How To Apply Overtime Rules

Two options are available in our software for applying overtime.

-

An Hourly option where the program will create overtime entries for the hours that went over the maximum regular rate hours.

-

An Overtime Premium option for when there is more than one pay rate for the work week.

Overtime: Hourly Time Only

If you are only entering hourly time, meaning:

-

There are no piecework wages in this check.

-

There are no other pay rate entries for this check.

Then you would enter RH, the Regular Hourly Wage Type, for all entries. The overtime for Hourly only wages will be paid out at 1 ½ x the hourly rate. The Rate column will show the employee’s regular hourly rate. The Overtime and Double-time rates will appear on the employee’s check and reports.

Follow these steps to enter payroll and calculate HOURLY OVERTIME.

-

Enter your line items with the RH wage type.

-

When you have finished entering this payroll, remove any filters. This includes Time Sheet, Crew, or Viewing Names so that all entries are displayed on the Daily Payroll entry.

-

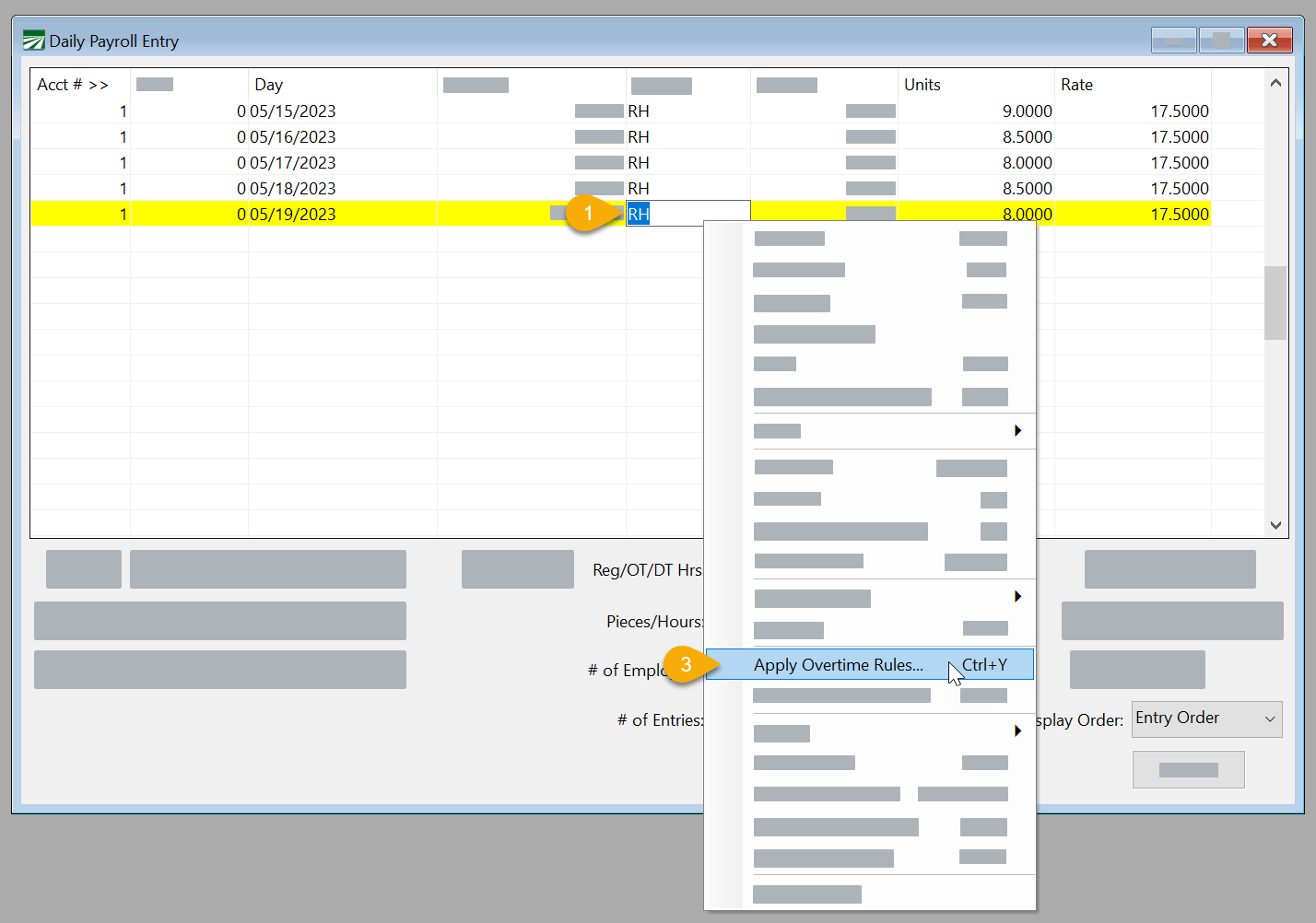

