Miscellaneous Deductions

Advances/Loans Employee Savings Plans Garnishments

A garnishment is a miscellaneous deduction that is withheld on behalf of a government agency. You must remit amounts withheld on a regular basis (for instance on a weekly or monthly basis). Examples would include child support payments withholding orders for payment of back taxes.

401(k)/125(c) Plans

The amounts deducted for insurance, 401(k), and cafeteria plans, may not be subject to certain taxes. Taxable wages are calculated based on the line items entered on a check; these items are typically handled by entering two special line items on a check. The first item subtracts the amount to be deducted from the gross check total. The second line adds the same amount back into the check total using a special wage type that specifies which taxes apply to the amount deducted. This insures that the correct amount of wages are used as a basis for tax calculations. A miscellaneous deduction is used to make the deduction from the employee's check.

The following instructions outline the steps that are needed. The first two steps involve one-time setup. The third step must be done for each employee with this type of deduction, and the fourth step shows how the deductions are made automatically by the payroll check entry program.

Set Up the Wage Type

This will help the program to determine what taxes to deduct from the employees’ wages. To do this, go to Payroll > Setup > Wage Types.

You may set up as many different wage types as necessary. Each wage type is assigned a two letter/digit code. In general, once a wage type has been set up, it should not be deleted (especially if you've used it on a check entry!) This includes the wage types that are set up by default when you start using the program.

Press [F1] to get more information on the settings on this window from the Help system. Here are a few general guidelines though:

Never select the memo wages box unless the wages are for tips or some other compensation that the employee has received that has not been taxed. The effect of selecting the memo wages box is that the wages are added into the employee's total wages for tax calculation purposes, but they are not added into the check amount.

Bonus, Piecework, and Salary are often good choices for the Base Pay Type setting.

Set Up the Miscellaneous Deduction Type

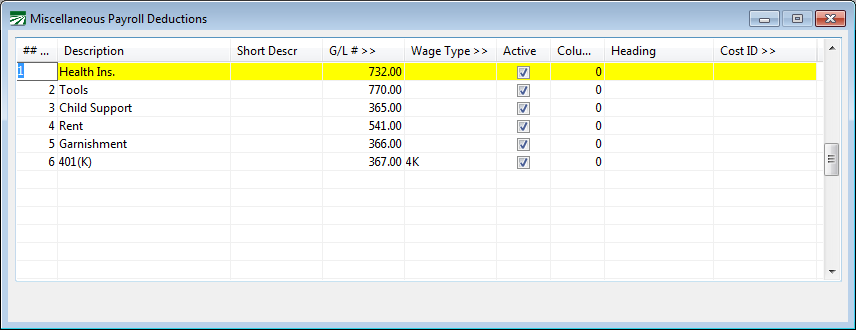

A Deduction Type must also be set up. This deduction can then be added to each employee. The deduction type also “links” the amount deducted to the pay type that defines the special taxability rules for that deduction. To set up a Deduction Type, go to Payroll > Setup > Miscellaneous Deductions. Here is an example of two deductions that have been set up for special taxability:

Deductions 4 and 5 have been set up to handle a 401(k) deduction and a cafeteria plan deduction, respectively. The Wage Type column specifies the corresponding wage type for each of these deductions. (For ordinary deductions you do not need to enter a wage type, as in deductions 1-3.) You can press the [F4] key in the Wage Type column to select a wage type from the lookup.

The Active column specifies whether or not the program should calculate the deduction. For instance, you may have a one-time deduction added to employee accounts. After the deduction has been made, you could simply deactivate the deduction for all employees by deselecting this box. Another situation where the Active check box is useful is when you are issuing checks for bonuses, vacations, sick pay, etc. You can deactivate the deductions that you don’t want calculated before entering checks, and then reactivate them when you are done.

Add Deduction to Employee Account(s)

Once you have set up the wage type and the deduction type, you’ll need to add the deduction to your employee account(s).

Go to Payroll > Employees > Deductions tab.

-

Open the employee’s Account #.

-

Simply select the Deduction Type, Method, and enter either an Amount (if it is a flat rate) or a Percentage.

-

Save the employee account after you have made your changes.

