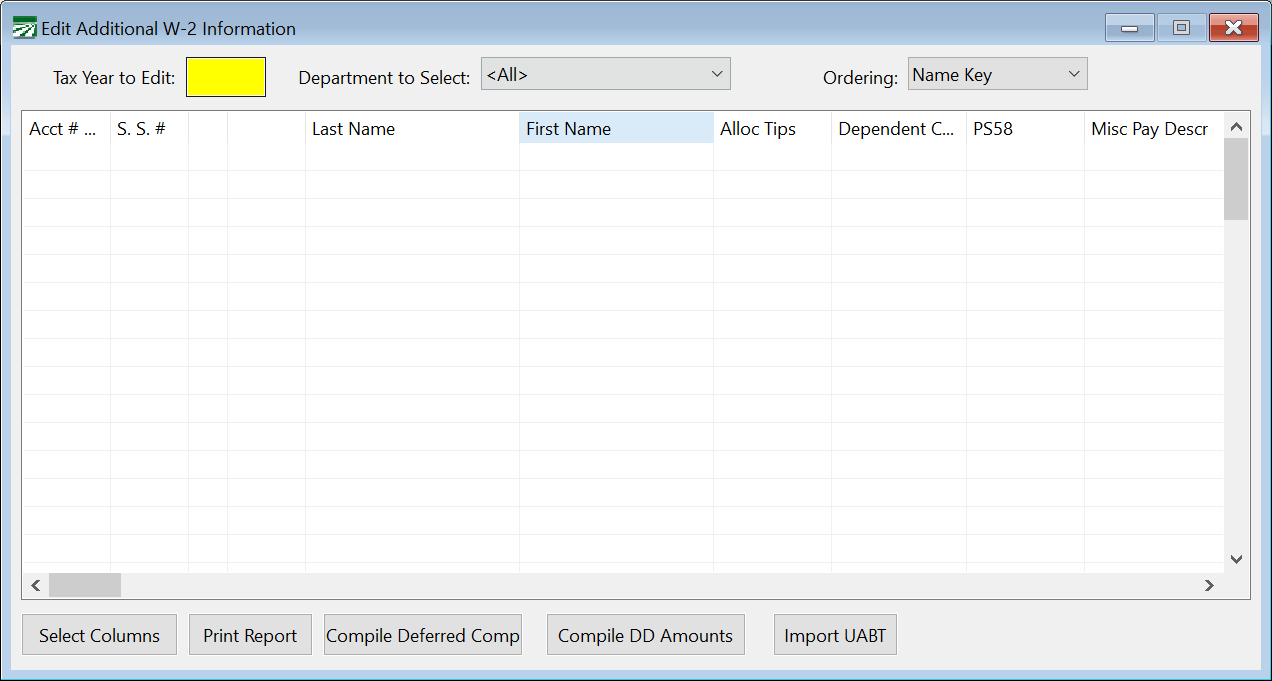

Edit Additional W-2 Information

This window allows you to easily edit the additional W-2 Info fields for all employees on a grid.

-

Go to Payroll > Payroll Tax Reports Control Center > Year End Closing tab > W-2 Information button.

-

Additionally, this window can be accessed by going to Payroll > Year End Tax Reporting > Edit YTD Archive File.

When using the Edit W-2 Information window, it is helpful to select just the columns you need to modify. Use the Select Columns button to choose which columns to display. Then, edit the amounts, box descriptions, and/or print settings as needed.

