Fixed Asset Lists

This option is used to print Fixed Assets Lists and depreciation schedules for the assets that are entered in the system.

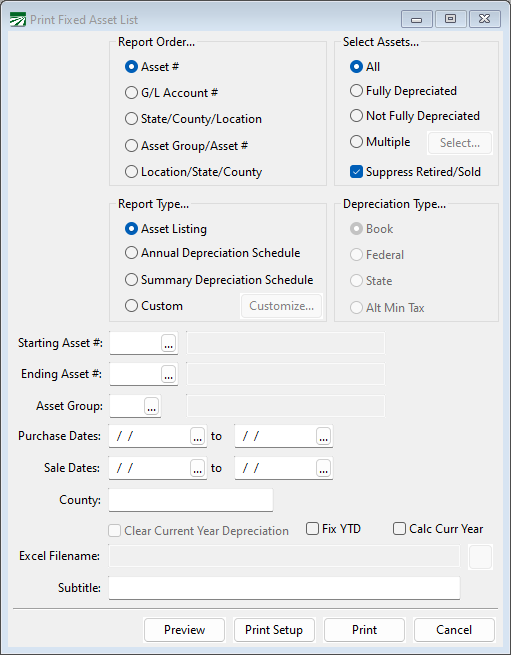

Go to Fixed Assets > Fixed Asset List.

Report Order

Select the order in which you want the assets listed on the report.

Depr. Type

Select the type of depreciation that you want to use for the list.

Report Type

The Asset Listing option will print each asset on a single line with the asset #, description, date purchased, original cost (book value) and market value.

The Annual Depreciation Schedule option will print the depreciation settings for each asset and a table showing the years, annual depreciation amounts, accumulated depreciation, book value, and month depreciation amounts for each year for asset.

The Summary Depreciation Schedule prints a single line for each asset listing the original cost, bonus depreciation, prior year’s depreciation total, current year depreciation, and book value.

For both the Annual Depreciation Schedule and the Summary Depreciation Schedule, the Depreciation Type selection determines which of the four types of depreciation is printed on the report.

The Custom option allows you to select the columns that appear on the report. Click Customize to select the columns.

Select Assets

Select which assets you want to include on the list based on whether or not the assets are fully or partially depreciated.

Selecting the Suppress Retired/Sold check box will exclude from the report any assets that are retired or have been sold.

Starting Asset # / Ending Asset #

Optional, these entries allow you to print a range of asset numbers.

Asset Group

Enter an asset group number to print only the assets that are assigned to that group.

Purchase Dates

Enter a date range to select assets based on the purchase date entered.

Sale Dates

Enter a date range to select assets based on the date sold.

County

This entry can be used to print all of the assets that are located in a particular county.

Clear Current Year Depreciation

Select this box when printing a report for the end of year. This will add the current year depreciation total to the prior year’s depreciation total and clear the current year depreciation total on each asset. This should be done at the end of the year, after you have posted the last month’s depreciation amounts and any bonus depreciation that you may be able to take. It should be done before you post any depreciation entries for the new year.

Fix YTD

This is a utility option that will add up the depreciation entries posted for the current fiscal year (as determined by the Date Last Closed for the General Ledger) and update the Current Year Depreciation amount for each asset. This can be used in cases where the total depreciation posted to the G/L is correct, but the amounts on the assets do not match these totals.

Calc Curr Year

This is a utility option that will add up the depreciation entries posted for the current fiscal year (as determined by the Date Last Closed for the General Ledger) and print these amounts instead of the current year depreciation amounts on the assets. This can be used prior to selecting the Fix YTD box to determine whether or not the current year deprecation amounts on the assets match what has been posted to the G/L.

If this box is selected along with the Fix YTD box, the report will also adjust the prior years depreciation as well, subtracting the current year’s depreciation total. This is meant to “back out” an incorrectly run report where the Clear Current Year Depreciation was checked before the end of the year.