Piecework Wages and Minimum Wage

Piecework wages allow you to pay employees based on their output--number of boxes picked, trees thinned, vines pruned, trays rolled--instead of the number of hours worked.

Although pay is based on a total number of units, when paying piecework wages you can also enter the total number of hours worked. The payroll system can then use the number of hours worked to verify that employees receive at least minimum wage. If you do not enter the number of hours worked, your payroll records will be incomplete and the program will not be able to verify that employees receive minimum wage.

Standard vs. Legacy Methods

In the past (prior to 2015), different methods for generating adjustment lines were used. These methods are referred to as “legacy” methods. Settings in the Program Setup window allow you to select which method you want to use. The “legacy” methods have been retained for customers that have been using these methods and prefer to continue using them.

All new installations will by default use the standard methods that are described in this section. A section at the end of this topic explains the differences in detail between the legacy and standard methods.

The standard method for minimum wage verification provides more accurate expensing of minimum wage adjustments and the legacy method. It does not affect the total amount of the adjustment made to bring employees’ wages up to the legal minimum hourly rate.

The two methods used for guaranteed wage adjustment can result in different adjustment amounts. This is because the legacy method makes an adjustment for each line item entered that is subject to a guaranteed rate while the standard method will make adjustments for an entire day or for the entire week. The Legacy Verification Settings section has more details on the differences that may arise.

Types of Piecework

Several different wage types are used in the payroll system for piecework wages.

The “PW” wage type is used for “straight” piecework. Employees receive a fixed rate per unit of output. If an employee doesn’t make at least minimum wage, the wages are adjusted up to minimum wage. Adjustments are made by adding an additional line to the employee’s check.

The “PO” wage type is used for piecework wages earned after the employee has worked long enough to qualify for overtime wages (time and a half). Using this wage type will cause the pay rate to be multiplied by 1.5. In addition, when performing the minimum verification, the program will multiply minimum wage by 1.5 and make sure the employee made at least this much for the overtime piecework wages.

The “IP” wage type is used for incentive pay where an employee receives a guaranteed hourly pay rate, plus a bonus piece rate paid on top of that base pay. In this situation, the “BH” pay type is used for the base hourly pay. The guaranteed hourly pay rate may be below the legal minimum wage, but it is expected that the incentive piecework part of the pay structure will be bring the employees’ hourly pay rate above minimum wage. (In cases where their pay does not meet or exceed minimum wage, an adjustment is added to bring their earnings up to minimum wage.)

The “GP” wage type is used for piecework wages where you are going to guarantee a minimum hourly pay rate to employees above the minimum wage required by law.

While you normally won’t be using them when entering payroll time, the “MW” and “GW” wages types are also related to piecework wages. When an employee falls short of making minimum wage, the program can add a line to make up the difference between what the employee’s piecework wages were and what he should have made a minimum wage. The “MW” wage is used on that line. Similarly, when an employee is guaranteed a minimum hourly rate (other than minimum wage) and falls short of that, the “GW” wage type is used on lines that are added to make up the difference.

By using different pay types, it helps distinguish between straight piecework, straight hourly, and hourly plus piece work. These pay types appear on the check stub, so that it is clear to the employee what the basis for his wages is.

Each of these different types of piecework wages will be discussed in more detail in the following sections.

Tracking Hours Worked

Recent court decisions in California (2014) and Washington (2015) and legislation passed in California (AB 1513 in 2015) have changed how time needs to be tracked when paying piece rates. By law, employers are required to provide standard break times when they work a certain number of hours. In addition, other types of breaks may be required (e.g. heat illness prevention breaks in California). There may also be other situations where employees are unable to work at piece rates and must be compensated for time between piecework jobs.

In general, this time is referred to as “rest and recovery time” or “break time” and must be paid separately from piecework earnings. When paying rest and recovery time, employees must be compensated at either their regular rate of pay or their average hourly pay rate for their piecework earnings. Because each employee is earning a different amount based on their total units, their hourly pay rates will vary. The system can calculate the average hour pay rate for piecework wages and apply this rate to the line items entered for rest and recovery time.

Example Employee A works 10 hours in one day, earning piecework wages for the entire day at a single rate. He takes two breaks totaling twenty minutes. The correct entries for this is to pay one line of piecework for 9.6667 hours and one line of break time for .3333 hours.

Example Employee A works for 5 hours in the morning at piecework, taking one break. In the afternoon, he switches to a different job where he is paid on an hourly basis at a rate of 10.00/hour and works another 5 hours. He takes one break in the afternoon as well. The correct entries for this situation is one line of piecework for 4.8333 hours, one line of break time for .1667 hours, and one line for regular time for five hours.

It is not necessary to pay the afternoon break separately, as this is included in the line for the regular time.

Custom Piecework Wage Types

You can set up additional piecework wage types for other situations. When doing this, select “Piecework” for the Base Pay Type on the wage type setup window. This identifies the wage type as piecework wages and enables the entry for the number of hours worked in addition to the piece count.

For example, suppose you pay employees on an hourly basis but also pay a production bonus based on the total number of pieces produced to employees that exceed a production target. (The production target may also be based on a group/crew quota or on an individual basis.) This is like the base hourly + incentive piecework situation described in the previous section, but it is different in a couple of respects.

First, the hourly pay rate is already at or above the legal minimum wage. Second, the piecework component is conditional. It is not always paid to employees, but only when they meet a production target.

The production bonus is paid based on a rate per piece, so a piecework pay rate would be appropriate. In this situation, you could set up a specific wage type for the production bonus. This would appear as a separate line item on the employees’ pay stubs, and you would be able to run reports by selecting this wage type to determine the total production bonuses paid.

