Federal Form 940

Form 940 is the Federal tax form for reporting of wages and Federal unemployment Insurance tax due. It is used for both regular and agricultural employees. Before you can print this form these items must be completed:

-

Verify year-to-date wage and deduction totals (See Topic: Year End Closing Checklist).

-

Archive employee totals for the year.

-

Make sure the legal name of your company has been entered in the Program Setup window if it is different than your trade name.

Go to Payroll > Year End Tax Reporting > Federal Form 940.

To complete the form, enter the following:

Year to Print

Enter the 4-digit tax year for which you are printing the form.

Calculate Totals

Click on this button to calculate the report totals. If you have a large number of employees, this might take a few minutes.

Part 1

One State Only

More than one state (Multi-state employer)

The state will automatically be entered for you when you click on the Calculate button, if you have wages in a single state. If you need to report wages for multiple states, the box will be checked to indicate that you are multi-state employer.

Wages in state subject to Credit Reduction

This box will be checked automatically if there is a Credit Reduction rate in the State Tax Rate Table for the year you are reporting. If you are in a Credit Reduction state and this box is not selected, add the rate in the State Tax Rate Table and then re-calculate the Form 940.

Part 2: Determine your FUTA tax before adjustments

Payments Exempt from FUTA Tax

If there is any exempt payment amount, you need to check one or more boxes to indicate that nature of the exempt payments.

Part 3: Determine your adjustments, if any

If you have any adjustments for lines 9 and 10, enter the amounts here. See the instructions for information about these adjustments.

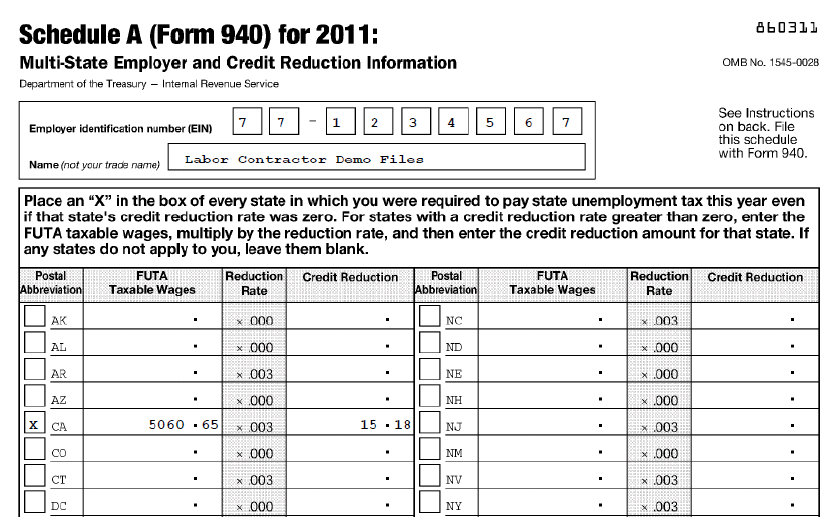

Credit Reduction, amount from Schedule A (940)

If you have paid any wages in a credit reduction state, and you have the credit reduction rate entered in the state tax rate file, the program will calculate the tax due, enter it here, and print the Schedule A(940).

Part 4: Determine your FUTA tax and balance due or overpayment

Total FUTA Tax Deposited For the Year

Enter the total amount of taxes you have deposited for the year.

You can get a list of tax deposits by using the vendor check inquiry screen to list the payments you have made. Be sure to include only payments for Form 940.

Balance Due

If you owe over $500 in FUTA tax, you must make a FUTA tax deposit before filing the form. A payment voucher will not be printed when the amount due is over $500.00.

Click here for instructions for Balance Due over $500.