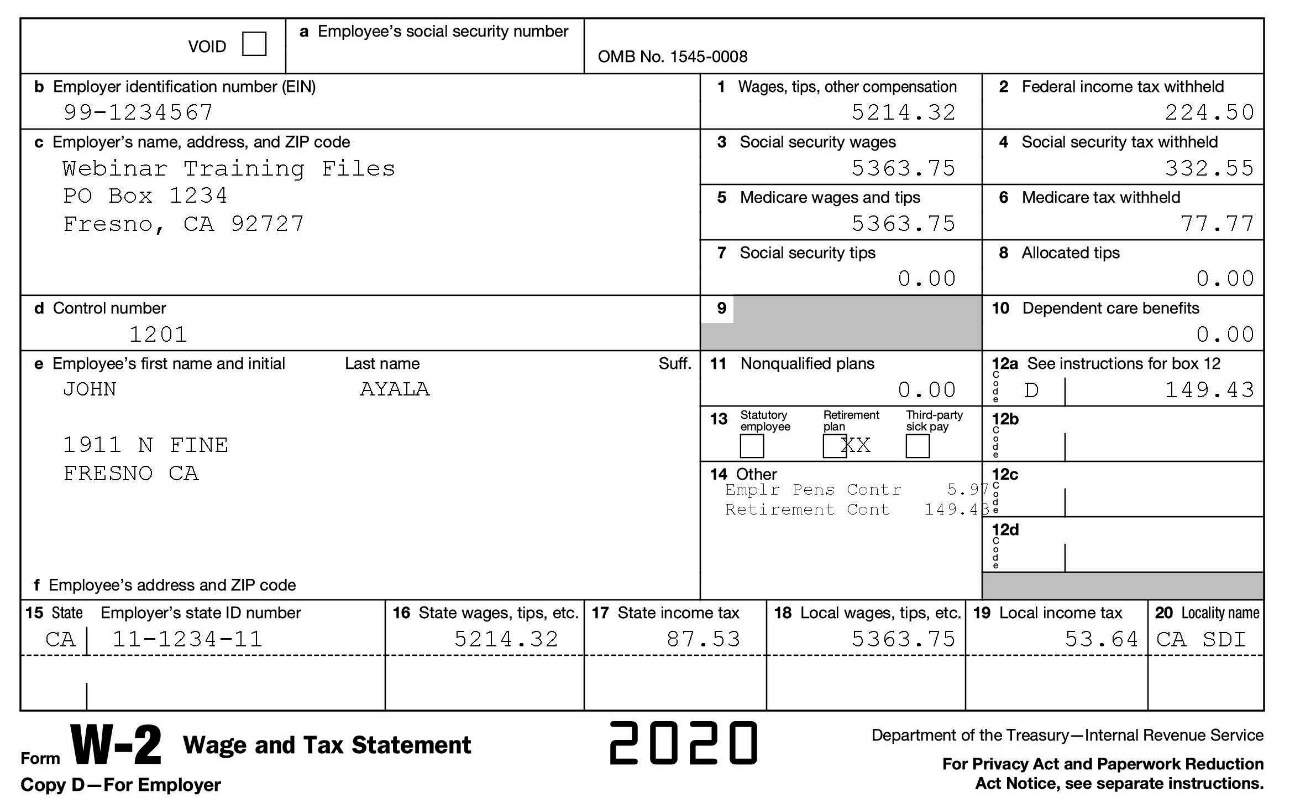

You can edit the information in the Archive file at any time. When W-2 forms are printed, the information entered on this tab will print in Box 14:

To use the grid entry:

Tax Year to Edit

Enter the tax year, 4 digits, ie “2024”. After entering the tax year, the employees with wages in that year will be displayed in the grid.

Department to Select

If you need to edit a selected group of employees by department, enter the Department to Select.

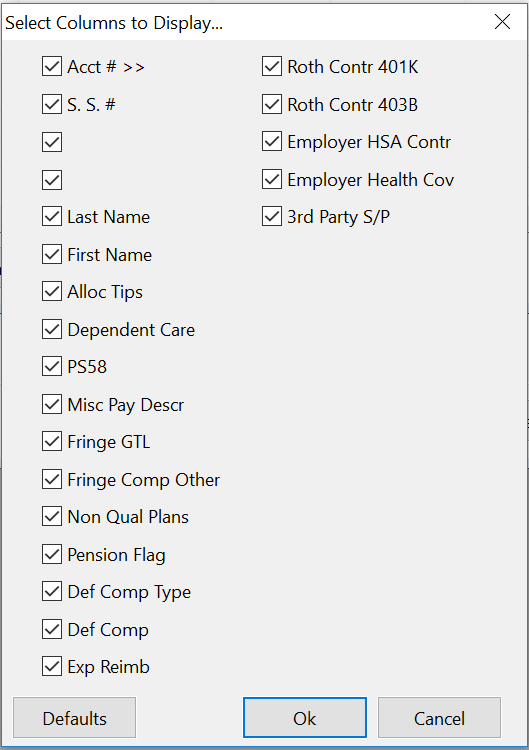

Select Columns

Before starting to edit, click on the Select Columns button to select only the columns you need to edit. This will reduce the horizontal size of the grid and make the data entry much quicker.

The window defaults to editing all of the Additional Information fields, but it is unlikely that you will need to edit all of these fields. Click on the Select Columns window at the bottom left corner to turn on just the columns you need:

After you click Ok, the grid will be rebuilt and resized to display the columns that you have selected.

The window is resizeable, so you can expand it to show more columns and employees.

Compile DD Amounts

For the Employer Health Care Coverage amount (reported under code DD in box 12) there are two methods available to add these amounts automatically to the W-2.

The first option may be used if you are not using the Human Resources Management software from Datatech. Create a wage type that is not taxable using the “Memo Wages” base pay type. This wage type can be used on a check to add the annual amount of the employer provided health coverage. Once this is done, you can use the Compile Deferred Comp button and select “DD-Health” for the Type of Deferred Income to add these amounts to the W-2.

The second approach uses the employee benefit records to compile the months that each employee is covered under a health plan along with the cost information that has been set up for each health plan to determine the amounts to report under the DD code on the W-2. For this option to work, you must have the correct enrollment dates for each employee and the correct cost information on your health plan setup. Refer to the Human Resources documentation for more information about doing this.

