Wage Types

Wage Type Setup

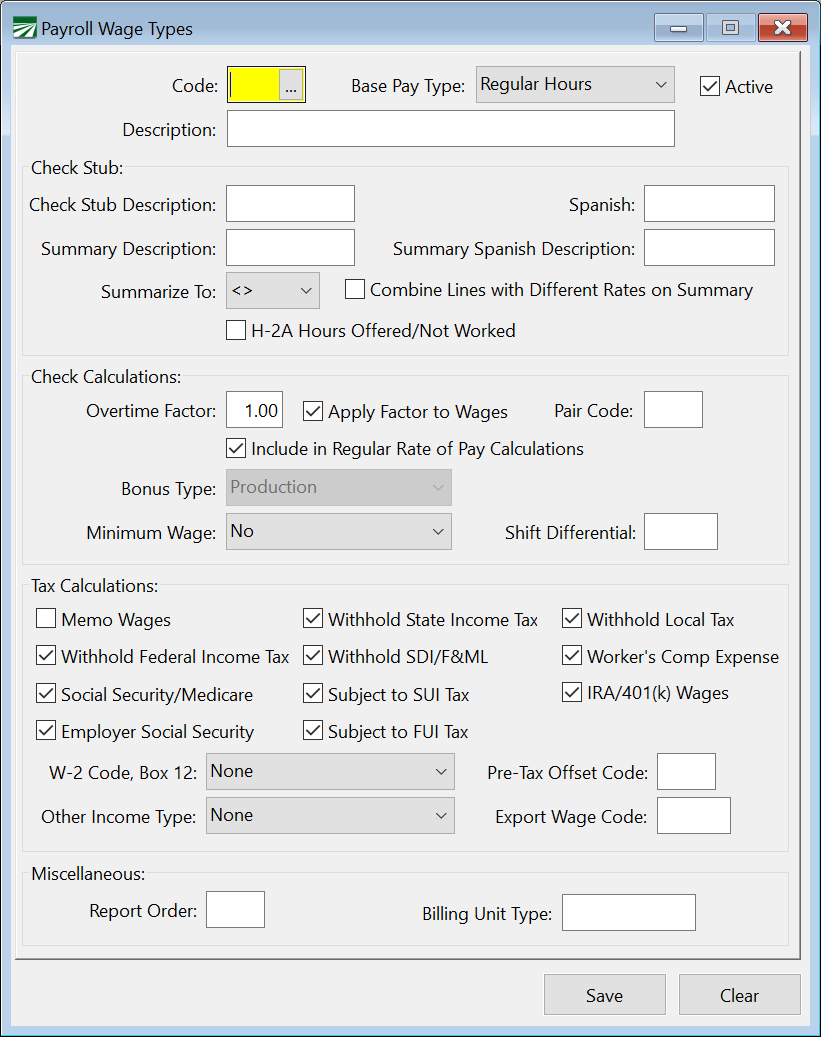

Th Payroll Wage Types window is used to define how various pay types are taxed and handled by the program. Most users will not need to add any entries to this file. A standard set of wage types is included when the software is installed (see Standard Wage Type section below for a list).

Go to Payroll > Setup > Wage Types.

Code

This is a two-letter code for the pay type.

Base Pay Type

This setting determines how wages of this type are handled internally by the program. There are 12 different wage totals that appear on the Recap tab page of the check entry window that correspond to the Base Pay Type.

The Piecework, Regular, Overtime, Double-time, Vacation, Illness, and Holiday wage types all count towards Hours of Service for determining insurance eligibility.

When Piecework is used as the Base Pay Type for a wage type, the program will allow you to enter the number of hours worked in the P/W Hrs column on the Batch Check Entry window.

Note For non-exempt salary and daily salary wage types, the Base Pay Type should be set to Piecework. This will allow you to enter hours into the piecework hours.

A thirteenth wage type, “Other Income”, is obsolete and no longer used.

Description

Enter a description of this pay type (for instance "Bonus", "Regular Hours", "Overtime", etc.) This will appear on entry screens and on the wage type lookup.

Check Stub Settings

Check Stub Descriptions

Enter a shorter description for printing on the check stub. The space on the check stub is much smaller, so abbreviations are necessary. For instance, you might have "Double-time" as the long description and "DT Hrs" as the check stub description.

Two entries are provided for the check stub description. The first entry is for the English description, the second entry is for the Spanish description. If a Spanish description is not provided and an employee has Spanish selected for the check stub language, the program will use the English description.

Summary Descriptions

An alternate description may be included for use by the summary totals. (Turn on the summary totals by the going to Tools > Program Setup > Payroll > Check Printing and selecting the Summary by Type/Rate box.)

