AB 1513 Safe Harbor Report

This report is designed to calculate break time that is due to employees and break time that has already been paid. The report calculates the amounts due to employees for breaks based on the two “safe harbor” methods defined by AB 1513. The difference between the two amounts may be used as the basis for making safe harbor payments to employees.

The report can generate a detail file that contains the total wages, hours, breaks paid, breaks due, and non-productive wages. This detail file is in turn used to print additional reports (such as by grower), review the payment information, and eventually generate the safe harbor check and the statement that must be given to the employee.

Go to Payroll > Reports > AB 1513 Reports > AB 1513 Safe Harbor Report.

Disclaimer

Datatech recommends that you seek legal advice if you choose to make payments under the AB 1513 safe harbor. By making the safe harbor payments, it will provide you with an “affirmative defense” for wage claims during the applicable time period. This does not mean that you are immune from a wage claim; only that you have a defense already that you have made the appropriate payments.

You are responsible for determining that the amounts calculated by this report are correct under the applicable safe harbor provisions. Datatech cannot be held responsible for errors in calculations that are beyond our control, including but not limited to: variances in setup, use of the program, how data has been entered on checks, or missing information that is needed for calculations to be made correctly. In some cases, customers have unique situations that may require additional programming or the addition of new logic to determine the correct amounts. If this applies to you, we will work with you to add the needed programming to make the calculations according to your specific needs.

At the time of initial release, this report should be sufficient to produce an estimate of the total number of employees to whom payments will be made as well as an estimate of the total payments to be made. The actual number of employees and actual payment amounts may vary if adjustments to the program’s calculations are required and/or changes are made by the user to the logic used to determine correct pay types, break times, or other items that will affect the calculations.

Report Assumptions

Several assumptions are built into the report logic:

Employees are only due break time when they are paid on a piecework basis during the pay period.

Any time that an employee is paid at a straight hourly rate is inclusive of breaks. In other words, if an employee is paid for 8 hours of regular time, the employee is due 20 minutes of break time and was paid for that break time (it was included in the 8 hours paid).

Any time that an employee is paid at a base hourly plus incentive piecework rate is also treated as including breaks. In this case however, the break time paid is credited only for the base hourly rate.

Any time that an employee is paid at a straight piecework rate is also inclusive of breaks. However, unless the break time is paid with separate line items on the check, the report assumes that the break was not paid for that time. The employee will be due break time wages for the number of breaks due based on the total piecework hours worked.

Any time that is paid to an employee at a straight piecework rate must include the number of hours worked by the employee. If the number of hours has not been entered, then the program will have no way of knowing how many breaks the employee was due for those wages.

In order to determine how many breaks each employee was due, the program must know how many hours were worked each day. A table is then used to determine how many breaks the employee was due based on the total hours worked per day. If your payroll is not entered with separate lines for each day, the report will not be able to accurately determine the correct number of breaks that the employee is due.

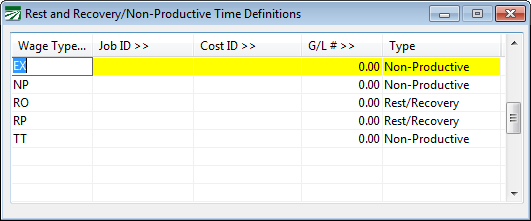

Using either safe harbor method, you must set up entries in the Rest & Recovery Time table to define what wage type codes (and/or phases, cost center ID’s, or G/L #’s) are used for rest and recovery line items. This is necessary for the report to identify lines items for breaks that have been paid.

If you are using the 4% safe harbor method, you must also set up entries in the table for any non-productive time that employees may have been paid for. This is necessary so that those amounts can be subtracted out separately from the gross amount due.

4% Safe Harbor Method

Under this method, for each employee the employer totals the gross wages for all pay periods in which any work was performed on a piece-rate basis from July 1, 2012 through December 31, 2015 and multiplies this by 4%. Then any amounts already paid to the employee for breaks separate from the piece rate compensation are subtracted from this number. Also, up to 1% of the gross wages for other non-productive time that may have been paid is subtracted. The result is the amount which is paid to the employee.

In some cases, the 4% method may lead to a negative adjustment for one or more days on a check (possible for the entire check). Since the calculation is based on the gross wages for the entire period from July 1, 2012 to December 31, 2015, negative amounts must be retained for the total of all checks to match the total for each employee.

Actual Sums Due Method

Using the “actual sums due” method, the employer determines the actual amounts due to employees for breaks (less breaks that have already been paid). Using this method, you are not able to subtract out non-productive time. The text of AB 1513 does not provide a definition for “actual sums due”, and the DIR has not provided a definition. If litigation were to be filed, a court would need to resolve the question of whether or not the definition for “actual sums due” that you used was correct.

In addition to the difference between what the employee is due and what was paid, you must pay interest on the amounts due the employee. (The interest rate is 10% per annum. This is assumed to be simple interest, not compounded interest.)

