Vendor Terms Table

Vendor Terms Table Overview

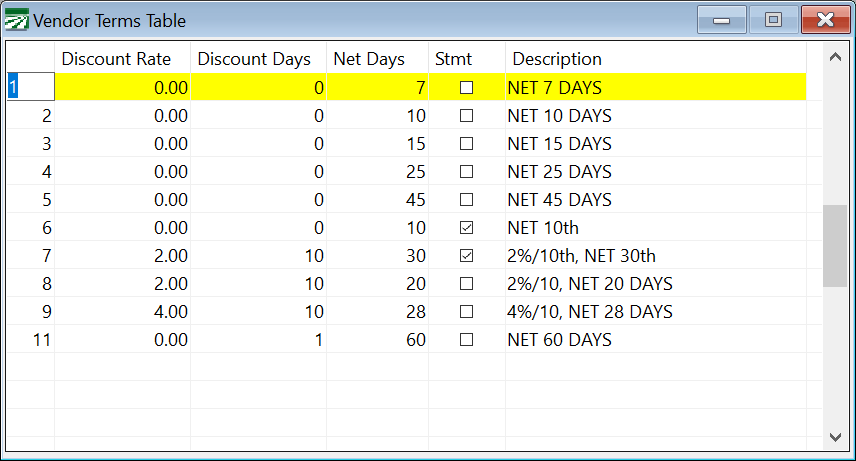

Vendor terms are used by the vendor invoicing system to calculate the due dates, and discount terms if applicable, for invoices that you enter. Each vendor can be assigned default terms that they offer you on their invoices. If you do not use the terms file, you will need to enter the invoice due date manually on each invoice.

If you are not entering vendor invoices, and are writing all checks through the Direct Expense check entry, then you do not need to enter terms.

If you have several vendors that offer you "Net 30 Days" terms, then you only need to make one entry in the terms file for "Net 30 Days", and each of these vendors are assigned that terms entry.

Go to Payables > Setup > Vendor Terms Table.

Up to 99 different entries can be made into the terms file. Enter the terms number to use in the first column

Discount Rate

If the vendor offers discounts for early payment, enter the discount rate here.

Discount Days

Enter the number of days you must pay the invoice by to deduct the discount.

Net Days

Enter the net terms to pay the invoices.

Statement

Select this option if the invoice must be paid within a certain number of days from the statement date.

This options works in connection with the Statement Closing Date entry on the vendor file.

Example If your vendor’s terms are to close statements on the 25th of each month and are due within 10 days of the statement closing date, you would:

Select Stmt on the Vendor Terms Table.

Enter Net 10 Days in the Description column.

Enter 25 in the Statement Closing Date entry on the Vendor’s file.

Then, when you post purchases after the closing date, those purchases would not show up as due on the Cash Requirements Report until the following month.

Description

Enter a short description for the discount. The description column will be filled in automatically for you based on the entries you have made.