For a production bonus (as with the base hourly + incentive wage types) it is not necessary to enter the number of hours worked on the production bonus line. This is because the number of hours worked is entered on the line where you pay the hourly rate. Entering the number of hours worked on the production bonus line would double the number of total hours worked.

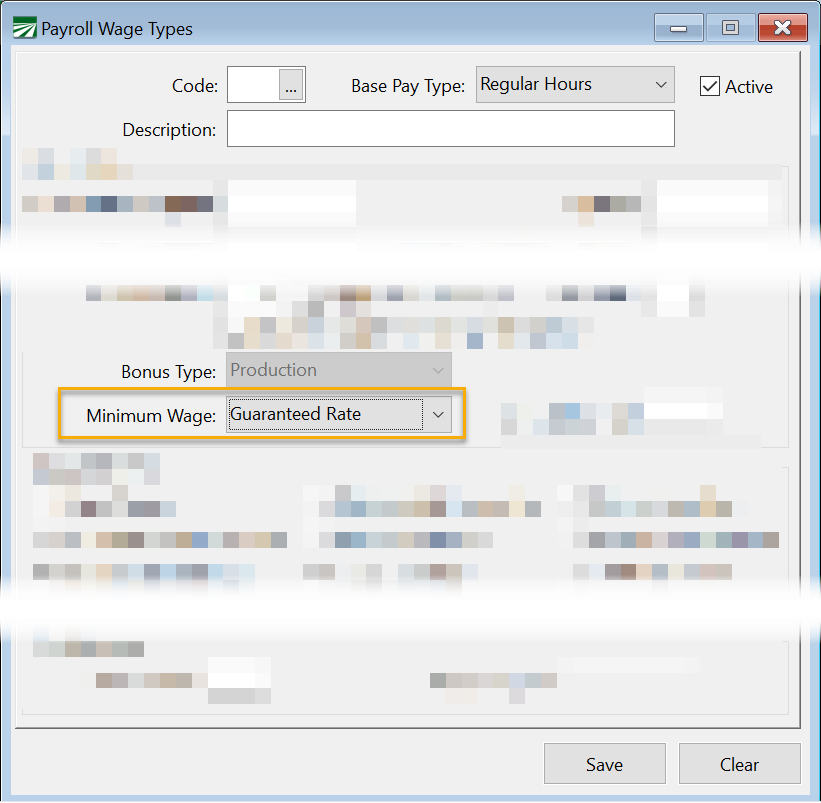

Minimum Wage Type

When you create new piecework wage types, you can select whether minimum wage rules or guaranteed wage rules will be applied. On the Payroll Wage Types window, the Minimum Wage setting controls this behavior.

Go to Payroll > Setup > Wage Types.

There are three options for this setting. The first, Yes, will apply minimum wage rules to lines entered under this wage type. If you have multiple lines on an check that use a wage type with the Minimum Wage option set to Yes, the wages and hours on those lines will be combined together to determine if the employee made minimum wage. This will happen even if the lines have different wages types.

The second option, Guaranteed Rate, will apply the guaranteed wage rules to that line. The program does not combine different lines together that all have the Minimum Wage option set to Guaranteed Rate. Each line is verified independently and an adjustment will be made for each line item separately.

The third option is No. This lets you set up wage types that are piecework based, but don’t have any minimum wage or guaranteed wage rules applied to them. For example you would use this option when setting up a special wage type for paying for bonuses.

Minimum Wage Verification

When paying piece rates, the program must know two things to verify that employees receive minimum wage: the number of hours worked and the minimum hourly wage. When you use a piecework wage type, the program allows you to enter the number of hours worked in the P/W Hrs column. The number of units that the employee is being paid for is entered in the Units column.

If you do not enter the number of hours worked in the P/W Hrs column, the program will not be able to verify that the employee made minimum wage. In some situations though, you may not need to enter the number of hours worked on every piecework line.

For instance, if you pay employees on a crew a certain rate, but also offer a bonus if the entire crew reaches a certain quota, you should not enter the hours on the bonus line. Or if you have employees pruning vines, and you are itemizing each row that the employees worked in, you may want to enter the total number of hours worked on the first line. Those lines will be combined together to determine the total wages for the hours entered.

Entering the hours worked when paying piece rates may is often necessary for other reasons. In some states (Oregon and Washington for instance) the number of hours employees worked must be reported on quarterly reports. It is also necessary to track hours worked to determine eligibility for health insurance coverage.

In Oregon, the Worker’s Benefit Fund Assessment deduction is based on the number of hours worked by employees. In Washington, the Labor & Industries Industrial Insurance is also based on the number of hours worked. When paying piecework wages, you must enter the number of hours worked in the P/W Hrs column for the program to calculate these deductions.

Determining the Minimum Wage

When the minimum wage verification is done, the program compares the federal minimum wage to the minimum wage for the state specified by the employee’s State for Withholding setting. The higher of the two rates is what it will use to determine the minimum wage for that employee.

If you employ workers in multiple states, the rate that applies will be determined by the state that the employees are working in. The multi-state payroll option must be enabled to enabled the state entry.

