Worker's Comp Table

Setting up the Worker's Comp Table and L+I Insurance Rates

The Worker's Comp table allows you to set up multiple workers’ comp rates for any combination of crop and job. Generally, for farming operations, each crop may have its own rate. However, if you are able to pay a lower rate for some jobs (for example, weeding in an orchard may have a lower rate than harvesting in an orchard) then you can set up different rates based on the job.

In addition to setting up rates by crop, you can also set up the worker's comp class codes and their rates, which allow the Worker's Comp Report to provide subtotals by the class code. So, if for example you have six different vineyards, the Worker's Comp Report will not only give you a total for each vineyard, but it will also give you a single total for all vineyard work.

If you have a non-farming operation, then you can base the worker's comp rates only on the general ledger expense account for the employee's labor.

In addition to setting the worker's comp rates, this table is also used by the Payroll Journal to specify the general ledger accounts to update the employer's worker's comp expense and payroll tax expense amounts to.

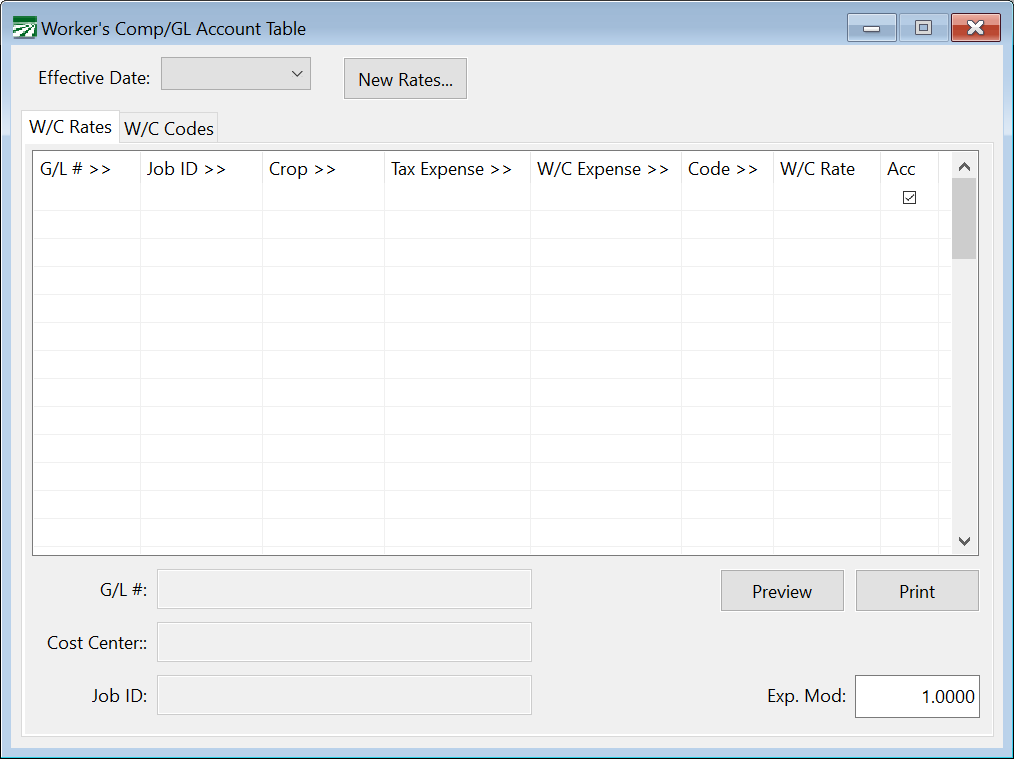

Go to Payroll > Setup > Worker’s Comp Table.

Effective Date

The program can track worker’s comp rates for multiple periods of time. This allows you to set up changes to your rates before they go into effect and allows historical reports to print the correct rates that were in effect when checks were written.

The first set of rates that you start out with can have a blank effective date. These rates will apply immediately. When a new set of rates needs to go into effect, click on the New Rates… button. The program will ask you for the effective date for the new rates, and the date to copy the rate from. The program will then set up a new set of entries in the Rate/Code tables that you can then modify.

Once rates for multiple dates have been set up, the program will automatically default to showing the latest set of rates when this window is opened. You can click on the drop-down arrow to display a list of the rates that have been set up already.

Note Before you create entries in the W/C Rates table, it is recommended that you set up the W/C Codes on the second tab. This way, you can assign the Code to each line that is entered. See the Worker’s Comp Classes section below for more information on setting up your codes.

G/L #

Enter the General Ledger wage expense account for this line.

Job ID

If you are using job codes, you can also specify the job code for this entry.

Crop

Enter the crop for this worker's comp rate entry.

W/C Expense Account

In these columns, enter the general ledger account number for both the employer tax expense account and the worker's comp expense account.

Code

Enter the worker's comp class code here, if you have set up your codes. The default rate will appear in the W/C Rate column.

W/C Rate

Enter the rate for this entry.

Accrue

Select this box if you want the Payroll Journal to accrue worker's comp to a liability account. When you write your worker's comp check, you would then expense the check to that liability account.

