Pension Contributions Report

Pension Contributions Report Overview

The Pension Contributions Report will include all pre-tax 401(k) or SIMPLE IRA deductions, post-tax Roth 401(k) deductions, and any employer contributions for any check date range.

You can ensure the report is collecting accurate data by looking at:

-

Wage Types: This report looks for specific information in the Wage Type setup to determine which amounts were deducted for any pre-tax 401(k)/Simple IRA plan. The wage type must either be “4K” (which is a default wage type set up by the program), or the wage type description must include “401” or “IRA”.

-

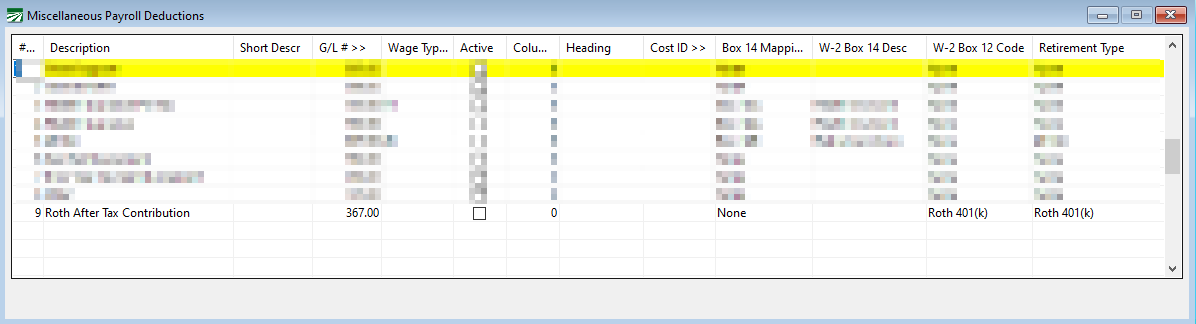

Miscellaneous Deductions: If you have a Roth 401(k) plan (where employees contribution money after taxes are calculated), then a Miscellaneous Deduction must be set up with a specific description for the program to recognize it as a post-tax defined contribution plan. Include the word “ROTH” or the words “POST” and “TAX” in the miscellaneous description. The description itself can be upper or lower case.

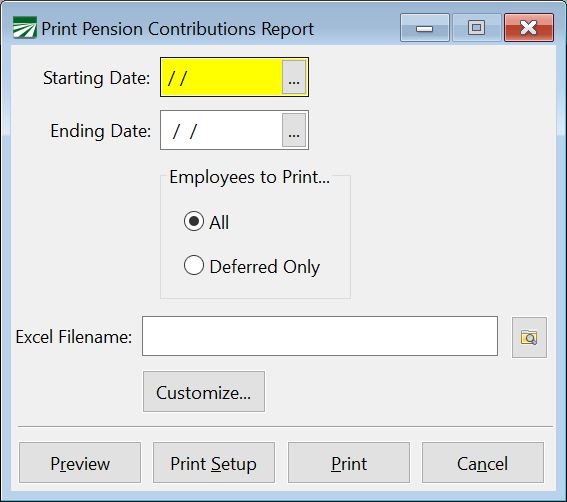

Go to Payroll > Reports > Pension Contributions Report (401k, IRA).

Starting Date / Ending Date

Enter the date range for the report you would like to run.

Employees to Print

All: When All is selected, the report will print all employees (that have wages within the selected date range) regardless of whether the employee has a 401(k) deduction or not.

Deferred: The Deferred Only option will only print employees who had and amount withheld on their checks for a 401(k) plan or an employer contribution amount.

Excel Filename

The report information can be exported to an Excel spreadsheet. This may be useful if you need to submit contribution information in an electronic file. Enter the path and filename to save the report data.

Customize

Click on this button to customize the exported data. (The report format will not be affected by the columns selected.) In some cases, the company managing your pension plan(s) may require more information than is included in the report.

As with other options that allow customization, you can enter a report title to save the selected columns for easy reuse later.

Setting Up 401(k) Employer Contributions

The program will calculate the employer’s contribution to a 401(k) or Simple IRA plan for each payroll check. The calculations are controlled by three settings.