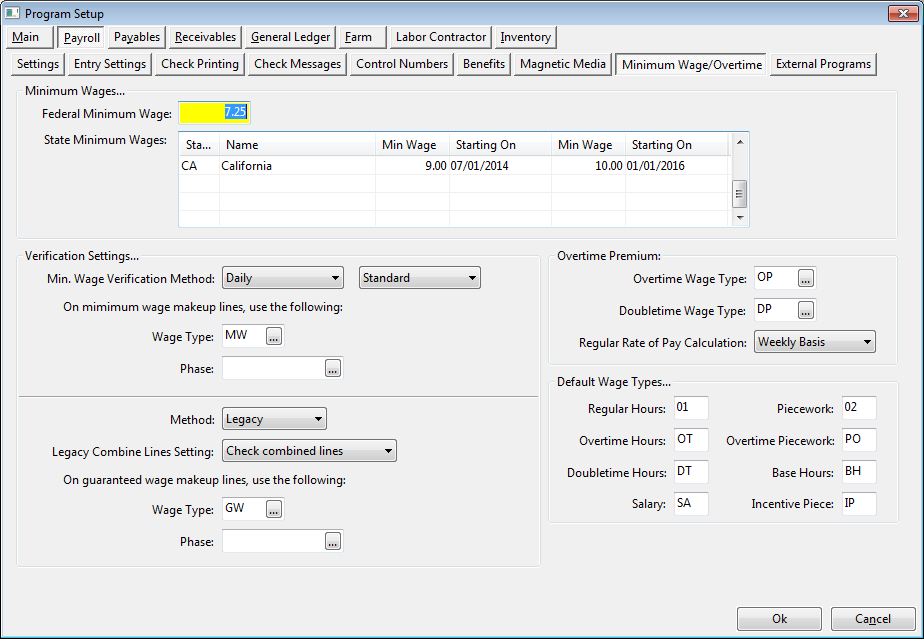

The federal and state minimum wage rates can be entered under Tools > Program Setup > Payroll > Minimum Wage.

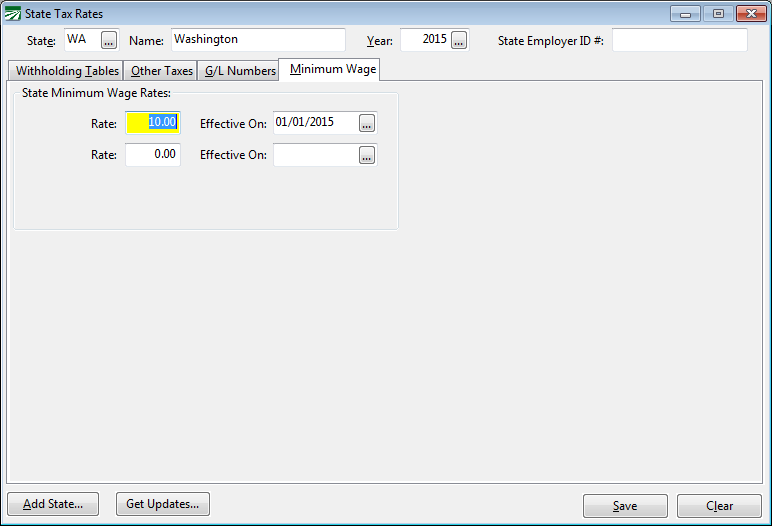

Although the state minimum wage rates can be edited on the Program Setup window, the rates are stored in the State Tax Rate file. You can also use the Payroll > Setup > State Tax Rates window to view and edit the state minimum wage:

Some states update the minimum hourly wage each year to keep it relative to a cost of living measure, while other states may pass laws changing the minimum wage. In either case, the minimum wage is set in the State Tax Rate Table. Updates to state tax rates each year include changes to the minimum wage.

The State Tax Rate file includes two different minimum wage rates and an Effective Date for each. This way, planned increases to the minimum wage may be scheduled ahead of time.

If you have payroll in multiple states, each state will be listed separately with its applicable minimum hourly wage.

Note While it is possible to edit the minimum wage, it is not recommended that you do so. If you need to pay employees a higher hourly rate than the legal minimum wage, the recommended method is to use a Guaranteed Wage wage type and set the guaranteed minimum rate either on the employee account(s), through the pay rate type, or on the grower accounts for farm labor contractors.

The reason we do not recommend changing the minimum wage in the State Tax Rate file is that updates to the state taxes will override the minimum wage and revert it back to the legal minimum. While this always happens at the beginning of the year, it is possible that updates or corrections to the state tax rate file will be released at any time during the year (for instance, updates are always released when new H-2A adverse effect rates are determined). If an update is installed to the state tax rate file and you do not change the minimum wage back to what you want, employees may end up being paid based on an incorrect minimum wage rate.

Daily vs. Weekly Minimum Wage Verification

Minimum Wage Verification can be performed on a daily basis or a weekly basis. The method that you use may depend on the regulations in your state. The method that you select applies to both minimum wage verification and guaranteed wage verification. In other words, you can’t verify minimum wage on a weekly basis and guaranteed wage on a daily basis.

For the Weekly method, all piecework wages on the check are added together, along with all piecework hours worked. If the piecework wages total is less than the minimum wage for the total hours worked, the program adds a line to the check to make up the difference.

Under the Daily method, the same type of calculation is done on each day that the employee worked. This can result in adjustments that may not be made using the Weekly method. An employee that fails to make minimum wage on one day may make up the difference later in the week, resulting in no adjustment under the Weekly method. But under the Daily method, the employees’ wages would be adjusted to meet minimum wage for that day.