Exp Mod

Enter your experience modifier here. The program will multiply the worker's comp amount by the experience modifier. If you do not enter anything here, it will default to one so that there is no change in the worker's comp calculation.

The experience modifier should be entered as a decimal value. For instance, 80% would be entered as "0.80". 110% would be entered as "1.10".

Copying G/L Expense Numbers

To copy the General Ledger account numbers that are entered on the current line to all lines in the worker’s comp table, press Ctrl+G.

How the Worker's Comp Table is used

This table is used to determine the worker's comp rate to apply to labor, as well as the payroll tax expense account and worker's comp. insurance expense account to use for accruing taxes and worker's comp.

By setting up this table correctly, you can separate ag and non-ag payroll tax expenses or keep separate payroll overhead expenses for different divisions of your business (for example, keeping farming and dairy payroll expenses separate).

The key to doing this is to set up the information in the first three columns so that the program will use the entry that you want. In the simplest example, with farm-only payroll, you may leave the first two columns blank on each entry, and simply enter the cost center in the third column. The program will select a line to use based on the cost center entered on the payroll check.

To extend this example, suppose you have an office worker who has a different worker's comp rate (and you want to keep the payroll overhead for office wages separate from farm wages). In this case you should have a General Ledger expense account for office wages, and you would enter this in the first column, and leave the job and cost center columns blank. The program will match the office wages general ledger account entered on the check to this entry, and thus will use it for the worker's comp rate and general ledger expense accounts.

When determine the entry in this table to use, there is a specific order that is used to search the table. The program will use an entry from the table based on the first entry that matches:

1. The General Ledger account, Job Code, and Cost Center

2. The General Ledger account and Cost Center

3. The Job Code and Cost Center

4. The General Ledger account

5. The Cost Center

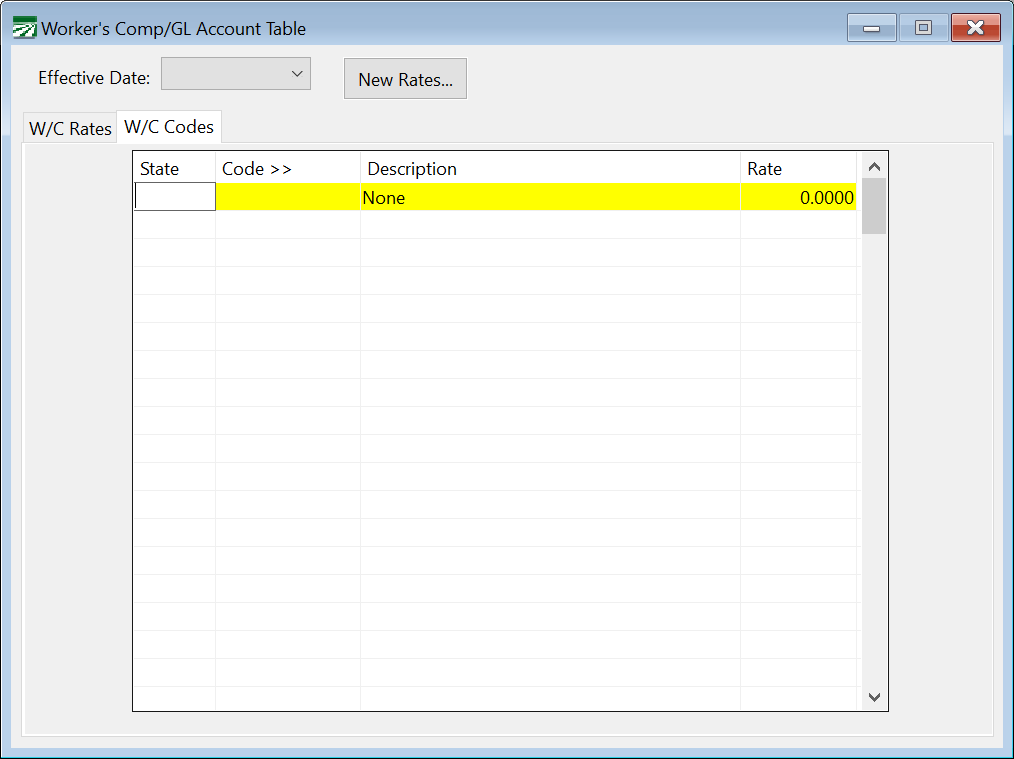

Worker's Comp Classes

The second tab page on the Worker's Comp window allows you to enter the class codes, descriptions, and rates for your various workers’ comp rates.

State

Enter the two-letter state abbreviation here.

Code

Enter the code here. This can be up to eight letters or numbers.

Description

Enter the description for this code here. It will print on the Worker's Comp Report summary.

Rate

Enter the rate here. This will be used as a default when you are making entries on the W/C Rates tab. Also, if you are changing the rate on an existing class code, the rate will be updated on the W/C Rates table automatically. This means that when you worker’s comp rates change; you do not need to manually edit each line on the W/C Rates table.

Note The program will not allow a class code that has been set up and used in the Worker's Comp Rate Table to be deleted.