The report provides three methods for determining the actual sums due. The first method uses the new regular rate of pay calculation for break wages put into effect on Jan 1 2016. It will calculate the regular rate of pay and use this as the basis for actual sums due for all breaks due during a pay period in which the employee had any piecework earnings. This standard was not in effect during this time period and a judge has ruled that AB 1513 does not impose this method for the safe harbor period. However, since it is the standard calculation going forward, you may view it as the method that is most likely to survive a challenge.

The second method is based on paying the minimum wage for all breaks due to employees when earning piecework wages. This method is designed to track the requirement imposed by the Bluford and Gonzalez decisions. Based on the number of piecework hours worked, the employee is credited with break time due, and that break time is due to be paid to the employee at the minimum wage in effect at the time. This method should be considered a “beta” feature as of its release on Sept 2, 2016.

Note Neither of these calculations takes into account the labor commissioner’s “average hourly piecework rate” calculation. The legal status of this calculation is unclear at this time. (Sept 2, 2016)

The third method uses either the rate on existing break lines of the check to determine the rate that unpaid break should be paid at. If no unpaid break lines are present, then the program calculates the average hourly rate and uses that rate. This option may be used in cases where employees were guaranteed an hourly rate that is above minimum wage (including for their breaks). The average hourly rate will be assumed to be at or above this minimum rate.

Report Selection Parameters

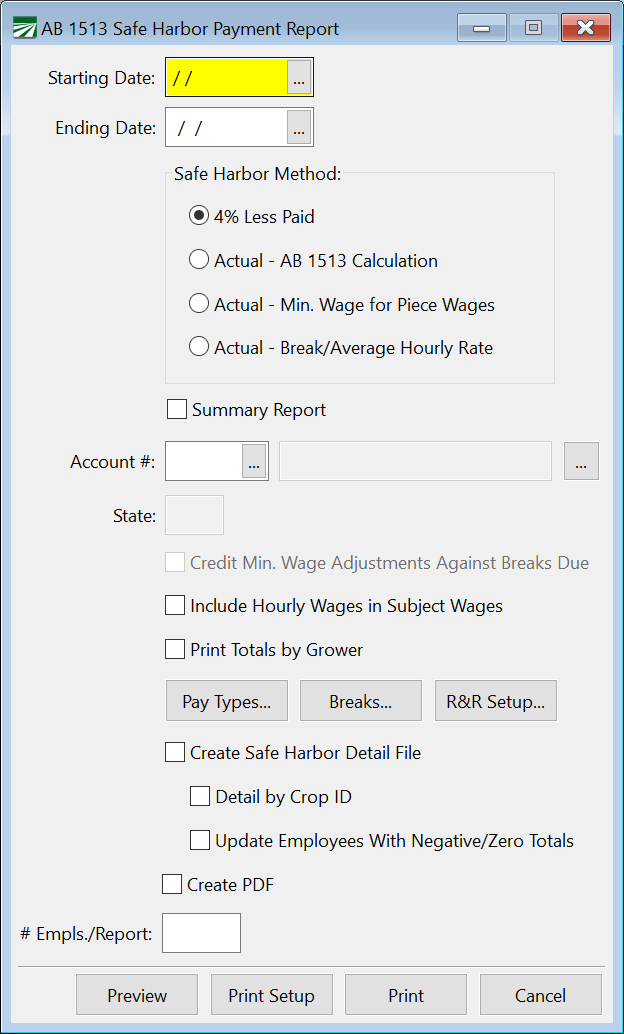

Starting Date/Ending Date

Enter the date range that you want to print the report for. When testing the report, we recommend that you print for a shorter time period (for instance, a single month) first to review the calculations before printing for a long time period.

Safe Harbor Method

Select either the 4% Less Paid or one of the the Actual methods. A different report layout is produced for the 4% vs. Actual methods.

Summary Report

This option currently only works on the “4% Less Paid” safe harbor method. If you select the “Actual” method, selecting this box will have no effect.

When selected, this will print a single line per check instead of printing a single line for each day worked.

Account #

To print the report for a single employee, enter the account # here. When testing the report, you may want to print a single employee for the entire period covered by the safe harbor option.

State

If you are a multi-state employer, this entry will be enabled and you can enter “CA” to only include checks that were issued for California.

Credit Minimum Wage Adjustments Against Breaks Due

If this box is selected, then when using the actual method, if an employee has minimum wage adjustments for a day, the adjustments wages will be credited against the breaks due. The reasoning behind this option is that an employee whose wages are brought up to minimum wage is not due any additional wages for breaks. All hours worked (piecework and breaks) have already been paid at minimum wage and the employee would be due no additional wages.

Print Totals by Grower

This option can be used by labor contractors. When this box is selected, a summary total section will be printed at the end of the report showing the break wages due for each grower.

Pay Types

Click on this button to override the “Base Pay Type” setting for

Breaks

Click on this button to change the hours that employees must work to be credited with break time.

R&R Setup

Click on this button to enter your Rest and Recover and Non-Productive Time definitions.

Create Safe Harbor Detail File

Select this box to generate the safe harbor detail file.