This is generally used to combine separate wage types for different types of non-productive time together or to combine regular breaks with heat-illness prevention breaks together. In these cases, you may want to use a generic term for the summary totals (e.g. “Non-Prod” or “R&R”) that are different than the descriptions used for the detail section.

As with the Check Stub Descriptions, a separate entry is provided for both an English and a Spanish description.

Summarize To

This setting can be used to specify a different wage type to use when combining wages for the Summary by Type/Rate option. This allows you to combine multiple types of non-productive time or rest and recovery time together under one wage type for the summary totals.

Combine Lines with Different Rates on Summary

Select this box if you want to combine multiple lines with different rates together on the summary totals on the check stub. This is generally used when minimum wage or guaranteed wage payments are added on a daily basis, where a different rate may be used for each day. Normally the summary by wage/type would itemize each of these amounts because the rates are different. By selecting this box, the total amounts will be combined into one total instead.

H-2A Hours Offered/Not Worked

This option will indicate that the wage type you are setting up is meant to be used for recording hours offered to employees, but not worked. Different wage types can be set up with different reasons for not working.

Check Calculations

Overtime Factor

This entry is used for overtime and double-time wages. Enter 1.0 for regular wages. Enter 1.5 for overtime and 2.0 for double-time. The pay rate entered on the employee check is multiplied by this factor if the Apply Factor to Wages box is selected.

Apply Factor to Wages

Select this box to have the program multiple the factor by the pay rate entered when calculating the total for lines entered under this pay type.

Generally for overtime or double-time wages, you always want the program to multiply the factor by the pay rate to pay time and a half or double time rates.

There are some cases where you may not want this for a pay rate structures for overtime/double-time piecework. In these cases, you can leave the box deselected while entering 1.5 or 2.0 for the Factor. In these cases, you must make sure that the Minimum Wage setting is set to Yes or Guaranteed Rate. The minimum/guaranteed rate verification will take into account the factor, and produce an adjustment (if needed) based on the overtime/double-timed status.

Pair Code

For cases where you are paying a base hourly plus an incentive piecework component, this entry allows you to tell the program what the other wage type used in this pay structure. For instance, the default pay type of BH will have the pair code set to IP, and IP will have the pair code set to BH.

Include in Regular Rate of Pay Calculations

Select this box if the wages are to be included in the regular rate of pay calculations. Generally, the regular rate of pay will include all wages except holiday, sick pay, vacation, reimbursements, and discretionary bonuses. (There are additional exceptions, check regulations for a complete list.)

Minimum Wage

If this wage type should be subject to minimum wage verification rules, select Yes on this entry. If this wage type is instead going to be subject to a guaranteed rate over the minimum wage, select the Guaranteed Rate setting.

Piecework wage type will normally always be subject to either the minimum wage or guaranteed wage verification. If you have some exception, for instance a bonus piece rate that is paid in addition to an hourly wage, you could select No on this entry.

For wages based on hours worked, this setting should normally be No. An exception would be if an employee is paid a base hourly rate plus a piece rate on top of that. If the base hourly rate is below minimum wage, the hourly wages need to be added to piecework wages to determine if the employee is making at least minimum wage. This is how the Base Hourly (BH) wage type is set up.

Shift Differential

If a special wage type is set up for a shift where the employee makes an additional amount above the normal pay rate, enter the additional amount here. When a line item is first entered, the shift differential amount will be added to the normal rate of pay. For instance, if the employee normally gets paid 7.50 per hour, but for working a late-night shift you want to pay an extra 75 cents, the 7.50 will be changed to 8.25 when the line item is entered.

Tax Calculations

Memo Wages

When this box is selected, wages paid using this pay type will be included in tax withholding calculations, but not added to the employee's total gross wages.

One use of memo wages is for tips. Tips received by employees must be reported as income and taxed, but the employer is not paying the amounts to the employee. By classifying tip wages as memo wages, the tips are included for tax calculation purposes, but the gross wages of the check are not increased.

Worker's Comp Expense

Selecting the boxes to indicate which taxes wages entered with this pay type are subject to.

IRA/401(k) Wages

When this box is selected (the default value) wages paid under this wage type will be included in the wages used to determine the employer’s contribution to an IRA/401(k) account.

Pre-Tax Offset Code

This setting is used to specify a wage type to use for offsetting wages that are subject to different taxation for a special deduction (such as a 401(k) or cafeteria plan). If this entry is left blank, the program will default to PW for offsetting the wages. The offset line is the line with the negative amount used to reduce the wages before adding them back in with this special taxability wage type.