After removing all filters, right-click within the grid and select Apply Overtime Rules. The following window will open:

-

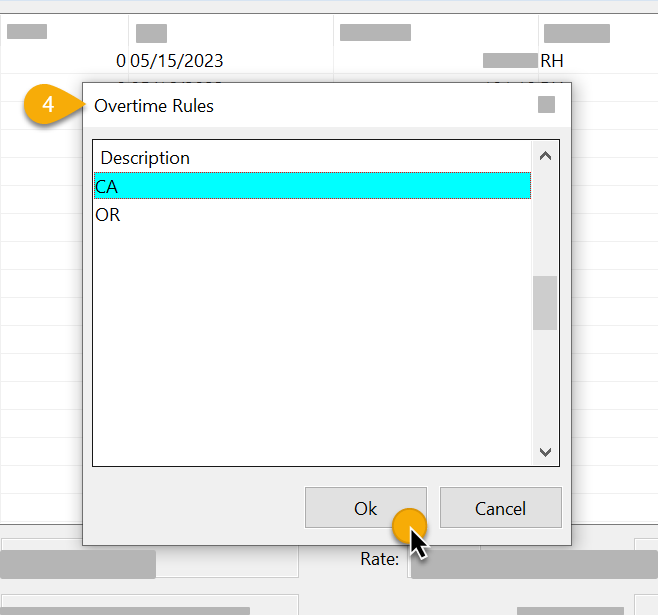

Select the Overtime Rule you would like to apply. The software will then calculate the amount of applicable overtime at 1 ½ x the hourly rate. and create new entries with the same GL, Cost/Crop ID, Job, etc… with the Overtime Wage Type.

Note If you have any exempt employees that fall under different Wage Types, you will want to create those checks before applying overtime rules so they don’t have incorrect calculations.

Overtime Premium: Multiple Rates per Week

When there is more than one wage type, Overtime Premium must be used. If you are entering multiple rates for the week, meaning:

-

There are piecework wages in this check.

-

There are other pay rate entries for this check.

Then you will need to use Overtime Premium.

In California and Washington, breaks are required any time there is piecework. That means there are automatically two types of pay. When there is more than one wage type, Overtime Premium must be used. Follow these steps to calculate Overtime Premium on multiple rates:

-

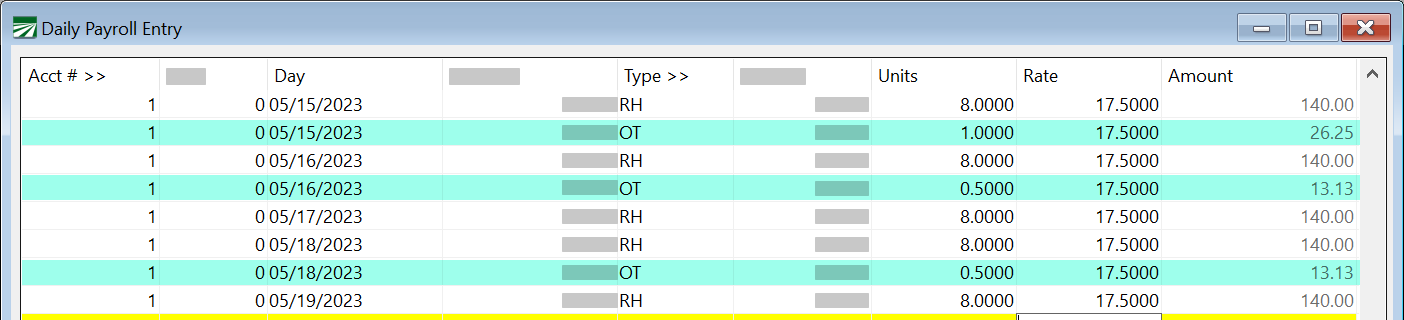

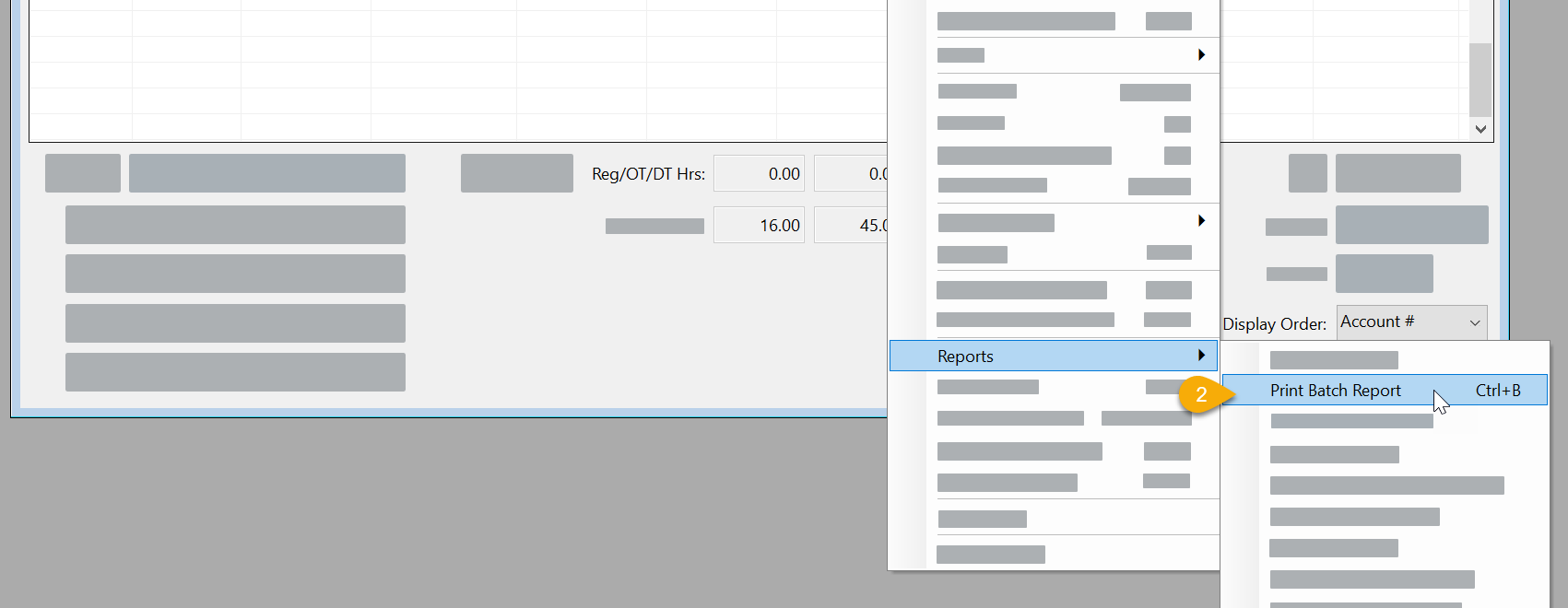

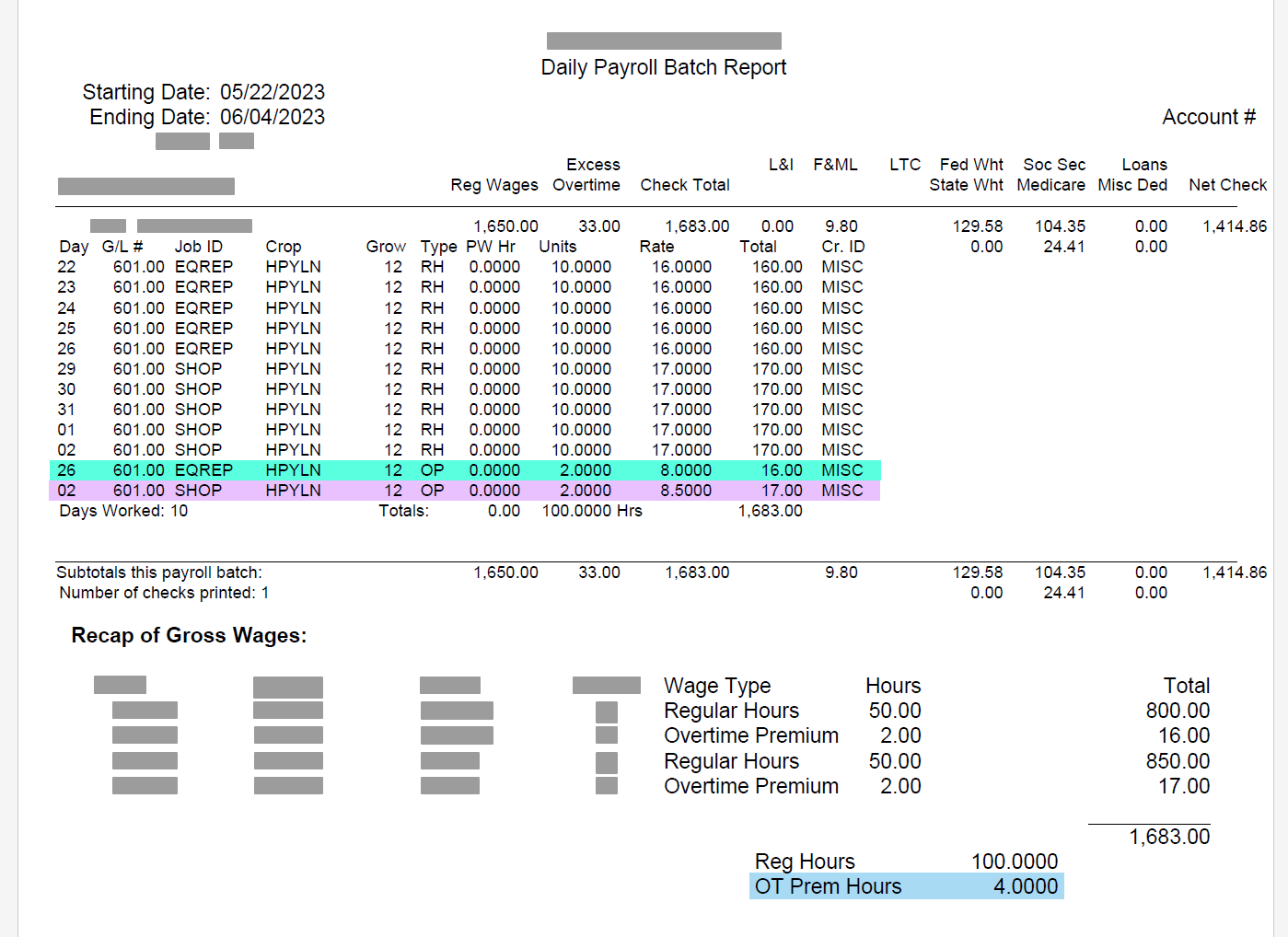

After all payroll has been entered in Daily Payroll Entry (including creating breaks), right-click in the grid and select Reports > Print Batch Report.