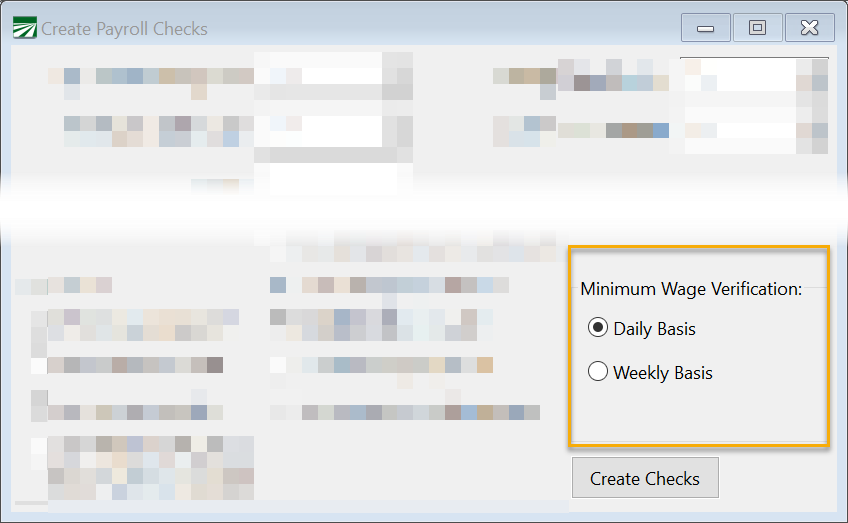

The Minimum Wage Verification section of the Program Setup window controls whether the default method is Daily or Weekly. This is found under Payroll > Minimum Wage > Verification Settings.

When you are using the Create Checks option in Daily Payroll, there is an option to use either the Weekly or Daily basis for minimum wage verification. The program will automatically default to what you have selected in the Program Setup window.

If you are entering check in the Batch Check Entry window, the program will use the method specified in the Program Setup window. When using the Daily method, you must enter the day of the week or day of the month in the Day column on each line. Otherwise, the program will have no way of determining which lines to group together for each day. When using the Weekly method, it doesn’t matter whether or not you enter the day on each line item.

Minimum Wage Adjustment Lines

When an employee does not make minimum wage, one or more lines will be added for the difference between the total piecework wages and what the employee should have made at minimum wage. When verification is being done on a daily basis, these lines will be added for each day the employee did not make minimum wage. Verification on a weekly basis will result in a single line or one set of lines being added to the check for the entire week.

The total amount that must be added to an employee’s check is allocated to the cost centers/Job ID’s/G/L #’s/grower accounts entered on the line items where the employee did not make minimum wage. For lines where the employee did make minimum wage or higher, no adjustments will be made. By doing this, the adjustments may be expensed (and billed to growers, in the case of labor contractors) proportionally. To get a better idea of how this works, see the examples in the next section.

The line item that is added will show one in the Units column and the difference in the Rate column. By default, the “MW” piecework wage type will be used. (It is possible to create your own wage type and use that instead of “MW”.) By using a different wage type for minimum wage adjustment lines, the wages paid are clearly identified as not hourly/piecework and are expressly paid to bring the employee’s earnings up to minimum wage. Also, for reports the program can produce separate totals for minimum wage adjustment lines. For instance, on the batch report, the minimum wage adjustment lines will be totaled separately on the recap by wage type at the end of the report.

Minimum Wage and Guaranteed Wage Verification calculations are performed during the Create Checks process if you are entering information through Daily Payroll. If you are entering checks using the Batch Check Entry window, the verification process is done when you have finished entering each check.

When you run the Daily Payroll Batch Report, there is an option to calculate the minimum/guaranteed wage adjustments. If this option is not selected, then the adjustments will not be included on the report, and the total wages on the report will not match the totals of the checks generated by the Create Checks process.

If you use the option to generate the grower labor report entries, then the program will also calculate the minimum/guaranteed wage adjustments and add these to the grower labor report file. It is important to note that the adjustments calculated are based on the labor entered at the time that you use the Generate Labor Reports option.

If changes are subsequently made to the daily payroll entries, this could affect the adjustments that should be calculated. As a result, the adjustments that were already calculates by the Generate Labor Reports option would not be correct. In this situation, you would need to use the Generate Labor Reports option again to create up to date entries for the Grower Labor Report. And you may need to void/re-issue any invoices that were generated from the out of date information.

Examples

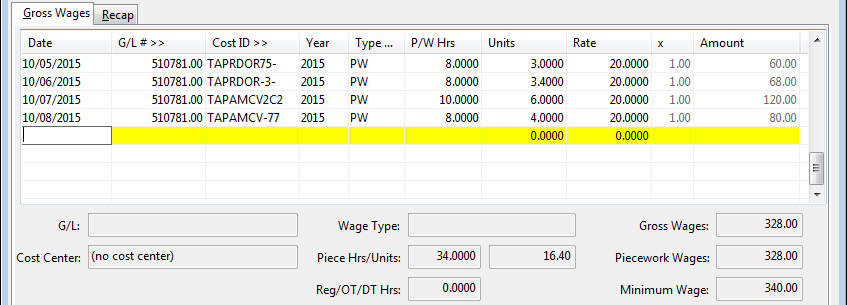

In the following screenshot, an employee has time on four days. The minimum wage is $10/hour. The first two days the employee does not make minimum wage. On the third day the employee makes more than minimum wage, and on the fourth day the employee make exactly minimum wage.

If the minimum wage verification is done on a daily basis, then an adjustment will be made for the first and second lines. No adjustments are needed for the third and fourth lines:

A separate adjustment line is created for each day.

