line item is and the total of all short amounts. So 60.9% ($7/$11.50) is allocated to the first line and 39.1% ($4.5/$11.50) to the second line. The result is one adjustment amount for $6.70 (60.9% of $11) and one for $4.30 (39.1% of $11).

Minimum Hours to Prorate

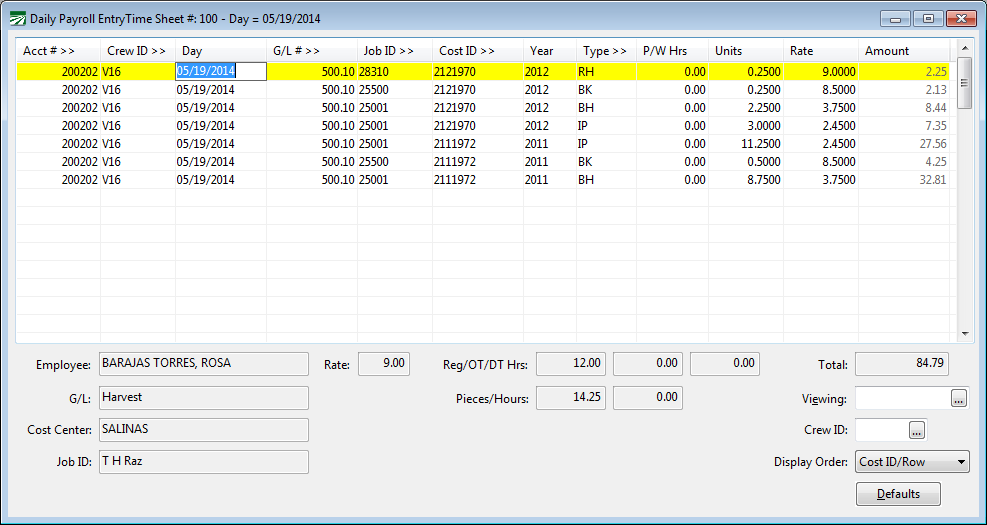

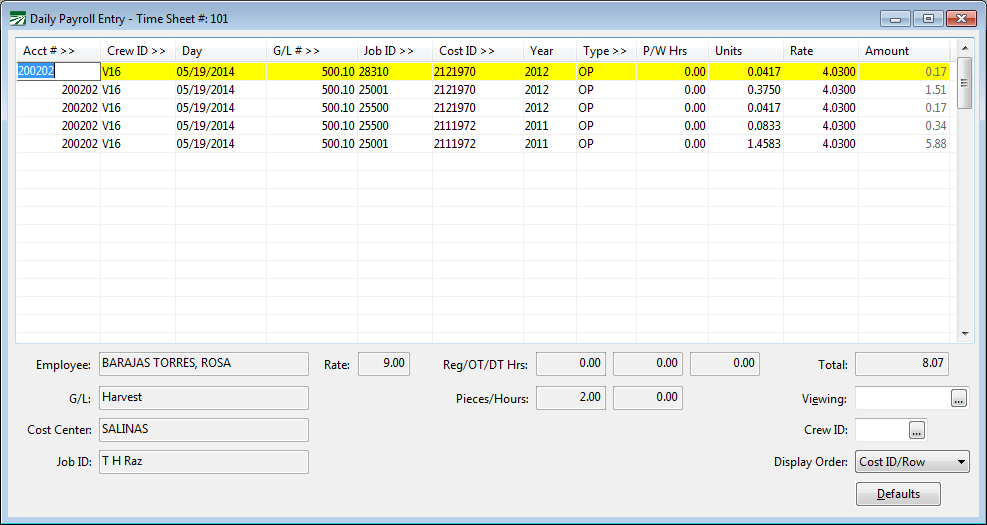

Normally the Overtime Premium Report will pro-rate the overtime hours across all of the line items on each day, so that the overtime will be applied proportionally to each Cost ID, Job Code, G/L # and Grower used. Here is an example of line items on one day with five different hour amounts:

The employee worked for a total of 12 hours on this day, and should be paid for two hours of overtime. The hours are entered on a total of five lines using the following wage types: one RH, two BK, and two BH. When the Overtime Premium Report is run, the following lines will be generated:

Because hours were entered on five different lines, the report has generated five lines with the two overtime hours allocated proportionally across all five, totaling $8.07. You may decide that you don’t want to bother allocating such small amounts for short periods of time. The more line items that are generated with small amounts, the more likely it is that unavoidable discrepancies due to rounding will occur.

Note The program will make sure that the employees are paid for the correct amount of overtime hours, even if it is necessary to adjust the units or pay rate to do so.

This example illustrates the rounding discrepancies that are possible: The employee should be paid for two hours at $4.03 overtime premium rate, or $8.06. However, because five separate calculations are done and the result of each is rounded to the nearest cent, the employee is actually paid one cent more.

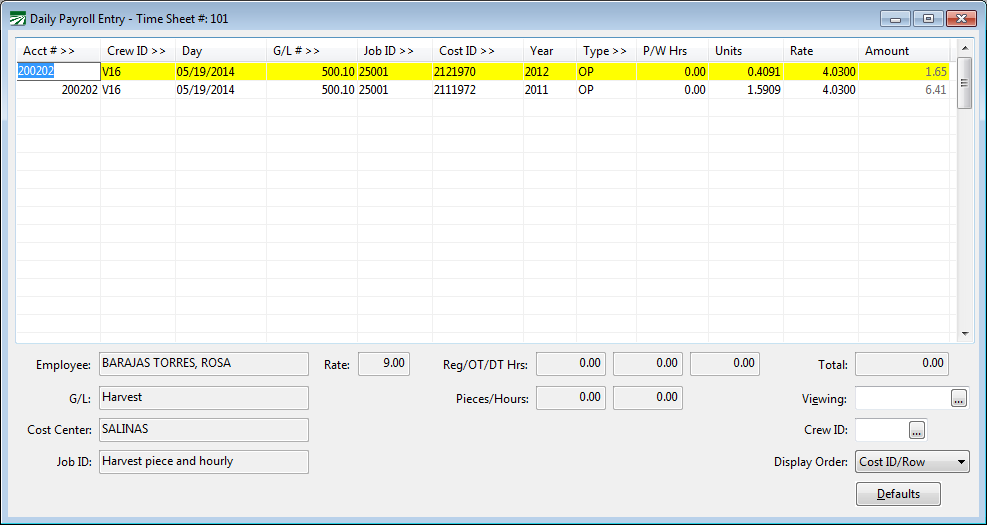

To minimize the number of line items that are generated (and that will print on the check stub) as well as the potential for rounding discrepancies, you can enter a minimum number of hours to filter out line items with a small number of hours from the pro-rating calculations. Employees will still be paid for the same number of hours on the overtime premium lines, it’s just that fewer lines items are generated (spreading the overtime costs over a smaller set of lines).

Using the above example, if the overtime premium report is run with a minimum hour to prorate of 1, only two line items are generated (from the lines with the BH wage type):

The RH and BK lines are not used when generating the overtime premium lines. The two BH lines are allocated proportionally; 2.25 and 8.75 with a total of 11 hours results in 20.45% and 79.55% respectively. The employee is still paid for two hours of overtime at $4.03/hour, and the entries that are generated total $8.06 (20.45% of $8.06 is $1.65 and 79.55% of $8.06 is 6.41).