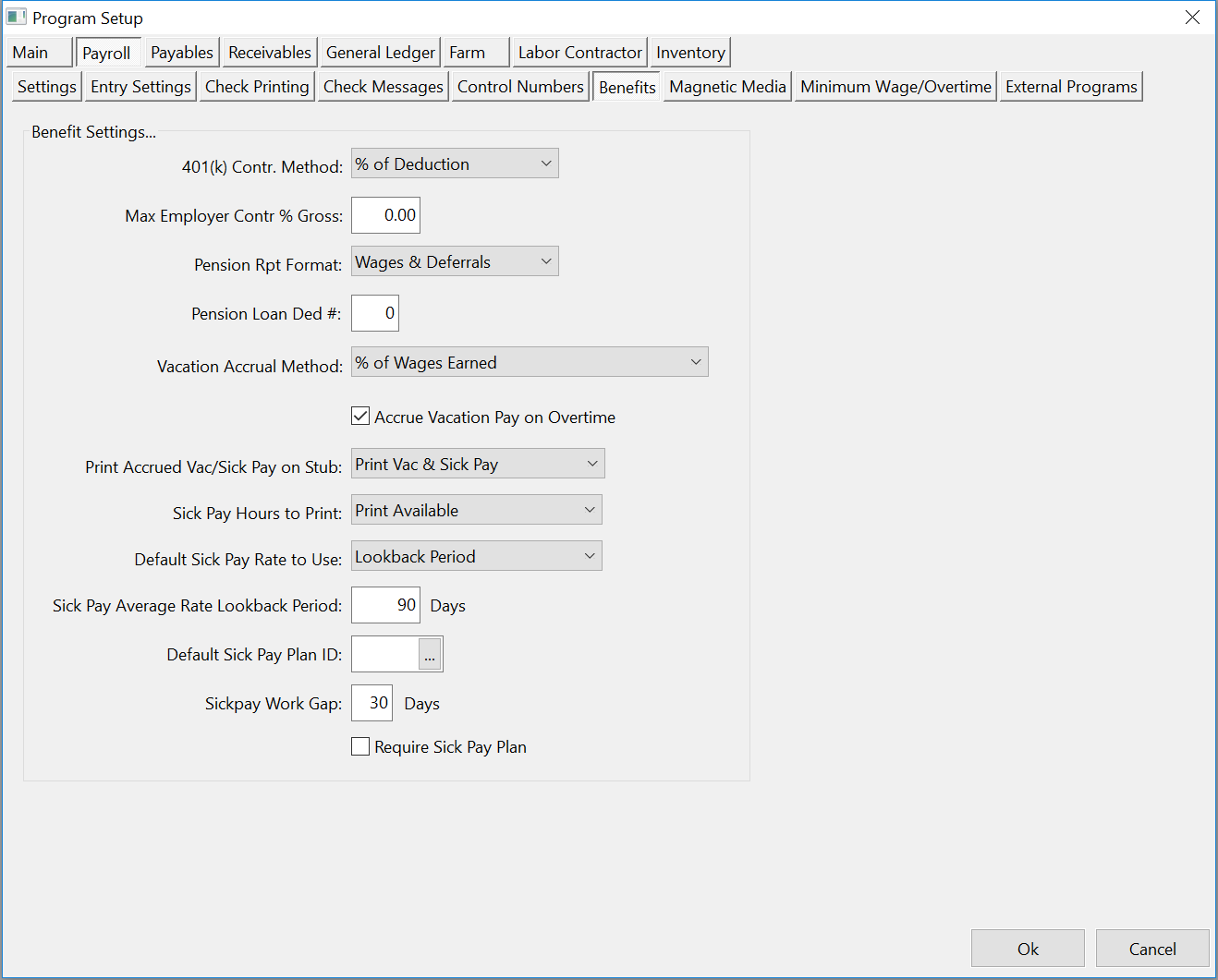

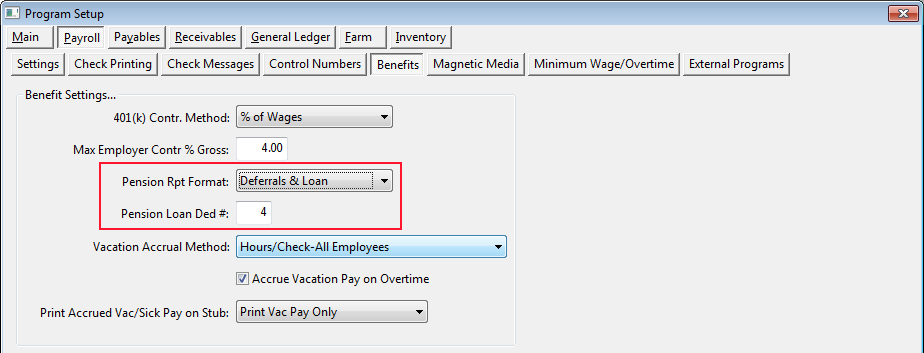

On the Program Setup window under Payroll, Benefits, the 401(k) Contribution Method setting tells the program whether the employer’s contribution is going to be calculated as a percentage of the 401(k) deduction or as percentage of the wages.

There are two options when calculating the employer contribution as a percentage of wages. The % of Wages setting will calculate it as a straight percentage. The % of Wages/Match setting will calculate the lesser of actual deduction amount and the percentage of wages. Say for instance that the employer contribution is set on the employee accounts to 3%. If an employee is withholding 3% or more of his gross pay, the employer contribution will be 3%. If an