-

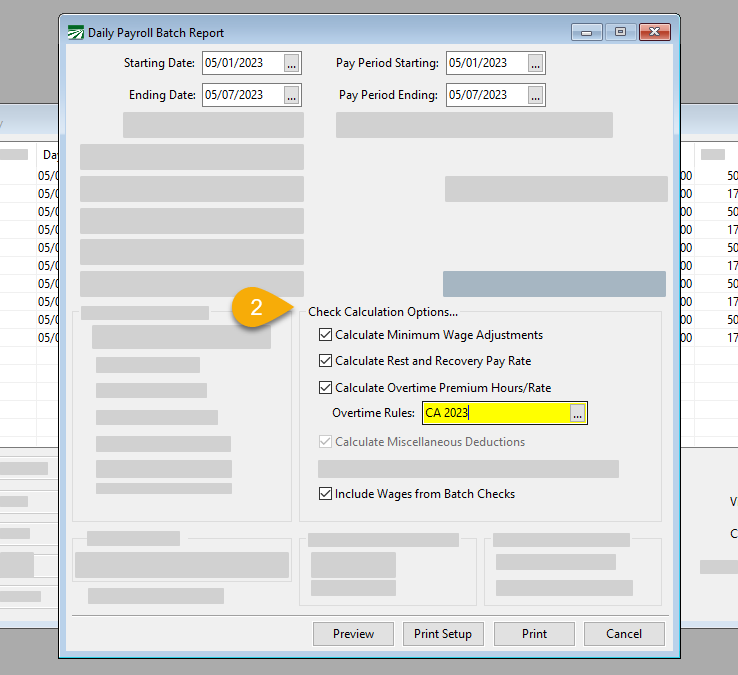

In the Daily Payroll Batch Report window, enter your Starting/Ending Dates as well as your Pay Period Dates. Then in the Check Calculation Options section, select

-

Calculate Rest and Recovery Pay Rate

-

Calculate Overtime Premium Hours Rate

-

Select the Overtime Rule to apply.

-

Click Preview. The report will then detail the calculations created.

The software will calculate the regular rate of pay and add additional lines for the amount of overtime hours at ½ the average regular rate of pay and double-time at the regular rate of pay. This is because 1 of 1 ½ is already compensated with the employees’ pieces and rest pay. The additional Overtime Premium is adding the extra ½ pay and the Double-time the extra 1 pay the employee is due.

Also of note, the overtime rate is ½ of their rest & recovery rate because both are using the same regular rate of pay method.

Note These lines are not actually created yet in Daily Payroll. Entries in daily payroll may still be edited. When entries have been reviewed and you are ready to create checks, the final calculations and addition of the lines to the check record will be made.

The Daily Payroll Batch Report calculates rest & recovery, minimum/guaranteed wages, overtime, and also creates checks.

While the Overtime Premium Report may be used for reviewing overtime calculations, the Daily Payroll Batch report should be used for doing the final creation of Overtime Premium.

When entries for the crew, batch, or week have been reviewed and you are ready to proceed with reviewing check calculations, run the Daily Batch Report. Select the Overtime Rule and all Check Calculation Options that apply.

Bi-Weekly Overtime Premium

If your payroll period is bi-weekly, follow these steps to calculate overtime premium:

-

After entering your payroll in Daily Payroll Entry, double-check that you only have lines with dates within the 14-day period. If you have checks from previous pay periods that need to be issued, you should issue a separate check.

Note If you have a check outside of these dates, the program will not be able to accurately create overtime premium for your bi-weekly pay period.

-

Right-click and select Reports > Print Batch Report.

-

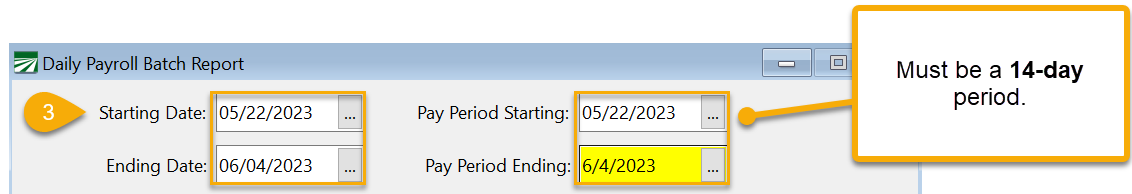

When entering your Starting/Ending Dates and your Pay Period Starting/Ending Dates, make sure that they match and are a 14-day period.

