Print Safe Harbor Statements

AB 1513 requires that the employer provide a statement to the employee explaining the payment. According to the law, this statements requires:

“(A) A statement that the payment has been made pursuant to this section.

(B) A statement as to whether the payment was determined based on the formula in subparagraph (A) of paragraph (1), or on the formula in subparagraph (B) of paragraph (1).

(C) If the payment is based on the formula in subparagraph (A) of paragraph (1), a statement, spreadsheet, listing, or similar document that states, for each pay period for which compensation was included in the payment, the total hours of rest and recovery periods and other nonproductive time of the employee, the rates of compensation for that time, and the gross wages paid for that time.

(D) If the payment is based on the formula in subparagraph (B) of paragraph (1), a statement, spreadsheet, listing, or similar document that shows, for each pay period during which the employee had earnings during the period from July 1, 2012, through December 31, 2015, inclusive, the gross wages of the employee and any amounts already paid to the employee, separate from piece-rate compensation, for rest and recovery periods and other nonproductive time.

(E) The calculations that were made to determine the total payment made.”

Paragraph (C) applies to the “actual sums due” method and paragraph (D) applies to the 4% method.

The Print Safe Harbor Employee Statements is designed to print all of the information required for each pay period according for each of the methods. In additional, you can prepare two files containing the require explanations in Word or WordPad, save these files as Rich Text File (RTF) documents, and include these explanations at the beginning and/or end of the statement.

In addition to printing the statements, this option can generate an individual PDF file for each employee. AB 1513 requires that you keep this information for until December 16, 2020 and furnish the records to an employee on request. You may also need to generate PDF copies of the statements and send these to a third party administrator that is actually issuing the payments.

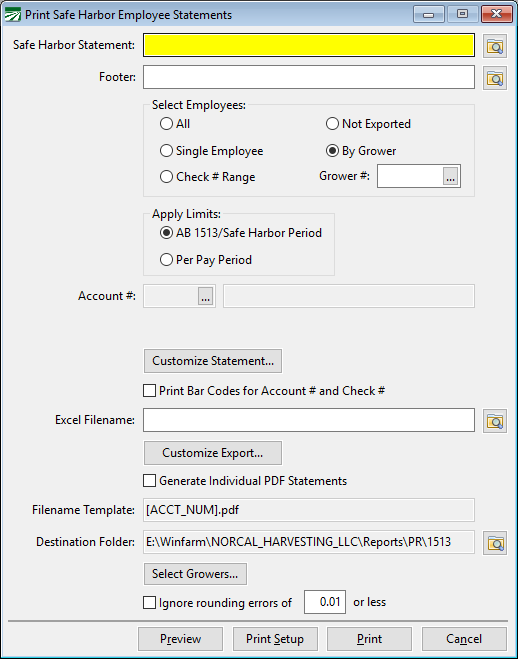

When you select the Print Safe Harbor Statements option, the following window will appear:

Footer

AB 1513 requires that you provide a written statement to the employee informing them that the payment is begin made under the Safe Harbor provisions of AB 1513 and explaining how the payment amounts were determined. You can create this explanation in Word and save it as a Rich Text File (RTF), then select that file for the Safe Harbor Statement. You can click on the prompt buttons to select the file names of the RTF files.

The Safe Harbor Statement will be printed on the first page of the statement, followed by a heading with the employee name, account number, last four digits of the employees social security number, and the check #. The pay period details will be printed after the employee/check information.

You can also create a separate file (also a Rich Text File) that will be printed at the end of the statement, and select this for the Footer.

The basic formatting of the text in the Rich Text Files will be retained (including font, font size, bold/italics/underline, indentation, etc.). Bitmaps/graphics will not be printed.

Select Employees

Select whether you want to print statements for all employees, a single employee for employees based on a check number range, employees that have not had their safe harbor payment data exported, or employees that worked for a specific grower account.

If you select the Single Employee option, the Acct # entry will be enabled below. If you select the Check # Range option, entries will appear for you to enter the starting and ending check numbers.

Apply Limits

When using the 4% Method, this option allows you to select one of two different methods of limiting previously paid non-productive and break wages. If you are using the “actual sums due” method, this selection will not be enabled.

The standard AB 1513 limits will be applied by default. This means that the payment amount will be based on 4% of the total subject wages for the entire Safe Harbor period, less previously paid breaks and less previously paid non-productive time up to 1% of the total subject wages.

The “Per Pay Period” option will apply the 1% limit for non-productive wages to each pay period. It will also limit the combined amount of break wages and non-productive wages previously paid to 4% of the gross wages for the pay period. Using these limits means that the safe harbor payment made to the employee will be higher than using the standard calculation specified in the law.

Since the Create Safe Harbor Checks and the Safe Harbor Statements both perform the same calculations to arrive at the safe harbor payment amount, and each of the methods for applying limits may result in different amounts, it is critical that you select the same option for this entry when using each of these options.

Customize Statement

Click on this button to change the columns that will appear on the statement. Different columns will be enabled depending on whether you are using the 4% or the actual sums due method.

Print Bar Codes for Account # and Check #

Select this box to print bar codes at the bottom of the pages. The employee account number bar code will print in the bottom left corner and the check # bar code will print at the bottom center.

Excel Filename

The safe harbor statement detail may be exported to an Excel spreadsheet. You may need to use this option if you need to send the statement detail information to a third party administrative company who will actually be generating the statements.

Customize Export

Click on this button to select the columns that will be included in the Excel spreadsheet that is exported.

Generate Individual PDF Statements

Select this box to generate PDF copies of statements for the selected employees.

Filename Template

Enter a template to use for the file name. A unique file name should be generated for each employee. This is accomplished by using codes in square brackets which will be replaced by the employees information. Anything that is not in square brackets will be part of the file name.

The following codes can be used in the template:

[ACCT_NUM] – Employee’s numeric account number.

[LAST_NAME] – Employee’s last name.

[FIRST_NAME] – Employee’s first name/middle initial.

[SS4] – The last four digits of the employee’s social security number.

Using “[SS4] [ACCT_NUM] Safe Harbor.pdf” will generate a file name with the first four digits at the beginning of the filename. This may make it easier to find the correct file if an employee requests a copy of the statement but does not remember his or her account number.

If you are sending a set of files to a third party administrator, then you could use the template “[ACCT_NUM].pdf” to generate a filename that consists solely of the employee’s account number.

Destination Folder

The default location that the statements will be saved in will be the “Reports\PR\1513” subfolder under your data folder. You can change this folder if you want to put the files in a different location. If the folder does not exists when the statements are generated, the program will attempt to create it.

Select Growers

If you need to include or exclude specific growers wages on the statement, click on this button to open a multi-select look-up list where you can select wages to include by grower account. This may be necessary in cases where a grower is making their own payments to employees.

In these situations, you must make sure that you select the same grower account(s) that were selected when the Safe Harbor checks were created. If not, the calculations will not match and you will receive warning messages telling you that the check amounts do not match the statement totals.

Ignore rounding errors

The 1513 Statement printing option performs a separate calculation for the total payment due to the employee. The Create Safe Harbor Checks process also performs its own calculation. Under normal circumstances, both of these calculations should arrive at the same number. It is possible under certain conditions that due to rounding or other factors, small differences between the calculations can arise. If you do not consider these differences material and do not want to see warning messages about differences in the calculations, you can select this box.