W-2 Code, Box 12

Select the code to use when reporting wages paid using this wage type on the W-2.

Note When YTD totals are archived, the program will automatically compile deferred compensation amounts. These amounts will appear in Box 12 on the W-2.

Other Income Type

If this wage type is for tips or a fringe benefit, select the appropriate type. The program will add tips and fringe benefit wages to the totals used for calculating taxes but will not add these amounts to the gross wages.

Using the Tips setting will result in the wages being reported separately on the 941 quarterly report on line 5b. The wages will also be reported in Box 7 (Social security tips) on the W-2.

Using the Fringe Benefits setting will result in the fringe benefit amount being reported in box 14 on the W-2.

Miscellaneous Settings

Report Order

This setting determines which order wages are reported on certain reports. While there are no standard values that must be used for each type, usually you will want to use 1 for Regular Hours, 2 for Overtime, and 3 for Double-time. Other wage types can be assigned different values depending on the order you want them printed in.

This setting can also be used on the Custom Check Format setup to control what order the line items are printed in both the detail and summary sections.

Billing Unit Type

For farm labor contractors, you can specify the unit type that will appear on the grower’s invoice for wages paid by each pay type. You may want a different description to appear on the invoice for certain types of wages.

Standard Wage Types

The following wage types are automatically set up for you. You should not modify or delete these entries, but you may set up new entries.

Code Description

RH Regular Hours

OT Overtime Hours

DT Doubletime Hours

SA Salary

CO Commission

BO Bonus

PW Piecework

MW Minimum Wage Payment

PO Overtime Piecework

GP Guaranteed Wage Piecework

GW Guaranteed Wage Payment

BH Base Hourly (Incentive Pay)

IP Piecework (Incentive Pay)

HO Paid Holiday

SP Sick Pay

VA Vacation Pay

OP Overtime Premium

RH, OT, and DT are used for hourly wages. When employees have overtime and/or double-time wages, separate lines are entered with each wage type. The program automatically multiplies the pay rate you enter by 1.5 or 2.0 respectively, for overtime and double-time wages.

When entering piecework wages, use PW as the wage type and you will enter both the number of house worked and the number of pieces. The program can then use this information in minimum wage verification calculations.

In cases where you have a base hourly pay rate plus a piecework incentive bonus, use the BH and IP wage types together (each wage type is entered on a separate line). By using these wage types, you can distinguish these wages from straight hourly wages or piece rate only wages. The minimum wage verification calculations are still done, but the wages entered under the base hourly pay type are combined with the incentive pay wages.

The salary, commission, bonus, and paid holiday wage types should be self-explanatory. These wage types are provided for other types of compensation that aren't covered by hourly or piecework wages.

The sick pay and vacation pay are treated differently by the program if you are accruing sick and/or vacation time/pay. By default, the accrual is based on wages, but you can change this to accruing by hour in the Program Setup. When accruing wages, you should enter 1 for the Units and the amount to pay under Rate. When accruing by hour, enter the number of hours under Units and the employee's regular hourly pay rate in the Rate column.

When a regular check is printed for an employee, the wages or hours are added to the employee's accrued vacation and/or sick pay totals. When a check with the vacation and/or sick pay wage types is printed, the wages or hours are subtracted from the accrued totals.

The Overtime Premium wage type is used to pay overtime premium amounts to employees that are paid two or more different rates in the same pay period. In this situation, it may be necessary to pay employees the premium for overtime hours worked at the employee’s regular rate of pay. The Overtime Premium Report will calculate the Regular Rate of Pay and the number of overtime hours and create line items to pay the overtime premium amounts using the OP wage type.

Note Regulations on overtime pay may vary from state to state. The following link has more information about paying overtime to employees that paid at two or more different rates in the same pay period in California: http://www.dir.ca.gov/dlse/faq_overtime.htm (question #1, example 4, and question #6 deal with calculating overtime for employees that are paid more than one rate in the same week).