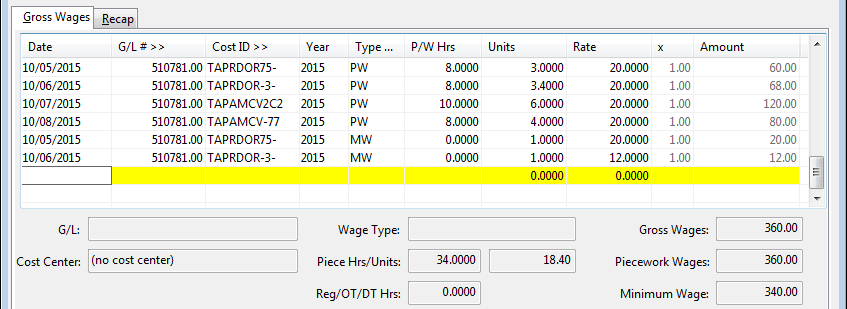

If the minimum wage verification is done on a weekly basis, then the program takes into consideration all of the wages on the check to determine how much of an adjustment is necessary. Since the employee made more than minimum wage on the third line item, this will partially offset the total adjustment needed. This screenshot shows the adjustments that will be created using the weekly basis for minimum wage verification:

Using the weekly method, the total adjustment is only $12, bringing the total check up to the $340 total for the week that the employee should make at minimum wage.

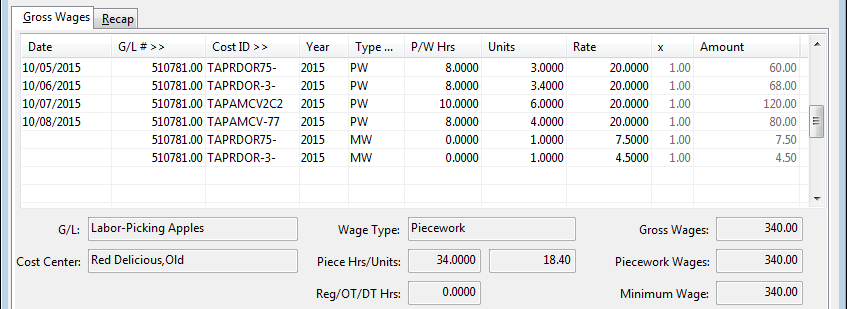

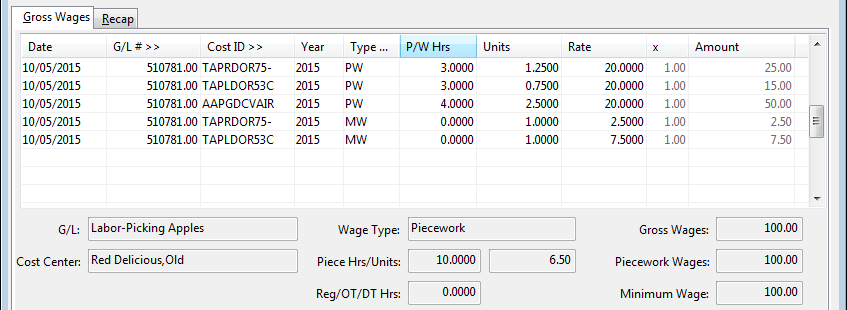

In the following example, the employee worked at three different cost centers in a single day. The employee worked a total of ten hours, and the minimum wage is set to $10/hour. At minimum wage, the employee should have earned $100 for this day, but the piecework wages total only $90. On the first two lines, the employee did not make minimum wage, but on the third line item the employee made more than minimum wage.

For the first lines item, the employee is short by $5.00. For the second line item, the employee is short by is short by $15.00. Since the employee made more than minimum wage on the third line by $10.00, for the entire day, the employee only needs $10 added to his wages to bring the total wages up to the minimum wage of $100.

The program will create two lines items for a total of $10. It will add up the total amount that the employee is short on the lines where he did not make minimum wage, $20 in this case. Then it determines the percentage of the total adjustment that should be allocated to the cost center/general ledger account/job ID entered on the lines that are short. In this case, 25% for the first line ($5/$20 = 25%) and 75% for the second line ($15/$20=75%).

Here is the screenshot of the check detail after the adjustments have been created:

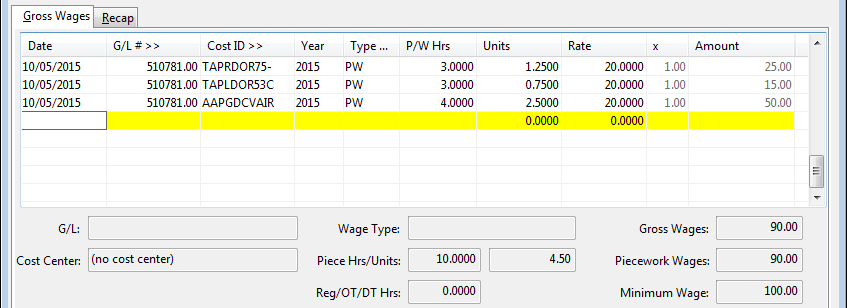

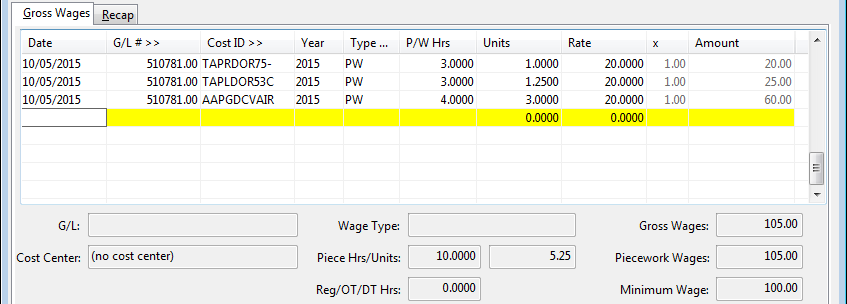

Of course it is possible for an employee to make enough on some piecework lines to entirely cover the shortfall on other lines. That is the case in the following screenshot:

In this case, the first two lines are still under minimum wage (3 hours @ $10/hour =$30) but the last line more than makes up f or the shortfall on the first two lines. No adjustments will be made for this employee.

