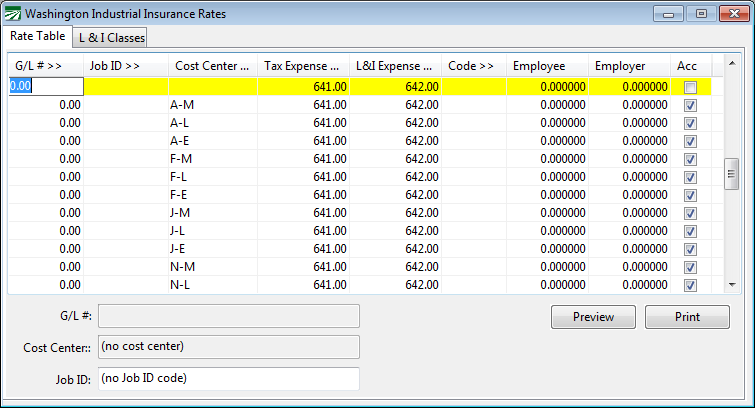

Washington Industrial Insurance Rates

In the state of Washington, the Department of Labor and Industries manages the Washington State Fund for worker’s compensation. The L&I rates include an amount that is deducted from the employees’ pay as well as an amount paid by the employer. Both rates are based on the number of hours worked.

The Industrial Insurance table is similar to the Worker’s Comp Table but adds an entry for the employee rate. The Industrial Insurance table allows you to set up multiple workers’ comp rates for any combination of crop and job. Generally, for farming operations, each crop may have its own rate. However, if you are able to pay a lower rate for some jobs (for example, weeding in an orchard may have a lower rate than harvesting in an orchard) then you can set up different rates based on the job.

In addition to setting up rates by crop, you will also set up the worker's comp class codes and their rates, which allow the quarterly Industrial Insurance Report to provide subtotals by the class code.

If you have a non-farming operation, then you can base the industrial insurance rates only on the general ledger expense account for the employee's labor.

In addition to setting the Industrial Insurance rates, this table is also used by the Payroll Journal to specify the general ledger accounts to update the employer's portion of the Industrial Insurance and payroll tax expense amounts to.

Go to Payroll > Setup > L&I Insurance Rates/Classes.

G/L #

Enter the wage general ledger account for this line.

Job ID

If you are using job codes, you can also specify the job code for this entry.

Cost Center

Enter the cost center for this entry.

W/C Expense Account

In these columns, enter the general ledger account number for both the employer tax expense account and the employer’s industrial insurance expense account.

Code

Enter the industrial insurance class code here. If you have set up your codes with default rates, those rates will appear automatically in the next entries.

Employee Rate

Enter the rate per hour to deduct from employees’ checks.

Employer Rate

Enter the employer’s rate per hour. If the state provides you with a total rate (employee plus employer portion) you will need to subtract the employee rate from the total to determine the employer rate.

Accrue

Select this box if you want the Payroll Journal to accrue worker's comp to a liability account. When you write your worker's comp check, you would then expense the check to that liability account.

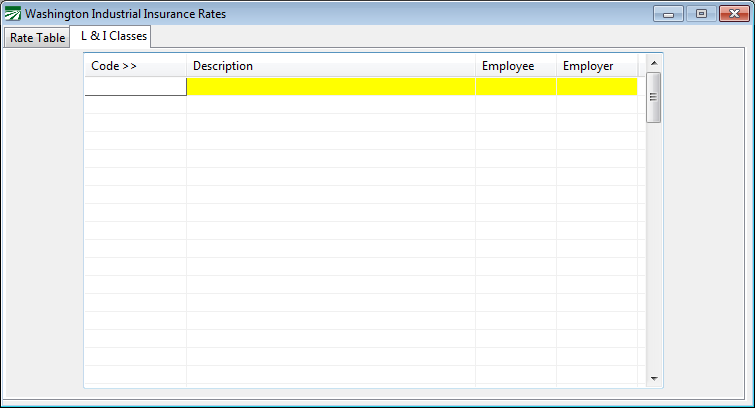

L&I Classes

The second tab page on the Worker's Comp window allows you to enter the class codes, descriptions, and rates for your various workers’ comp rates.

Code

Enter the code here. This can be up to eight letters or numbers.

Description

Enter the description for this code here. It will print on the Worker's Comp Report summary.

Employee

Enter the rate to deduct from the employees’ pay here. This will be used as a default when you are making entries on the Rate Table tab. Also, if you are changing the rate on an existing class code, the rate will be updated on all entries where this code is used on the Rate Table automatically.

Employer

Enter the employer’s rate per hour. If the state provides you with a total rate (employee plus employer portion) you will need to subtract the employee rate from the total to determine the employer rate.

This will be used as a default when you are making entries on the Rate Table tab. Also, if you are changing the rate on an existing class code, the rate will be updated on all entries where this code is used on the Rate Table automatically.

Note The program will not allow an L&I class code that has been set up and used in the L&I rate table to be deleted.