-

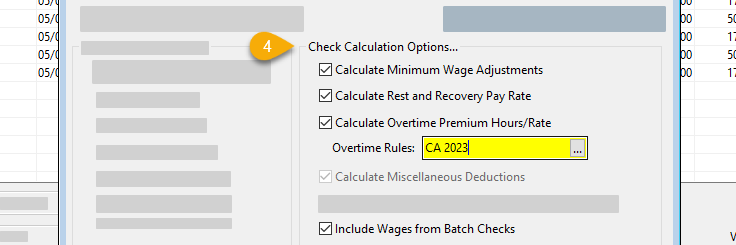

Then, in the Check Calculation Options section, select:

-

Calculate Rest and Recovery Pay Rate

-

Calculate Overtime Premium Hours Rate

-

Select the Overtime Rule to apply.

-

Click Preview. The report will then detail the calculations created.

The software will calculate the regular rate of pay and add additional lines for the amount of overtime hours by week at ½ the average regular rate of pay and double-time at the regular rate of pay.

This is because 1 of 1 ½ is already compensated with the employees’ pieces and rest pay. The additional Overtime Premium is adding the extra ½ pay and the Double-time the extra 1 pay the employee is due.

Also of note, the overtime rate is ½ of their rest & recovery rate because both are using the same regular rate of pay method.

Note These lines are not actually created yet in Daily Payroll. Entries in Daily Payroll may still be edited. When entries have been reviewed and you are ready to create checks, the final calculations and addition of the lines to the check record will be made.

What does this mean for employees?

Employees are getting a fair compensation for their overtime work, but often have a hard time getting used to seeing their overtime paid this way. In the past, many Ag employers simply paid the piecework overtime by paying 1 ½ times the normal rate. Customers have expressed to us difficulty in explaining this new method to their employees. However, this is the correct method of calculation and properly compensates the employees.