Guaranteed Hourly Rates

In some cases, an employer may want to guarantee employees a certain hourly rate, over and above the minimum wage set by law, when employees are paid piecework wages. For instance, an employee that works in a packing house and is normally paid $10.00 per hour may join a crew performing field labor. The employees in the crew are paid piecework. If the packing house employee is productive, he has the opportunity to make more than his normal hourly rate. However, the employer may want to guarantee that he makes at least $10.00/hour, or what he would have made if he had been working in the packing house during that time.

In some cases when the labor supply is tight, employers may need to offer higher wages than the current minimum wage set by the state or federal government.

Another scenario is that the employer wants to pay piece rates but guarantee a minimum hourly wage for certain types of jobs to all employees. In this situation, you may even need to set different guaranteed rates for different jobs.

It is also possible to combine both of the above situations. You may guarantee the field workers a minimum hourly rate of $9.50, and this is set up in the Pay Rate table. However, the packing house employee will still be guaranteed $10.00 per hour, because that is his normal rate of pay.

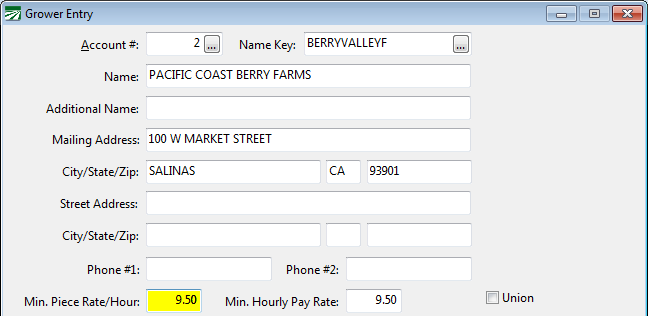

Setting a Guaranteed Hourly Rate for a Grower

In some cases, a labor contractor may have agreed on different minimum hourly rates that employees will be paid for each grower. In this situation, you can enter the minimum hourly rate for piecework earnings on the Grower Entry window as shown below:

If an employee works for two different growers in the same pay period that have different guaranteed hourly rates, the program will perform a separate guaranteed rate calculation for the hours worked for each grower.

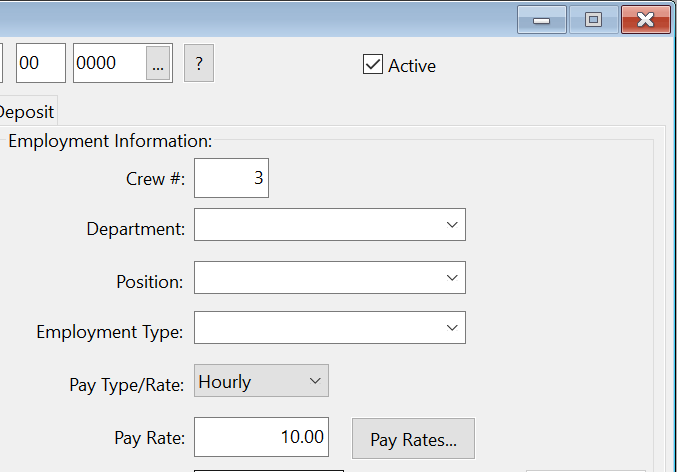

Guaranteed Hourly Rate for an Employee

In this situation, the employee account must be set to Hourly for the Pay Type, and an hourly rate must also be entered. When paying the employee, use the “GP” wage type (Guaranteed Piecework) or the “GO” wage type (Guaranteed Piecework Overtime).

Just as with straight piecework, you must enter the number of hours worked in the P/W Hrs column for the program to make the necessary calculations. The program will compare the wages entered under these wage types to the hourly rate on the employee account, and add a line to make up the difference if the employee did not make that rate. This process is done at the same time the minimum wage verification is done—during the Create Checks process in Daily Payroll, or when you have finished entering a check in Batch Check Entry.

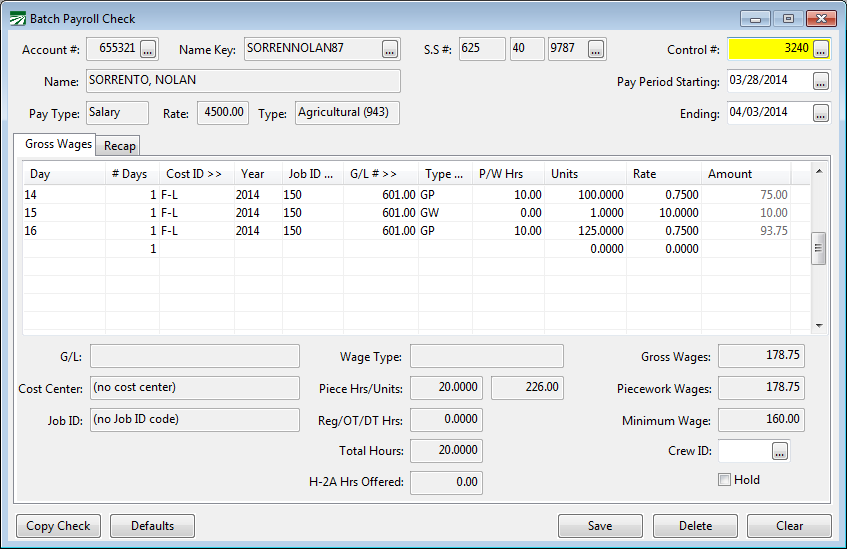

In the following example, the employee worked two days, ten hours each day, at a guaranteed rate of 8.50/hour, and a piecework rate of .75/unit:

Each day the employee is guaranteed to make $85.00 for ten hours. On the first day, the guaranteed piecework wages are $75.00, so a line is added to the check for $10 to bring the employee’s wages up to $85.00. On the second day, the employee made $93.75. No adjustment is made because the employee made more than the guaranteed rate.