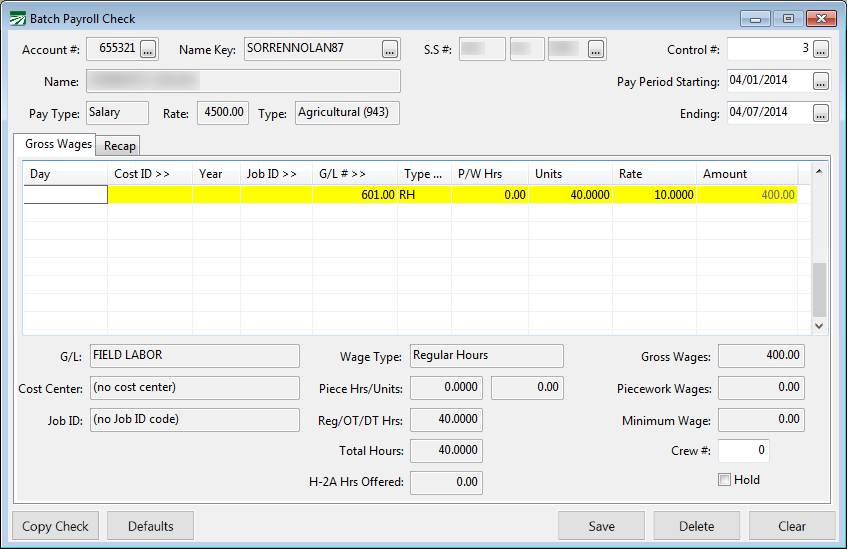

Enter Payroll Checks

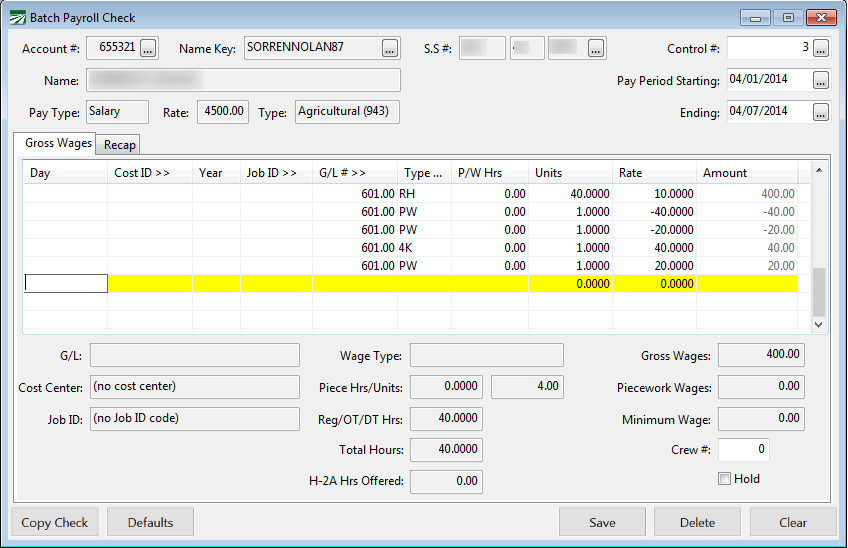

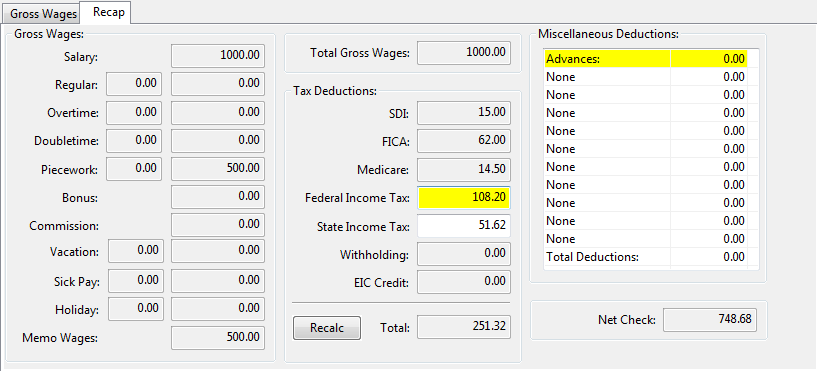

Enter the payroll check information as you normally would. When you click on the Recap tab page, the program will calculate the deductions and create the extra lines on the Gross Wages page to handle the taxability status.

Of course, since you are switching to a different tab page, you don’t see the entries, but if you click back on the Gross Wages tab, you’ll see them.

When the program creates the additional lines, taxes will be recalculated according to the settings in the wage type file.

