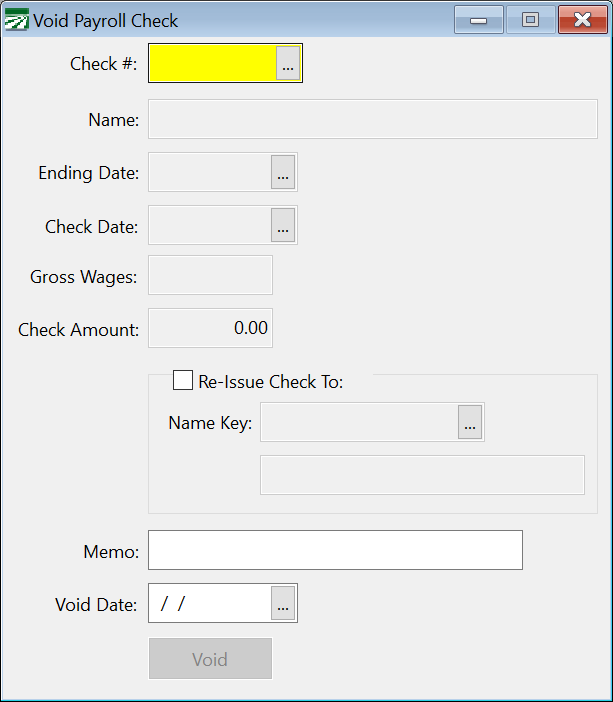

Void Payroll Check

Voiding Payroll Checks

This option is used to void a payroll check or advance check that has already been entered and printed through the check entry program.

In some cases, you do not need to use the void check option. For instance, if a check gets jammed in the printer and is not usable, you can simply reprint the check instead of voiding it, re-entering it, and reprinting it. Another situation where checks should not be voided is unclaimed payroll checks.

Cases where you would use the void check option might include:

-

A check was printed using the wrong employee account. The check should be voided to correct the wrong employee account and the check re-entered and re-printed on the correct employee account.

-

Wages or deductions are incorrect on an employee check and the employee hasn’t received the check yet or has returned the check for corrections.

-

A check was printed incorrectly or is unusable, and you updated the payroll journal by mistake (once the payroll journal is updated, the Reprint Checks option cannot be used for those checks).

To void a payroll check, follow these steps:

1. Go to Payroll > Checks > Void Payroll Check.

2. Simply enter the check number you want to void. You can also click on the lookup button or press [F4] to get the selection list. The check information will be displayed.

Tip In cases where a check is issued to the wrong employee account, or corrections need to be made to the wages and/or deductions, select “Re-Issue Check To” before you click Void. You may then select the Name Key for the employee account that you want to re-issue the check to.

When you click Void, the Batch Payroll Check window will appear with a copy of the original check. You can then make changes to this check and print it when you are done.

3. Click Void to record the void.

Note When you void a check, the program creates a Void entry that will appear on the Payroll Journal. This is the same as the original check, except it is negative. This will result in the employee account totals being reduced as well as all journal transactions being reversed for this check.

When you void a payroll check, the Void entry will not appear on your Checkbook Register window until the Payroll Journal is run and updated to the General Ledger.

Checks in a prior quarter or year may not be voided. Therefore, you should make sure that all checks are correct before closing the quarter and year.

Void Payroll Check FAQ

Can I reuse the check number and check date of a voided check?

Yes! Once a check is voided, you can reuse that check number and date.