Detail by Crop ID

Select this box if you want the safe harbor detail to be compiled by cost ID. If this option is chosen, then the resulting safe harbor checks will be created with the cost center information (based on the cost center(s) the employee worked in when wages were originally earned).

For farm labor contractors, the detail file will automatically generate detail records for each grower.

Pay Type Definitions

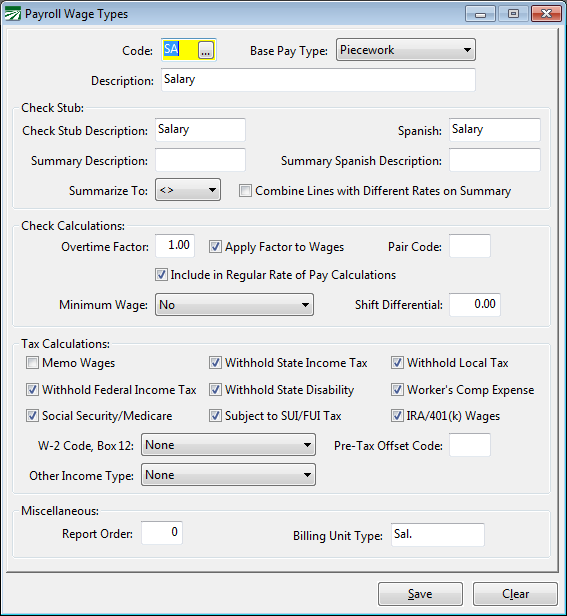

In the wage type file, the “Base Pay Type” is fundamental in determining how wages are classified and treated. The “Piecework” setting for the “Base Pay Type” is what tells the program that the wages are to be treated as piecework wages.

In some cases, customers have modified the “Base Pay Type” of the default pay types. In other cases, some wages types that were meant for one purpose are used for another and so the base pay type really doesn’t apply. It may also be the case that new wages types have been set up that for this report need to be treated differently than how they are defined. For purposes of the AB 1513 calculations, the Base Pay Type may need to be overridden in these cases.

For instance, some customers change the Base Pay type on the Salary wage type (SA) from Salary to Piecework as shown below:

Doing this will enable the P/W Hours column, and this allows the actual hours worked by salary employees to be entered. But it also means that the program will consider all wages entered under the SA wage type to be piecework wages.

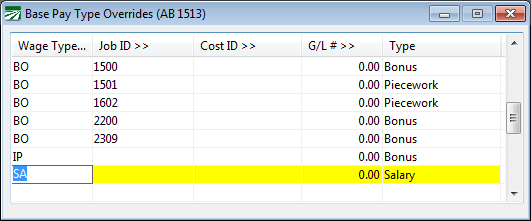

For purposes of AB 1513, these wages should not be treated as piecework wages. Therefore, you may need to add a line as highlighted below:

For purposes of the AB 1513 report, the line for the SA wage type in this table tells the report to treat all wages entered under the SA wage type as Salary wages instead of Piecework wages.

The line for the IP wage type tells the program to treat those wages as a bonus amount, instead of piecework wages. In this case, the IP wage type was used on payroll checks as a bonus amount instead of as an incentive piecework rate paid in addition to a base hourly rate (it’s intended function).

In addition to simply entering the wage type, you can also enter a Job ID, Cost Center ID, and/or G/L #. The BO lines in the screenshot above all have different Job IDs. In this example, lines where the BO wage type is used are treated as either Bonus or Piecework wages, depending on which Job ID was used on the line.

Break Setup

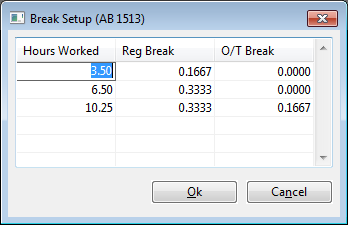

The program determines how many breaks the employee was due based on the break table. This is also used to determine how much break time the employee was paid for that is included in hourly wages. You may modify this table if you want to control how breaks time is determined.

The default settings are shown above. If an employee works less than 3.5 hours, then no breaks will be due/credited. If the employee works at least 3.5 hours but less than 6.5 hours, then the employee is credited with one break. If the employee works more than 6.5 hours but less than 10.25 hours, the employee is credited with two breaks. If the employee works more than 10.25 hours, the employee is credited with three breaks, one of which is paid at an overtime rate.

Each break is assumed to be 10 minutes long (.1667 for one break, .3333 for two breaks, and .5 for three breaks).

Rest and Recovery/Non-Productive Time

If you have paid employees for breaks during the report period, the program needs to know how those lines were entered so that it can subtract paid breaks from the amount due the employee. In addition, if you have paid the employees for other non-productive time and are using the 4% safe harbor method, the program needs to know which wages types are used for that time so that it can add up the non-productive time and subtract that separately.

If you are already using the Rest and Recovery calculations available on the Daily Payroll options, then you likely already have your rest and recovery codes defined. You may just need to add any non-productive time wage types.