Health Savings Accounts

Health Savings Accounts (HSAs) allow employees to make contributions to savings accounts that are tax free to pay for qualified medical expenses. To handle these types of deductions, set up a miscellaneous deduction that is linked to a wage type as shown below:

The Wage Type defines which taxes the employee contributions are subject to:

At the time of this writing, HSA contributions are exempt from federal taxes and state income taxes, except for California, New Jersey, and Alabama. Consult your accountant or state franchise tax board (or equivalent agency) to verify the taxability status of HSA contributions.

Add the miscellaneous deduction to the employees that have HSA accounts. When you issue payroll checks to these employees, lines will be added to the payroll check to adjust the taxable wages to account for the HSA deduction. Refer to the prior section covering 401(k)/125(c) plans for examples.

Employer Contributions

If HSA contributions are taxable in your state, then any contributions made by the employer will increase the employees’ state taxable wages. This can be recorded by setting up a separate memo wage type and using it on the employees’ check. This will increase the state wages reported on the W-2.

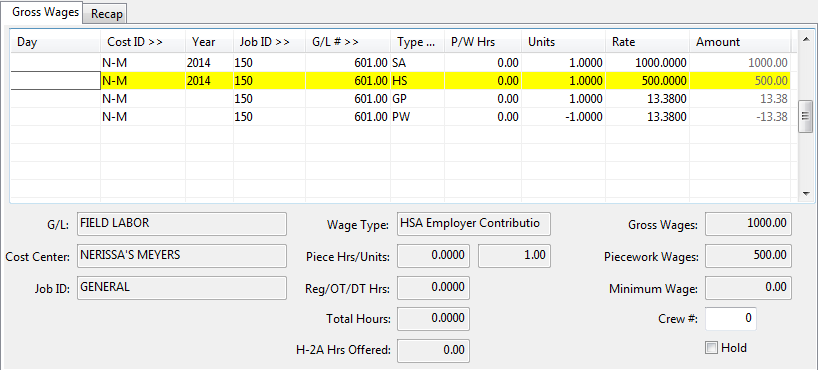

Here is an example of a check where the employer is making a $500 contribution to the employee’s HSA account using the HS wage type as shown above:

On the Recap tab, the total gross wages are based on the employee’s regular salary, the state income tax and SDI taxes calculations include the employer’s contribution added by the memo wage line, and the rest of the tax calculations are based on the employee’s regular salary:

If HSA contributions are not taxable in your state, then this step is unnecessary. However, you do need to keep track of all employer contributions for each employee for reporting purposes at the end of the year.

Reporting HSA Contributions on the W-2

HSA contributions (both made by the employer and deductions from employee wages) must be reported on the W-2 in box 12 with a “W” code. To do this, go to Payroll > Year End Tax Reporting > Edit YTD Archive File > W-2 Information tab.

Enter the total amount of contributions and click Save.

You may also need to add any employer contributions to the Employer-Sponsored Health Coverage amount (check with your accountant or tax advisor).

Union Dues Deductions

The Union Dues Calculation is designed for farm labor contractors that have some growers where employees are paid union wages and other growers where they are not. The Union Dues are based on a percentage of the employee union wages only, excluding non-union wages from the calculation. A special deduction calculation method is used on the employee accounts for this type of deduction. .

A setting on the Grower file determines whether wages for that grower are considered union wages or not. If this box is selected, the program will use any wages paid to the employee for work done on that grower account in the union dues calculation.

On the employee account, you must set up a deduction for the union dues using the “Percent of Union Wages” method as shown below:

Workflow

Enter your payroll in Daily Payroll and Create Checks as usual.

Go to Payroll > Checks > Calculate Union Deductions.

You may select a particular Crew, Operator, or Department. If you want to create the union deductions for all checks in the batch, leave these entries blank.

The report will look similar to this:

If you have not set up Employees/Growers as Union, you may edit the accounts and re-run the Union Deduction Report. If an employee is on the report that shouldn’t be (you entered the wrong grower), you can edit the check, and re-run the Union Deductions Report. The program will re-calculate the deductions and remove it, based on the current entries in the file.

The Union Deduction can be run as many times as you need prior to printing checks.

The deductions that are calculated by the report will appear on the Batch Payroll Check entry window in the Miscellaneous Deduction section:

Handling Deposits for Tools/Supplies

Suppose you have a situation where a deposit for items used by your employees will be taken out of the employees’ wages, then refunded when all work is completed.

Support Dept. (Ref. Phone #21743)