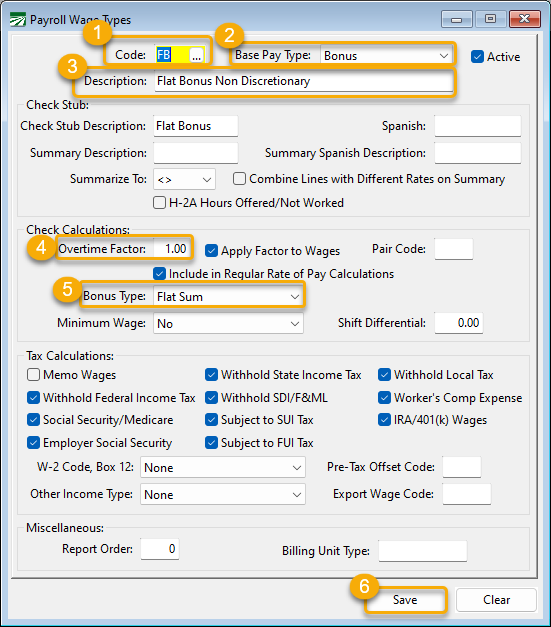

Flat Sum Bonus Wage Type Setup

If you pay flat sum bonuses and have overtime on a payroll check, the flat sum bonus overtime premium is calculated separately using only the straight time hours. To accurately pay the overtime for flat sum bonuses, you will need to add specific wage types for the Flat Sum Bonus, Bonus Overtime Premium, and Bonus Double-time Premium.

Follow these steps to set up a Flat Rate Bonus type for regular, overtime, and double-time.

Flat Sum Wage Type Setup

-

Go to Payroll> Setup > Wage Types. Start by entering a two-digit code for the Flat Sum Wage Type.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

In the Check Calculations section, set the Overtime Factor to 1.00.

-

On the Bonus Type drop-down, select Flat Sum.

-

Enter any other necessary information and click Save.

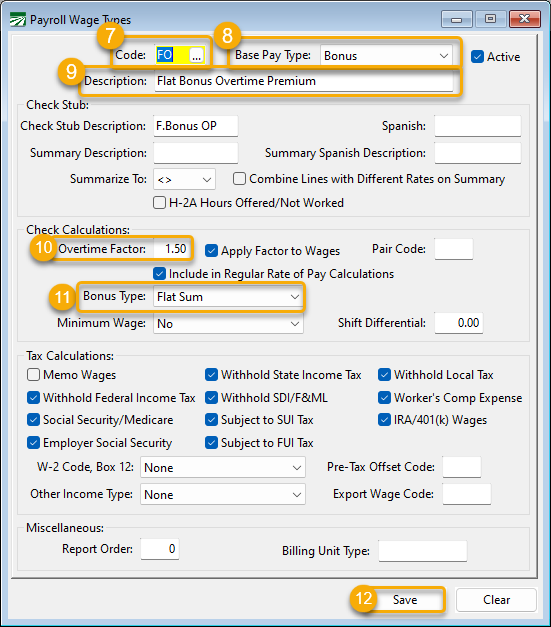

Flat Sum Overtime Wage Type Setup

-

Now create a Wage Type for Flat Sum Overtime. Enter a new two-digit code.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

In the Check Calculations section, set the Overtime Factor to 1.50.

-

On the Bonus Type drop-down, select Flat Sum.

-

Enter any other necessary information and click Save.

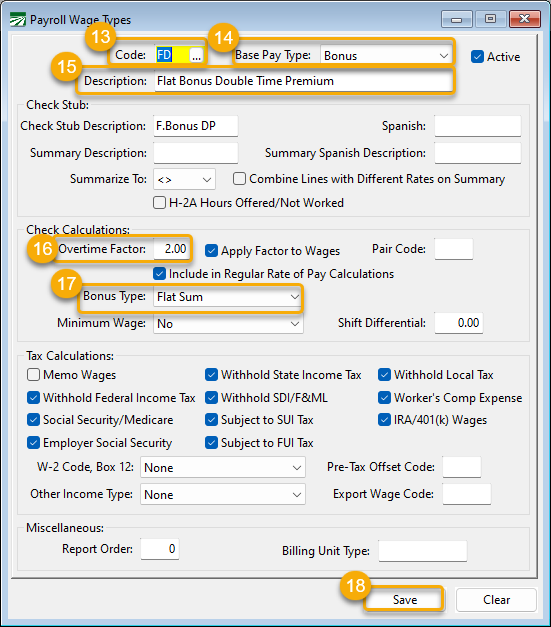

Flat Sum Double-Time Wage Type Setup

-

Create a Flat Sum Double-Time Wage Type. Enter a new two-digit code.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

In the Check Calculations section, set the Overtime Factor to 2.00.

-

On the Bonus Type drop-down, select Flat Sum.

-

Enter any other necessary information and click Save.

Production Bonus Wage Type Setup

To accurately pay the overtime for production bonuses, you will need to add specific wage types for the Production Bonus, Bonus Overtime Premium, and Bonus Double-time Premium.

Follow these steps to set up a Production Bonus wage type for regular, overtime, and double-time.