employee is withholding less than 3% of his gross pay, then the employer contribution will match the amount that the employee is withholding for the 401(k)/IRA plan.

The Contribution Method setting in Program Setup controls how the calculation is performed for all employees.

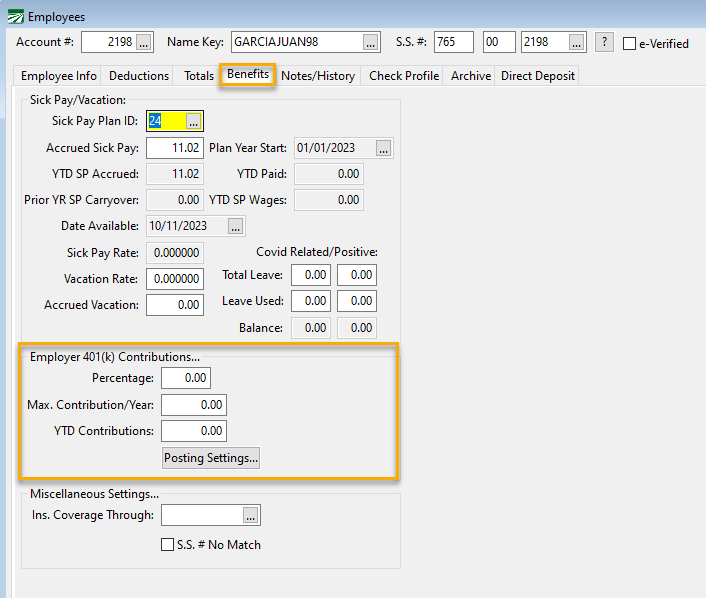

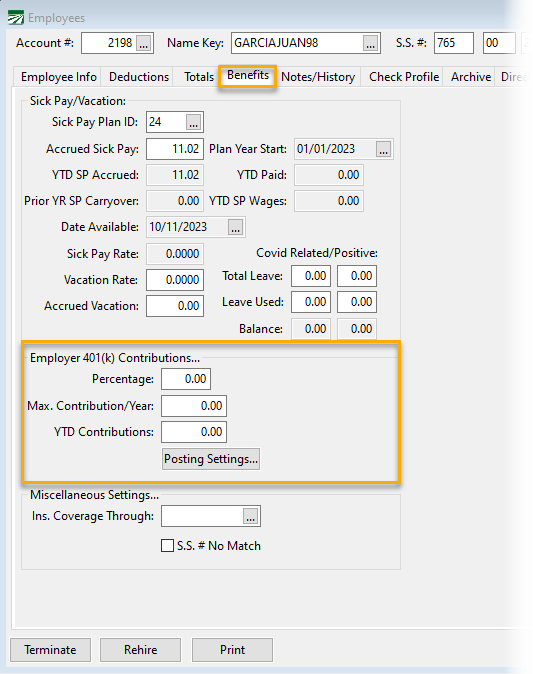

In addition, in the Employees window on the Benefits tab page, there are two settings in the Employer 401(k) Contributions group: Percentage and Max. Contribution/Year. Here you can enter the percentage that the employer will contribute (of either the wages or the deduction) and the maximum amount that the employer will contribute in one year. Each employee may have a different percentage and/or maximum contribution amount.