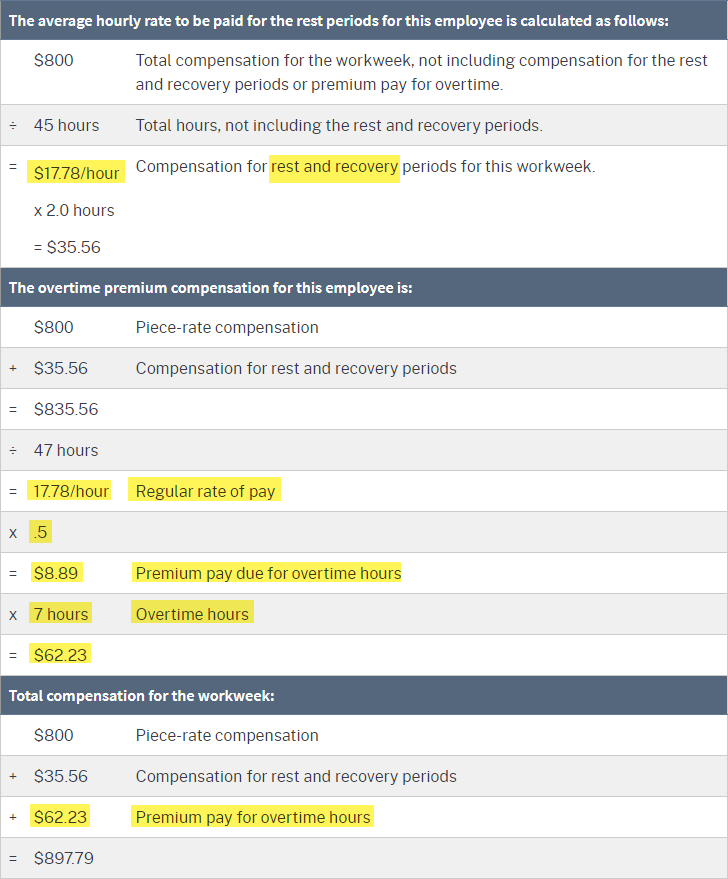

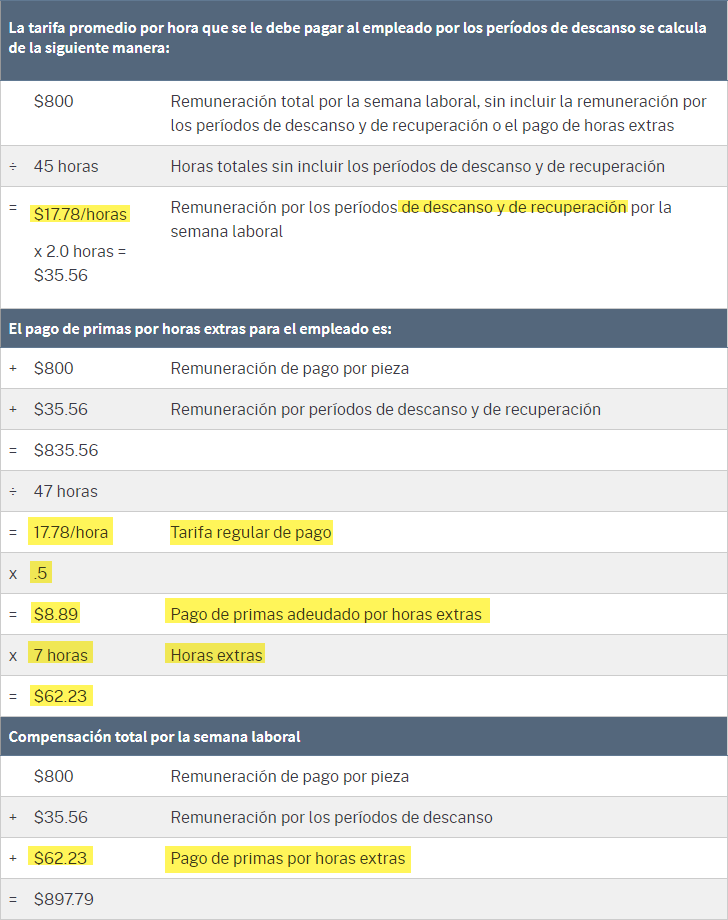

It would be beneficial to make sure your supervisors and employees are aware of how overtime will be paid before they engage in the work. The following example (from the California Department of Industrial Relations FAQ’s Piece-Rate Compensation) shows the calculation with rest and recovery and overtime; you might consider showing it your employees to help them understand how the calculations are done. The example is provided in both English and Spanish.

For a workweek of piece-rate compensation and overtime hours:

-

An employee works a 6-day, 47-hour workweek, for which 7 hours constitute overtime.

-

The employee has two 10-minute rest periods authorized and permitted per day, for a total of 120 minutes (2.0 hours) of rest periods for the workweek.

-

The employee earns a total of $800 in piece-rate compensation for the workweek.

Para una semana laboral de pago por pieza y horas extras:

-

Un empleado cumple una semana laboral de 6 días, 47 horas, para los cuales 7 horas constituyen horas extras.

-

El empleado tiene dos períodos de descanso de 10 minutos autorizados y permitidos por día, por un total de 120 minutos (2.0 horas) de período de descanso para la semana laboral.

-

El empleado gana un total de $800 en pago por pieza por la semana laboral.

Applying Overtime Rules to Custom Wage Types

The program can also create overtime and double-time line items when custom wage types are used.

For example, you might set up regular/overtime/double-time custom wages for shift work. When an employee is paid using the regular hourly shift work wage type and has overtime/double-time, the program will use the corresponding custom overtime/double-time wage type instead of the standard overtime/double-time wage type.

See topic: Overtime Rules - Wage Types for instructions on adding custom wage types to overtime rules.