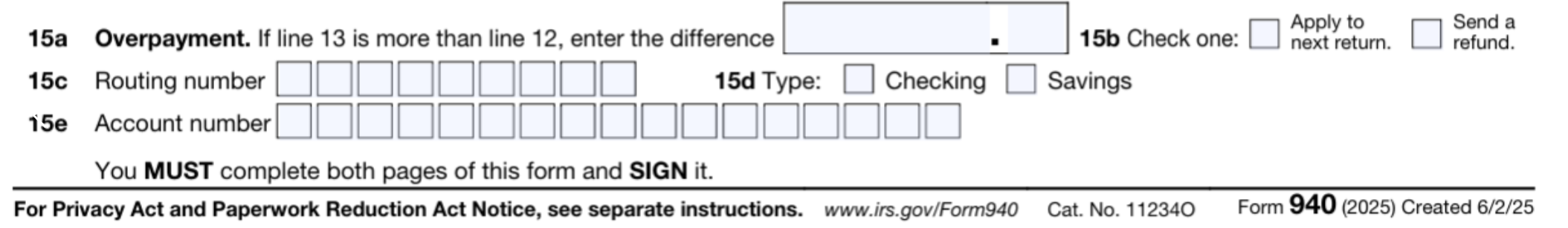

Overpayment Disposition

If there is an overpayment, check the appropriate box to indicate whether you want the overpayment “Apply to Next Return” or “Refunded”.

Bank Account Information

If you have an overpayment, the IRS is now requiring refunds via direct deposit.

Enter your Routing & Account Numbers.

Then select the type of bank account, Checking or Savings.

Note If you have an overpayment, the IRS is now requiring refunds via direct deposit. Enter your Routing & Account numbers and select the type of bank account.

This can also be used for sending a payment due, however, if you are required to make payments via EFTPS, you should still make your payment this way. For now, payments may also be made via check using the voucher to those not required to use the EFTPS.

Part 5: Quarterly FUI Tax Liability

Your tax liability for each quarter should appear here. If it does not, you may not have printed the Tax Liability Report for the year. You can calculate the tax liability by clicking on the Update Tax Liability button.

If the Total Liability for Year does not equal Line 8, and the difference is due to rounding, or due to an amount due for the credit reduction, you can click on the Adjust Tax Liability button to adjust the tax liability.

Any Credit Reduction taxes that are due are deemed to be a liability in December, and that is how the program will adjust.

Part 6: Third Party Designee

If you wish to designate an employee or other individual to discuss this return with the IRS, enter their name and personal ID number.

Part 7: Signature

Signature Information

Enter the name and title of the person signing the return, the date and phone number.

Preview/Print

You can now print the form. If you have a duplex printer, pages one and two can be printed on one sheet. Pages three and four must be printed on separate sheets.

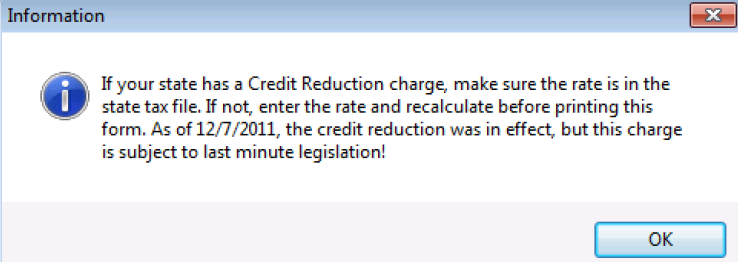

When you Preview or Print the report you will get a reminder that if you are in a credit reduction state you must have a rate in the state tax file. If this has been verified and the Form completed correctly, click OK on the message to proceed. If you are in a Credit Reduction state and the rate is not in the file, click OK, enter the rate and come back and complete the form.

Printed Report

When the form is printed Schedule A will be the 3rd page. Send this form with your completed and signed Form 940.

Instructions for Balance Due Over $500

940 Form Voucher Not Printing?

If the program is not printing the 940 Voucher, you owe more than $500 in FUTA Tax. You cannot have an amount due of more than $500. If you do, you must make a FUTA tax deposit before filing the form.

When Must You Deposit Your FUTA Tax?

According to the 2023 940 instructions, “… you may have to deposit your FUTA tax before you file your return. If your FUTA tax is more than $500 for the calendar year, you must deposit at least one quarterly payment.”

The instructions further explain, “If your FUTA tax for the fourth quarter (plus any un-depositied amounts from earlier quarters) is more than $500, deposit the entire amount by January 31, 2023. If it is $500 or less, you can either deposit the amount or pay it with your Form 940 by January 31, 2023. In years when there are credit reduction states, you must include liabilities owed for credit reduction with our fourth quarter deposit.”

Note You will need to check each year for current due dates.