Federal Form 943

Form 943 is a Federal tax form for the reporting of wages, Social Security, Medicare and Federal income taxes. All agricultural wages are reported on this form.

The payroll program prints the entire form on blank paper so that you do not have to transfer totals to the form you receive in the mail. The program will automatically compile the wage and tax information, and you can then enter on the screen various adjustments and other information needed before printing the final form.

You will also need a list of the tax deposits you have made for the quarter you are processing. You can use the check inquiry screen to get a list of payments. Make sure you include payments for the current year only, excluding any payments that may have been made in the first month of the year for the prior year, and including any payments made in the month following the year end for the last month of the year you are processing.

Keep in mind that while the program has made the process of filling out the Form 943 easier, Datatech cannot be held responsible for any errors you might make in your tax reporting. Therefore, please make sure you have a correct understanding of reporting requirements and procedures.

Before you can print this form, these items must be completed:

-

Verify year to date wage and deduction totals.

-

Archive employee totals for the year.

-

Make sure the legal name of your company has been entered in the system file, if it is different than your trade name.

Accessing Federal Form 943 in the Program

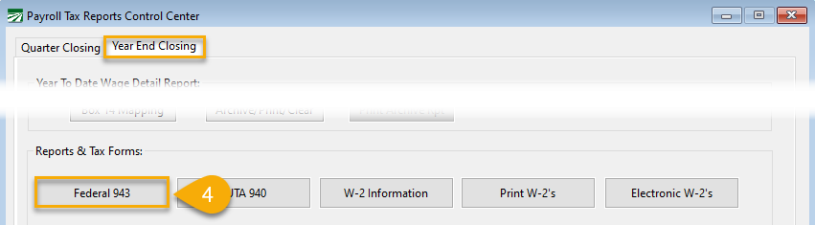

It is recommended that you open the 943 from the Payroll Tax Reports Control Center. Go to Payroll > Payroll Tax Reports Control Center.

-

Under the Quarter Closing tab, enter the current year in the Year field.

-

In the Quarter field, select the current quarter from the drop-down menu.

-

Click the Year End Closing tab.

-

Click Federal 943 at the bottom of the window.

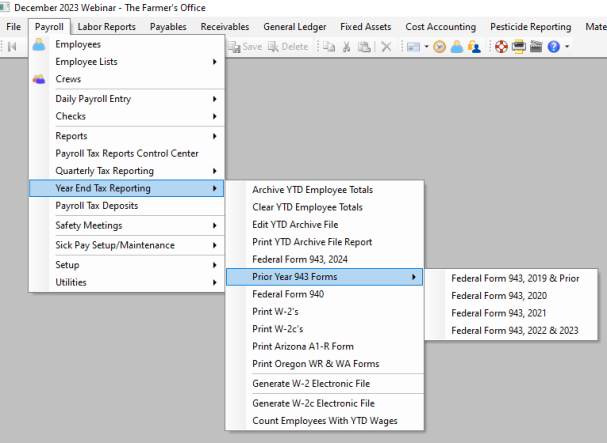

You can also access the 943 by going to Payroll > Year End Tax Reporting. From here, you can select the form for the current year or for previous years.

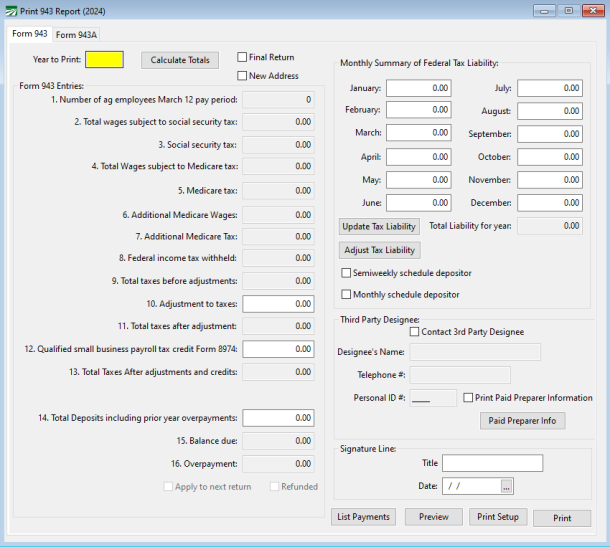

Whether you use the Payroll Tax Reports Control Center or the Year End Tax Reporting menu option to access the 943, the following window will open:

Year to Print

Enter the tax year for which you are printing the Form 943.

Calculate Totals

Click this button to calculate the totals for this report. Depending on the number of employees you have, this may take a few minutes. When it is finished, totals will be automatically populated.

10. Adjustments to Taxes

Enter any rounding adjustments to the tax owed. If you wish to subtract an adjustment, enter it with the minus (-) sign.

12. Qualified small business payroll tax credit Form 8974

See IRS instructions for Form 943 to determine whether or not this field is applicable to your company.

14. Total Deposits including prior year overpayments

Enter the total tax deposits you have made for this year. If you have an overpayment from the previous year, include that amount.

You can get a list of tax deposits by using the vendor check inquiry screen to list the payments you have made. Be sure to include only payments for Form 943.

16. Overpayment

If there is an overpayment, select either the Apply to next return or Refunded check box.

Update Tax Liability

Click this button to update the tax liability amounts.

Semiweekly schedule depositor/Monthly schedule depositor

If the total tax due is less than $2500, do not select either of the depositor boxes. Otherwise, select either the Semiweekly schedule depositor or Monthly schedule depositor check box.

Total Liability for year

Make sure that the total tax liability for the year equals line 9, Total taxes before adjustments.

If there is a small difference, it is usually due to rounding differences, and you can adjust the liability for the last month of the year to balance. To do this, click Adjust Tax Liability to automatically adjust the liability on line 9.

If there is a large difference, you may need to investigate further.

Third Party Designee

If you wish to designate an employee or another individual to discuss this return with the IRS, select this box. Then enter their name, phone number and personal ID number.

Signature Line

Enter the title of the person signing the return and the date.

You can now proceed with printing Form 943.

Semiweekly Depositor, Form 943A

If you are a semiweekly depositor, you must file Form 943A. This form details your tax liability for each day of the year. To view this liability data, click the Form 943A tab page.

If amounts do not appear in this window or on the 943A when printed, you will need to click Update Tax Liability on the Form 943 tab to compile the amounts. If the total tax liability for the year does not equal line 9 of the 943, click Adjust Tax Liability on the Form 943 tab so that they are equal.

Once the adjustments are made, this form can be printed.