Overtime Audit Report

The Overtime Audit Report is designed to provide warning messages when there are discrepancies with how overtime has been calculated and/or paid.

The report also shows the difference between what an employee was paid and what they should have been paid. This information can then be used to create a check to compensate the employee for the difference.

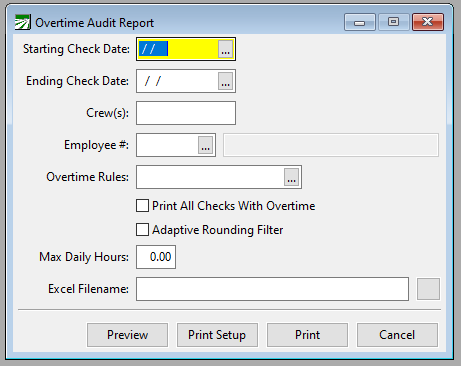

Go to Payroll > Reports > Overtime Audit Report.

Starting Check Date/Ending Check Date

The report is generated based on a date range. Enter a starting and ending check date here for the date range you have chosen.

Employee #

If you want to generate the report for a single employee, enter their account number here or select the employee using the lookup button. Leave this entry blank if you want to generate the report for all employees.

Overtime Rules

Enter the applicable overtime rules or select them using the lookup button.

Print All Checks With Overtime

Select this checkbox if you want the report to only include checks with overtime.

Adaptive Rounding Filter

Select this checkbox if you want to exclude checks where only a few cents were calculated as being owed to the employee.

Excel Filename

If you want to export the report to Excel, enter a filename here and select a location on your computer to where it should be saved.

The report will provide the following warning messages based on the discrepancies the program finds:

-

“WARNING: "Regular hours negative: (Regular Hours)”

Regular Hours are less than zero.

-

“WARNING: "Overtime hours negative: (Overtime Hours)”

Overtime Hours are less than zero.

-

“WARNING: "Double time hours negative: (Double Time Hours)”

Double Time Hours are less than zero.

-

“WARNING: Multiple pay rates on this check, make sure manual overtime is paid at employee's Regular Rate of Pay: (Regular Rate of Pay)”

The overtime pay is not paid out correctly

-

"WARNING: Difference in calculated vs. manually paid overtime/double time hours, verify hours paid on this check"

If overtime hours are not zero, this warning is generated: “(Date Worked) OT calculated: (Calculated OT Hours for the day) Paid manually: (Paid OT Hours for the day)”.

If double time hours are not zero, this warning is generated: “(Date Worked) DT calculated: (Calculated DT Hours for the day) Paid manually: (Paid DT Hours for the day)”

-

“WARNING: Bonus overtime wage type not defined for wage type: (Wage Type) on (Overtime Rule) rules"

The wage type for bonus overtime has not been set up.

-

“WARNING: Bonus double time wage type not defined for wage type: (Wage Type) on (Overtime Rule) rules"

The wage type for bonus double time has not been set up.

-

“WARNING: Flat sum bonus double time wage type not defined for wage type (Wage Type) on (Overtime Rule) rules"

The wage type for flat sum bonus double time has not been set up.

-

“WARNING: Flat sum bonus overtime wage type not defined for wage type (Wage Type) on (Overtime Rule) rules"

The wage type for flat sum bonus overtime has not been set up.

-

“Error DFERR_PROGRAM "Program update needed for overtime rule exceptions."

The program may need to be updated to the latest version.