Guaranteed Hourly Rates for a Crew

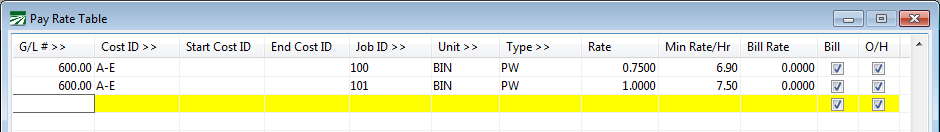

For situations where you guarantee a minimum hourly wage to all employees, the Pay Rate table can be used to enter a rate that applies to all employees performing particular jobs. Here is an example of how these rates can be set up:

In this example, two piecework rates are set up for two different Crop ID’s (1001 and 1006) and two different Job Codes (027 and 034). On the first line, employees are paid 0.75 per bin, and guaranteed to make at least $6.90/hour. The second line pays employees 1.00 and guarantees that they make $7.50/hour.

One thing to keep in mind when setting up minimum hourly rates through the Pay Rate table is that you can use any piecework wage type. Note that in this example, the regular piecework wage type, “PW”, is used, not the Guaranteed Piecework wage type, “GP”. The Guaranteed Piecework wage type is only necessary for the program to compare piecework earnings to the normal hourly rate specified on the employee account.

You could just as easily use the “GP” wage type in the Pay Rate table entries instead of “PW”. One reason that you might use “PW” is that your data entry personnel do not need to remember when to use “GP” and when to use “PW”.

One effect of using “GP” in a Pay Rate table entry is that the program will compare the hourly rate on the employee account against the minimum hourly rate in the table, and pick the higher rate when checking to see if the employee made the guaranteed minimum. This means that if an employee is guaranteed a higher hourly rate than others working in the same crew, the program will pay the higher rate to the employee.

Combining an Hourly Rate with Piecework

A variation on the straight piecework method is to pay employees a base rate per hour worked plus a piece rate. Separate wage types are used for this type of combination pay. This is so that the base hourly rate is not confused with regular hourly wages and the piecework component is not confused with straight piecework wages. This way, it is clear to employees (and potentially auditors) what the basis for employee pay is, and there is no confusion about whether or not employees make minimum wage.

In this situation, you must enter two lines in the Daily Payroll Entry or on the employees check in Batch Payroll Entry. The first line is where you enter the number of hours worked and the base hourly rate using the “BH” (Base Hourly) wage type. The second line is where you enter the number of pieces and the piece rate, using the “IP” (Incentive Pay) wage type.

Note that on the piecework line, you do not need to enter the number of hours worked for the program to perform the minimum wage verification. For minimum wage verification purposes, the program adds the two lines together, and gets the number of hours worked from the first line. If you were to enter the hours worked on the second line in the P/W Hours column, then the program would think the employees worked twice as many hours as they actually did.

Minimum Wage Verification

The legacy minimum wage verification method is limited in that it can only create one adjustment line for each day (when doing a daily verification) or one adjustment line for the entire week (when doing weekly verification). This adjustment line will be for the entire amount that the employee needs to be paid to bring their wages up to minimum wage for the day/week.

As a result, the wages for minimum wage adjustments may not be distributed according to the actual cost centers, job codes, and general ledger accounts entered. This may not be much of an issue if you do not typically have a lot of different combinations on your payroll checks.

There is no difference between the legacy and standard methods in the amount of the adjustment. The standard method is simply capable of making a more complex allocation of the overall cost for minimum wage adjustments between multiple cost centers/job codes/general ledger accounts.

Guaranteed Wage Verification

The legacy guaranteed wage verification system evaluates each line of guaranteed piecework that is paid to an employee to determine whether or not the employee made the guaranteed minimum on that line. If the employee did not make the guaranteed minimum, an adjustment is created for that line.

In contrast, the standard method of guaranteed wage verification works exactly like the standard method of minimum wage verification. The only difference is the hourly pay rate that the employee must meet to trigger adjustments.

Wages are totaled for each day or for the week (depending on the verification period setting in Program Setup). Then the total wages are checked to see if the employee meets the guaranteed wage. If the employee doesn’t meet the guaranteed minimum wage, then one or more adjustment lines are created. Adjustment amounts are pro-rated based on the line items where the employee did not meet the guaranteed minimum.

