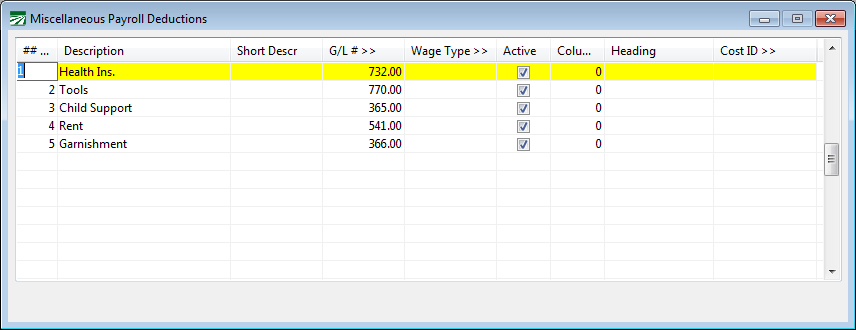

Miscellaneous Payroll Deductions

Setting Up Deductions

The payroll system allows you to deduct non-tax items from employee paychecks, such as deductions for tools, child support, garnishments, 401(k) plans, etc. A deduction type must be set up for each different kind of miscellaneous deduction you have. The deduction type only needs to be set up once. For instance, you may have several employees with a child support deduction, but you only need to set up one entry in the Miscellaneous Deduction file. Then you can set up the child support deduction on each employee account where it is needed.

Go to Payroll > Setup > Miscellaneous Deduction.

Each deduction type is listed on a separate line.

Deduction #

In the first column enter a number from 1 to 99.

Description

Enter a description for the deduction. This description will appear on the payroll check entry and the employee's check stub.

If you have some employees set to print Spanish language check stubs, a second description column can be enabled where you can enter the description to use on Spanish language check stubs. To enable this column, right click on the grid and select the Enable Spanish Descriptions option.

G/L #

Enter the General Ledger account number to use when updating the total deduction from employee checks. When you print the Payroll Journal and update it to the General Ledger, this General Ledger account is used. The General Ledger account may be an asset, liability, income, or expense account, depending on the nature of the deduction.

An asset account is typically used for deductions for advances or similar situations where the employee owes the company money.

Liability accounts are normally used for money that is withheld on behalf of the government or another company. Amounts withheld become a liability because you must pay them to someone else. For instance, child support payments withheld must be remitted to the district attorney or state; back taxes must be paid to the state or federal governments; 401(k) deductions must be remitted to the company that administers your retirement plan.

If an amount withheld represents income to the employer, an income account would be used. For instance, if an employer provides housing for some employees, a rent deduction should be posted to an income account.

An expense account is normally used when the amounts withheld are offsetting an expense the company has incurred. For example, a company that pays for half of the health insurance premiums will expense the bill for health insurance to an expense account. Amounts that are withheld from employees’ paychecks are posted (as credits) to the same account, reducing the total expense for the company.

Wage Type

For some deductions, such as 401(k) or cafeteria plans, wages that are withheld are not subject to certain taxes. You can specify the wage type that corresponds with the deduction in this column. (The wage type is what tells the program which taxes the wages are not subject to.)

Active

This checkbox will determine whether or not this deduction type is calculated for all employees with this type. For instance, if you have a one-time deduction for tools, you can disable the deduction by deselecting this box after the deduction has been made. On the next checks, the Tools deduction will not be taken out.

Column

This specifies which column amounts for this deduction type will appear in the Miscellaneous Deduction Report. This setting is not currently used.

Heading

This is the heading that will appear at the top of the Miscellaneous Deduction Report. This setting is not currently used.

Cost ID

When the Payroll Journal updates the General Ledger, the credits amounts that are posted for miscellaneous deductions normally do not have a cost center. In some situations, you may want these transactions to be assigned to a cost center, and you can enter the cost center to use in this column.

Example You have several employees that must have money deducted for child support payments. You already have three deductions listed in the Miscellaneous Payroll Deduction file (see sample screen above). Click on the blank line under Garnishments, enter 4 for the deduction number, "Child Support" for the description, and your General Ledger account (usually a liability account) for child support payments.

As mentioned above, you only need to set up one entry in this window for each different kind of deduction. In some situations, you may find it useful to set up more than one deduction type for the same kind of deduction. For instance, if you have employees whose child support must be paid to different counties, you may want to set up more than one deduction, each with the description "Child Support" but with different General Ledger account numbers so that the amounts are separate on the General Ledger; this way, they can be tracked more easily.

Example You have a health insurance deduction for employees. The company pays for 75% of the insurance premiums and the employees have a 25% deduction from their paychecks. In this case, you would normally set up an entry with an expense account as the General Ledger account (see the sample screen above). When you pay the health insurance bill, you use the same General Ledger account. When a check is written, a debit is recorded to the expense account; when money is deducted from paychecks, this is updated as a credit to the same account. In this way, the net total expensed to the account is 75% of the cost of the health insurance.

Example You receive a withholding order for an employee who owes state income taxes for prior years. First, you will set up a new liability account to which the amounts being withheld are posted. You would not use your existing State Income Tax Withheld account because this account is for current taxes that are withheld. Using this account would distort the amount of state taxes that are due on the Payroll Tax Liability window. A separate account needs to be set up to handle the back taxes due. Then you can set up a deduction type that uses the new liability account that you have set up. Amounts withheld from the employee will be posted to this account. When you pay the state, you can write a direct expense check that is expensed to this liability account which will erase the liability for the wages that have been withheld.