How to Accrue Credit Reduction

Entering the Credit Reduction in the State Tax Rate Table

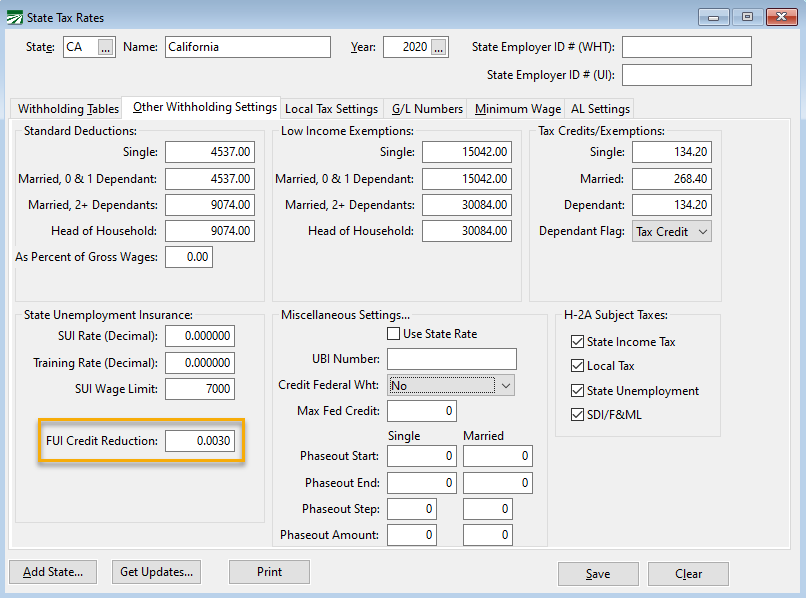

In your Datatech Software, the Credit Reduction is set by state on the State Tax Rate Table. To edit this rate, follow these steps:

-

Go to Payroll > Setup > State Tax Rate Table. Then click the Other Withholding Settings tab.

-

Enter the rate in the FUI Credit Reduction entry.

Verifying the Accrual Method is Turned On

The FUI tax will likely continue for several years. Companies with a large number of employees will be hit the hardest, possibly owing tens of thousands of dollars in extra 940 taxes at the end of the year.

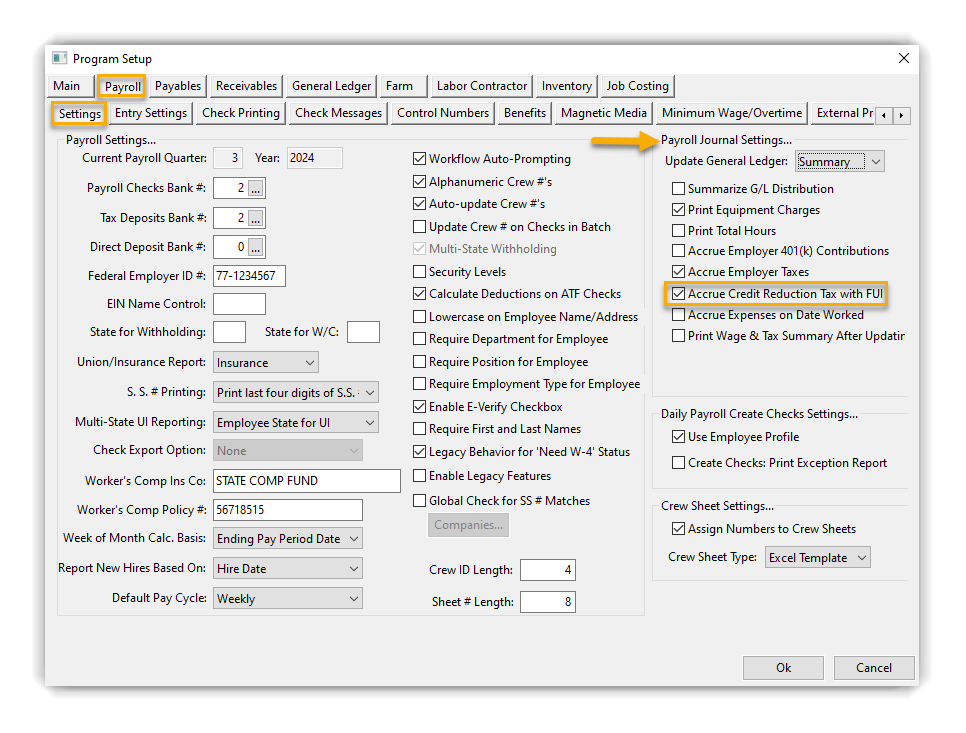

Companies may choose to spread the cost of the credit reduction throughout the year instead of paying the credit reduction tax in the fourth quarter. To do this, follow these steps:

-

Go to Tools > Program Setup. Click the Payroll tab.