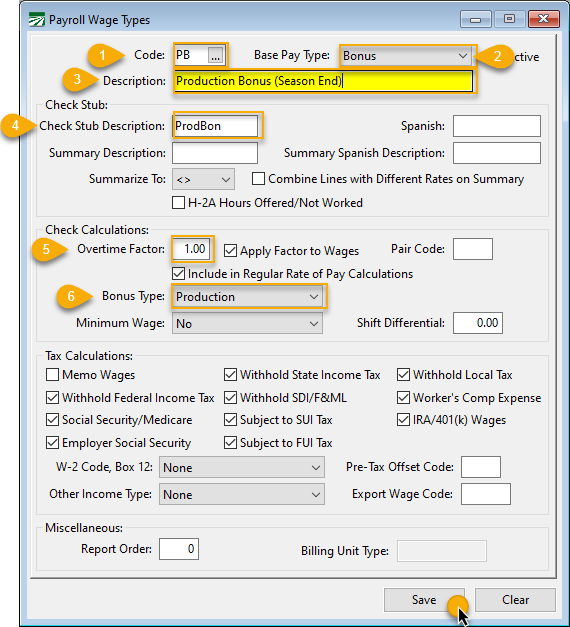

Production Bonus Wage Type Setup

-

Go to Payroll> Setup > Wage Types. Start by entering a two-digit code for the Production Bonus Wage Type.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

Enter a Check Stub Description.

-

In the Check Calculations section, set the Overtime Factor to 1.00.

-

On the Bonus Type drop-down, select Production.

-

Enter any other necessary information and click Save.

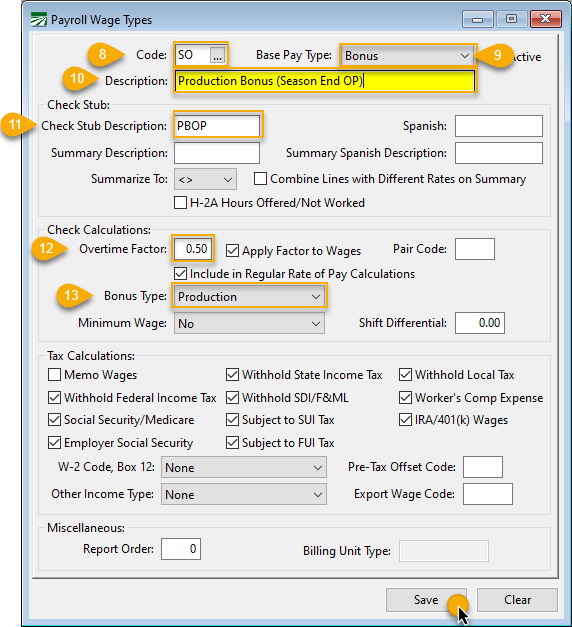

Production Overtime Wage Type Setup

-

Now create a Wage Type for Production Overtime. Enter a new two-digit code.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

Enter a Check Stub Description.

-

In the Check Calculations section, set the Overtime Factor to .5.

-

On the Bonus Type drop-down, select Production.

-

Enter any other necessary information and click Save.

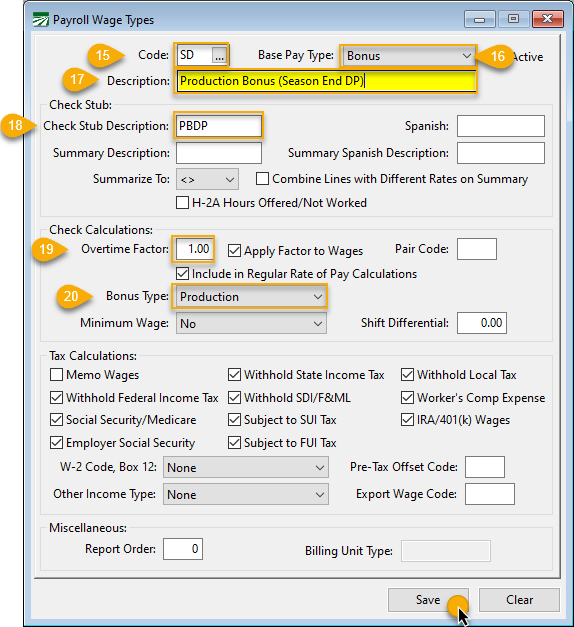

Production Double-Time Wage Type Setup

-

Create a Production Double-Time Wage Type. Enter a new two-digit code.

-

On the Base Pay Type drop-down, select Bonus.

-

Enter a description and any other information needed in the Check Stub section.

-

Enter a Check Stub Description.

-

In the Check Calculations section, set the Overtime Factor to 1.00.

-

On the Bonus Type drop-down, select Production.

-

Enter any other necessary information and click Save.