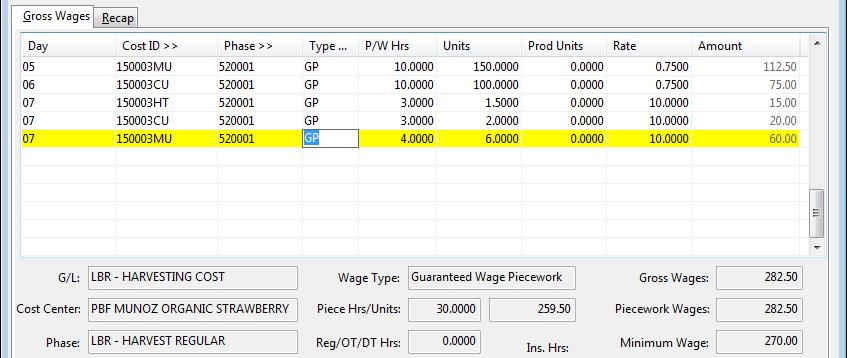

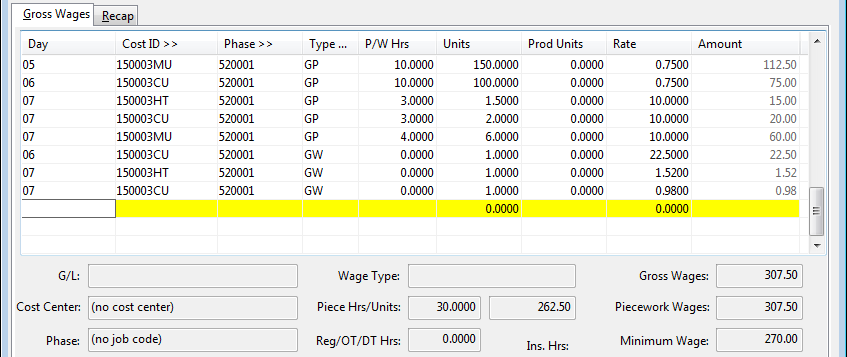

The following examples show the difference between the legacy and the standard minimum wage calculations. The following screenshot shows a check before any adjustments have been created.

For these examples the employee is guaranteed $9.75/hour, so for a ten hour day, the employee is guaranteed $97.50 ($292.50 for 30 hours worked total). The employee has made more than this hourly rate on the first and last line items. However, on the middle three lines, the employee made less. The following screenshot shows the adjustments that are created when the legacy method is in use:

Adjustments have been created (the lines with the “GW” wage type) for the middle three lines to bring the pay up to the rate of $9.75 for those lines. The first and last lines where the employee made more than the guaranteed minimum do not factor into the guaranteed wage calculation at all. Note that the daily vs. weekly setting does not come into play at all, because each line is evaluated individually.

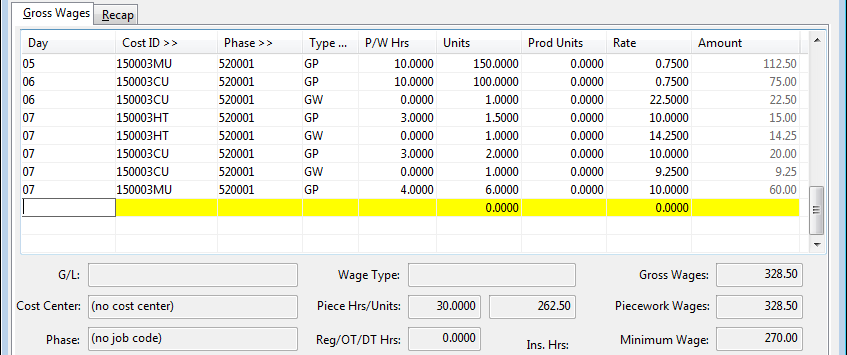

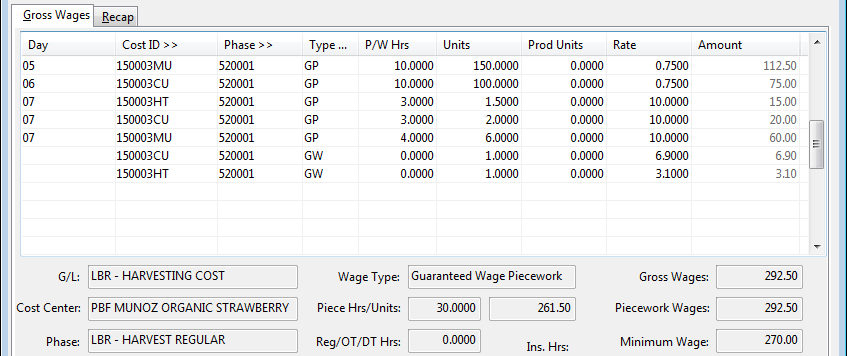

Under the standard method, the total wages are added up and an adjustment is made to bring the employee up to the guaranteed minimum overall. Here are the adjustments made under the standard method when the verification is done on a daily basis:

As in the first example, three adjustment lines have been created, but they are for different amounts than the legacy method. This is because when you are using the standard method, the employee is guaranteed to make $9.75 for each day. The adjustment for the 6th is the same, $22.50 (to bring the employee’s pay for that day up to $97.50). But on the 7th, the employee has one line item where he made more than $9.75/hour. The total wages on the 7th are $95.00. This means the total adjustment needed for the day is only $2.50.

In the final example, the verification is done on a weekly basis:

Looking at the wages on a weekly basis, the employee should make a total of $292.50 (30 hours @ $9.75/hour). A total adjustment of $10 is needed to bring the employee’s wages from the original total of $282.50 to $292.50. The adjustment is split between two cost centers according to the following calculations:

For cost center 150003CU, a total of 13 hours was worked on two days. The employee earned $95 on these two lines; at a guaranteed rate of $9.75/hour, the total earnings should be $126.75, for a difference of $31.75. For cost center 150003HT, the employee worked 3 hours and earned $15; at a guaranteed rate of $9.75/hour, the total earnings should be $29.25, for difference of $14.25. The total dollar difference for these two lines is $46.

For cost center 150003CU, the adjustment is 69% (31.75/46) of $10.00, or $6.90. For cost center 150003HT, the adjustment is 31% (14.25/46) of $10.00, or $3.10.

Because the adjustments are made for the entire week and don’t correspond to any single day, the day entry is left blank.