-

Under Payroll Journal Settings, select Accrue Credit Reduction Tax with FUI if you would like the additional tax included with the accrual.

How do the Following Reports Work With the FUI Tax?

Payroll Journal

FUI accruals will be broken down by state on the Payroll Journal GL Distribution Report. Because the accrual transaction includes the tax rate and FUI tax rates may vary for each state, a separate accrual transaction will be posted for each state.

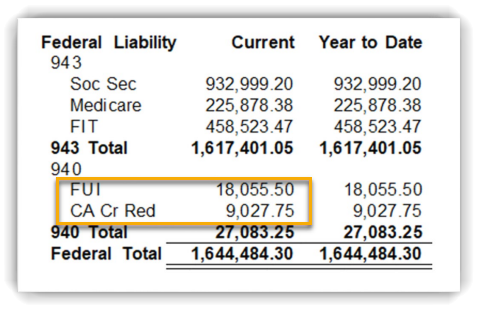

Wage and Tax Summary

The 940 will now include two lines: one for the base rate of .6%, and another line for the credit reduction additional tax.

Here’s an example:

Taxable Wages by Quarter

When printing this report for FUI taxes for single state, it will also print the FUI Credit Reduction Rate and calculate the additional amount of tax owed.

Note Once the accrual is turned on, the credit reduction tax will only start accruing with the next payroll. If you would like to make a journal entry to accrue the year-to-date anticipated tax, you may run the Wage and Tax Summary to get the additional tax. You would then credit your 940-liability account to increase the liability by this amount and debit your payroll tax expense account.

How to Include the FUI Tax When Billing Growers

All labor contractors bill growers for overhead payroll expenses. Labor contactors that bill a simple flat percentage of labor to cover overhead should consider increasing this percentage to cover the additional FUI tax.

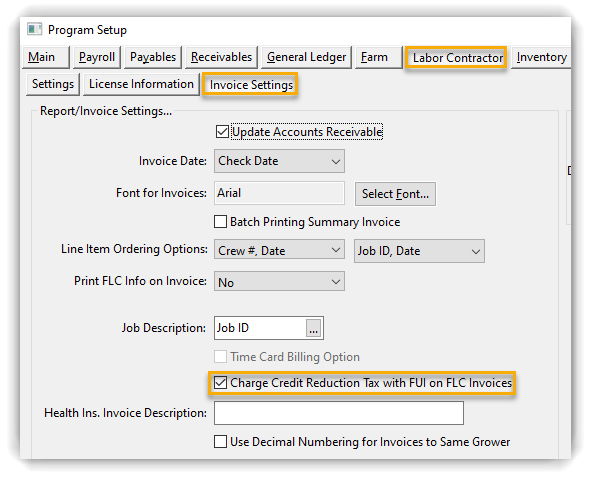

Some labor contractors itemize the payroll overhead costs separately on their invoices. In these cases, you may want to include the FUI Credit Reduction in the FUI percentage that is billed to your growers. To do this, follow these steps:

-

Go to Tools > Program Setup. Click the Labor Contractor tab, then click Invoice Settings.

-

Under Report/Invoice Settings…, select Charge Credit Reduction Tax with FUI on all FLC Invoices.

When this box is selected, a California grower would be billed .9% for FUI instead of .6%. However, this option will only apply to grower accounts that have the “Bill FUI” option selected on the Billing Information tab of their grower account. Follow steps 3-5 for further instructions:

-

Go to Labor Reports > Grower Entry. In the Account # entry, enter the account number of the grower you would like to bill for FUI. You can also use the lookup button to select the grower.

-

Click the Billing Information tab, then select Bill FUI.

-

Click Save. Continue to do this for any other grower accounts you would like to bill for FUI.