Ap Invoice/Inventory Audit Report

By running the Inventory Audit Report, you can find if there are discrepancies between what has been posted through Purchases Orders and what has been invoiced in the Accounts Payable program. It is a good idea to run this at least once a month to check for and correct any discrepancies.

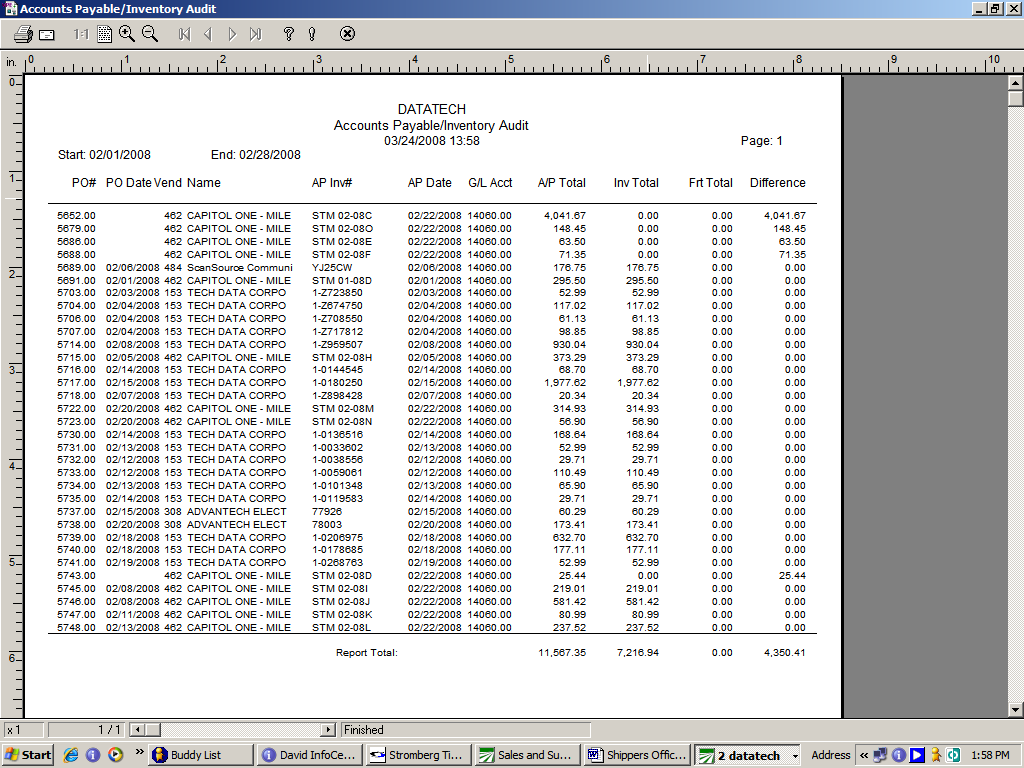

Following is a sample of this report.

You can see on this report that there are some items which have a total in Accounts Payable, but not in Inventory. This means an Accounts Payable invoice has been entered, referencing the Purchase Order number, but the Purchase Order has not been finalized. Or, the Purchase Order and AP Invoice may have dates in two different months.

Another scenario would be if you have a purchase order that has been finalized without updating Accounts Payable, and there has not been a manual Accounts Payable Invoice entered. Or the Accounts Payable Invoice may have been entered, but does not have the PO # referenced in the PO# field.

You will also be able to tell if a Purchase Order has been entered for one amount, and the Accounts Payable Invoice entered for another amount. This would also cause a difference on the report. So, this report gives you a starting point to audit between Purchase Orders and Account Payable to be sure all items are updated correctly.

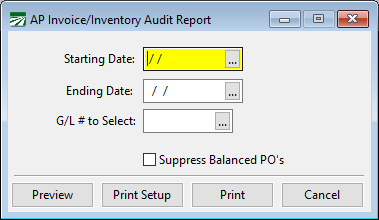

Go to Inventory > Purchase Orders > AP Invoice/Inventory Audit Report.

Starting/Ending Dates

Enter the starting and ending dates for the period you are auditing.

Suppress Balance PO’s

If you do not need to view Purchase Orders that are in balance with Accounts Payable entries, select this box. The report will suppress these items.

When you have made your report criteria selections, you can preview the report on screen or print the report using the print options at the bottom of the window.