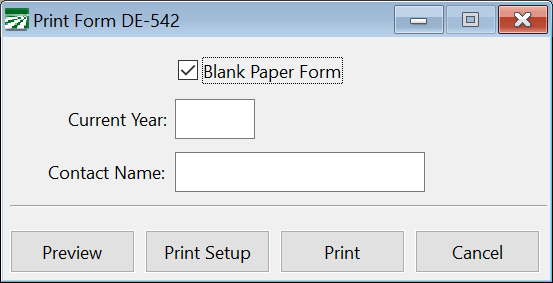

Print Form DE-542

In California, all businesses must report information regarding independent contractors with whom they do business. This information must be filed within 20 days of either entering into a contract with an independent contractor for $600 or more, or making payments totaling $600 or more to an independent contractor in any calendar year, whichever is earlier.

In general, businesses are required to report independent contractors that are sole-proprietors. Corporations, general partnerships, or limited liability companies do not need to be reported.

For complete information and requirements for the DE-542 report, contact the EDD.

Note Before you use the option to print the DE-542 form, you must use the Compile Vendor YTD Purchases option so that the program has the current YTD paid amounts for each vendor. This is necessary for vendors that are reported after purchases go above $600.

Go to Payables > Vendor Lists > Print Form DE-542.

Blank Paper Form

Select this box if you are printing on blank paper. If you are, then headings will be printed for this report. If you are printing on the form, these headings are not needed.

Current Year

Enter the current year that you are printing the report for.

Contact Name

Enter the contact name that should appear on the report for your company.