Importing Coverage

The Import Coverage button will import coverage information from a spreadsheet file provided by your insurance company. The program currently supports importing information from UABT and Western Growers/Pinnacle. This option is designed to accomplish two things:

-

Import the employer’s cost of coverage for each employee and update the W-2 information with the total cost for the year.

-

Compare the coverage dates and enrolled plan(s) to the benefit records in the Human Resources Management system. A report will be generated so that you can review the information in both the insurance companies file and in the HR system. You can then choose to import the information from the insurance company’s spreadsheet. This will update your existing records and create new records if necessary in the HR system.

After you click on the button, the program will ask you to select the spreadsheet to import. The program will read the information read from the spreadsheet, and then produce two reports.

The first report will have the annual employer health coverage cost amounts on it. After the preview window for the report appears, the program will ask if you want to update the employer sponsored health insurance amounts. Currently, only UABT provides the cost information. If no costs are included in the spreadsheet, then the program will display the report but it will not ask you to update the amounts.

The second report will list the employee enrollment dates from the import file and from your records in the Human Resource Management program. The Group or Plan # will be listed on this report along with the starting and ending dates from both the import file and the current HR benefit records. The rightmost column on the report will print zero to three checkboxes, depending on whether of not the information matches between the import file and the HR records.

The first two checkboxes indicate whether the starting and ending dates match. The third checkbox indicates whether the insurance plan matches.

If three checkboxes appear in the Match column on the report, then your records match the insurance company’s information exactly. If the first or second checkboxes is missing, then either the starting date or ending date of enrollment does not match. If the third checkbox is missing, then the plan on the benefit record could not be matched to the plan in the insurance company’s file.

If no checkboxes appear in the Match column on the report, this could indicate that the employee was enrolled in coverage but this information was never entered into the HR program. (For instance, the employee was enrolled through a manual process and not through an electronic enrollment file.)

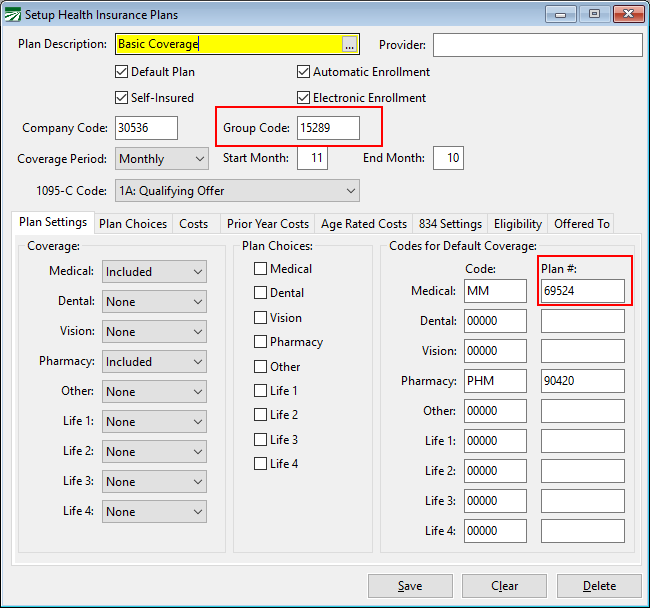

UABT provides a “Group Code” in the spreadsheet to identify the plan. Your medical plan setup must have a plan with a match group code for the program to be able to match the plan selected on the HR benefit records to the information in the spreadsheet.

Western Growers provides a Plan Number in the spreadsheet to identify the plan. Your medical paln set up must have a plan with a matching Plan # for the program to be able to match the plan select on the HR benefit records to the information in the spreadsheet.

After the preview window for the second report appears, the program will ask if you want to update the HR coverage records. Answer No if you want to review the benefit records in the HR program before importing the information.

Matching Employee Accounts

For both reports, there may be cases where the program is unable to identify the employee accounts listed in the insurance company’s spreadsheet. Usually the insurance company will have the employee’s social security number. If you have corrected the employee’s Social Security Number (for example, a data entry error was made when the employee was originally set up) then the insurance company may have enrolled the employee under the original, incorrect S.S. #.

You may also have a situation where a person is enrolled in coverage but they are not an employee. For instance, the owner of a company may not receive a payroll check, but still be enrolled in coverage. In this case, the program may not be able to find an archive record for the individual. In this situation, nothing may need to be done. If the individual is not going to receive a W-2 because he or she did not receive any wages, then reporting a DD amount is not relevant.

If the program cannot identify the account number for an individual based on the Social Security Number, it will display a zero for the Account # on the reports. For the Health Coverage Enrollment Dates Report, it will also not be able to find any health benefit records, so the Match column will not have any checkboxes.

The program will not be able to import any amounts or enrollment dates if it cannot identify the employee account based on the social security number. In these cases, you have two options:

-

Manually find the correct employee accounts and review/update the information as needed.

-

Determine the correct social security numbers for the individuals and edit the insurance company’s spreadsheet so that it has the correct information. You can then re-import the file and the program should then find the correct accounts.