Example L & S Produce Distributing contributes 3% of wages to their employee’s SIMPLE IRA plan, up to a maximum of $4,000. On the Program Setup window under Payroll, Benefits, they set the 401(k) Contr. Method to % of Wages. On their employee accounts, the Employer 401(k) Contribution Percentage is set to 3.00 and the Max. Contributions/Year is set to $4,000 (both of these settings are on the History/Benefits tab page.)

Example Progressive Farming, Inc. has a 401(k) plan where the company matches 100% of deductions for corporate officers up to $10,000. For other employees, the company matches 50% of deductions up to $5,000. In this case, the 401(k) Contr. Method on the Program Setup window should be set to % of Deduction. On the employee accounts of the corporate officers, the Employer 401(k) Contribution Percentage would be set to 100, while the Max. Contributions/Year should be set to $10,000. Other employees participating in the 401(k) would have their percentage set to 50 and the maximum contributions set to $5,000.

Setting up ROTH 401(k) Employer Contributions

The program is also able to calculate after-tax employer contributions for ROTH 401k plans. To do this:

-

Set up a Miscellaneous Deduction for the contribution. In the Retirement Type column, select ROTH 401(k) from the drop-down menu.

Note For detailed instructions on setting up a miscellaneous deduction, click here.

-

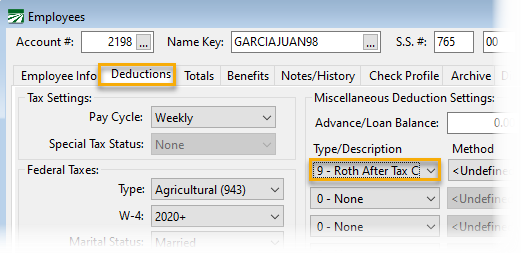

Go to the Deductions tab in the employee file. Under the Type/Description column, select the ROTH deduction from the drop-down menu.

-

Click on the Benefits tab in the employee file. Under Employer 401(k) Contributions...enter a percentage and maximum contribution for the year.

-

Click Save.

401(k) Loans

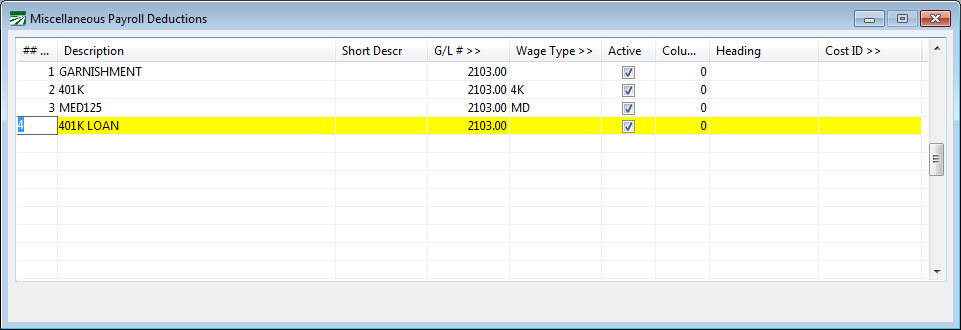

Employees can take a loan from their 401(k) accounts and pay it back through deductions made from their payroll checks. To track loan repayments, first set up a deduction in the Miscellaneous Deduction file:

Next, set up the deduction on the employee account with the amount that the employee wants taken out of each check. Then enter the Deduction Number for 401(k) Loans on the Program Setup window under Payroll > Benefits, and select the “Deferrals & Loans” option for the Pension Report Format, as shown here:

When you print the Pension Contributions Report, a column will appear on the report showing the amount of the 401(k) loans repaid deduction.