Fix Employee Totals

Fixing Totals for the Quarter or Year

Totals from payroll checks are updated to the employee file through the check printing process; these totals are then used for quarterly and year-end payroll forms. If those totals are somehow affected (e.g. the checking printing process is interrupted), there is an option to fix - or recalculate - those totals. The program will clear the total field and then recalculate it based on the check records for the time period selected.

Fixing totals can also be used to update the archive file when changes are made to employee information such as name, address, social security number, etc.

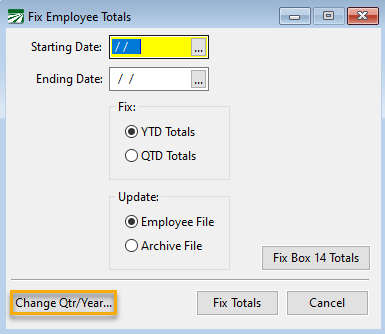

Go to Payroll > Utilities > Fix Employee Totals.

-

Enter the Starting Date and Ending Date for the quarter or year that needs to be fixed.

-

Select the time period you are fixing, either YTD (year-to-date) or QTD (quarter-to-date) Totals.

-

Select the file to update, either the Employee File (if you are fixing names, addresses, social security numbers) or the Archive File (if you are fixing check totals).

-

Click Fix Totals.

See the example below:

Note This option does not allow you to fix totals to the employee file if the Starting and Ending dates used don't match the current quarter or year. The Change Qtr/Year button should be used if you have to fix totals outside of the current quarter and/or year.

Fix Box 14 Totals

This option should be used if (1) the archive file has already been created and box 14 totals were not updated; or (2) edits were made to the mapping.

Since only box 14 totals and employer pension contributions are updated when using this option (not any wage totals), it will also work with multi-state payroll.

Changing the Current Quarter/Year

The payroll system keeps track of the current payroll quarter and year and uses this information to make sure that dates you enter when printing checks are correct.

In some cases, you may have closed the quarter or year and discover that you need to write additional checks or void checks in the prior quarter/year. Because you have closed the quarter and/or year, the program doesn’t let you date transactions in the prior quarter: a new quarter/year has been started, and totals have been zeroed out for the new quarter/year.

However, there is an option that makes re-opening a quarter and/or year a single-step process.

-

To re-open a quarter/year, go to Payroll > Utilities > Fix Options > Fix Employee Totals.

-

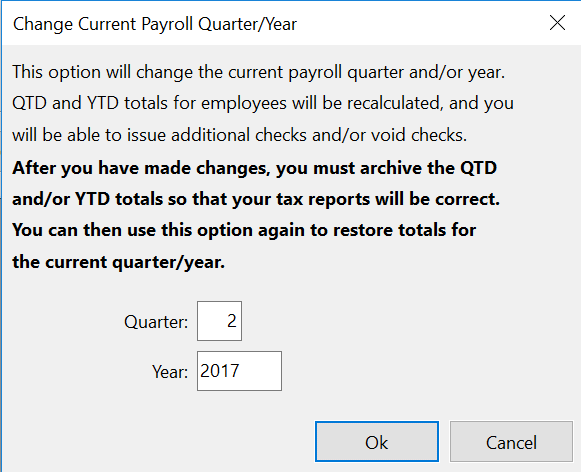

Click Change Qtr/Year in the bottom left corner of the window and the following window will open:

This window will show the current payroll quarter and year.

-

Enter the Quarter/Year that you want to re-open then click Ok. The program will add up all checks in the quarter/year that you selected and save the totals to employee accounts. This process may take some time, depending on how many checks you have written. A progress bar will appear at the bottom of the program window two times (once for the quarter-to-date totals and once for the year-to-date totals) indicating how far along the process is.

-

After you have re-opened a quarter, you can issue additional checks or void checks in that quarter.

Note While in a prior quarter, you cannot create checks for the current quarter in Batch Payroll Check entry, nor can you print checks. However, Daily Payroll Entry can be used to enter checks since it does not involve tax deduction calculations.

After Corrections Are Made

Once you have finished making changes, you can archive the quarter-to-date totals (and year-to-date totals, if necessary). You can then print tax reports for the quarter/year that include the changes you have made.

Keep in mind that if you have already filed quarterly or annual reports and then make changes, you will need to file amended or corrected reports with state and federal agencies. The program does not keep track of the changes that you make, so you will need to do this and know the procedures and requirements for filing amended reports.

If you have not filed any reports yet, you will not need to worry about filing amended or corrected reports.

After you have re-archived the quarter and/or year-to-date totals, you will need to use this option again to change back to the current quarter/year. Otherwise, you will not be able to issue current payroll checks. For this reason, it is also important for companies that use the payroll system on a network to coordinate with other users. For instance, if you need to make adjustments in the prior quarter and change back to that quarter, other users cannot print checks in the current quarter until you are done.

Example In January 2024, Monica discovers that a payroll check in December was issued to the wrong employee account. The employee account that the check was written to had the same name, but it was the wrong account number. The employee went ahead and cashed the check, so she doesn’t need to re-issue a check to him. However, the employee’s W-2 totals and total wages on her quarterly report will be wrong.

To correct this, first she changes the current quarter back to 4 and the current year to 2023 using the Change Qtr/Year button on the Fix Employee Totals window. Next she voids the check that was issued to the wrong account, and selects the correct account to re-issue the check to. She prints the re-issued check on blank paper (because the employee doesn’t need a replacement check), then she prints and finalizes the Payroll Journal. Then she archives the quarter-to-date totals and the year-to-date totals, so that her quarterly report and W-2’s will be correct. Finally, she goes back to the Fix Employee Totals option and uses the Change Qtr/Year button to change the current quarter back to 1 and the current year back to 2024. This restores the totals for the checks that have been issued so far in January.

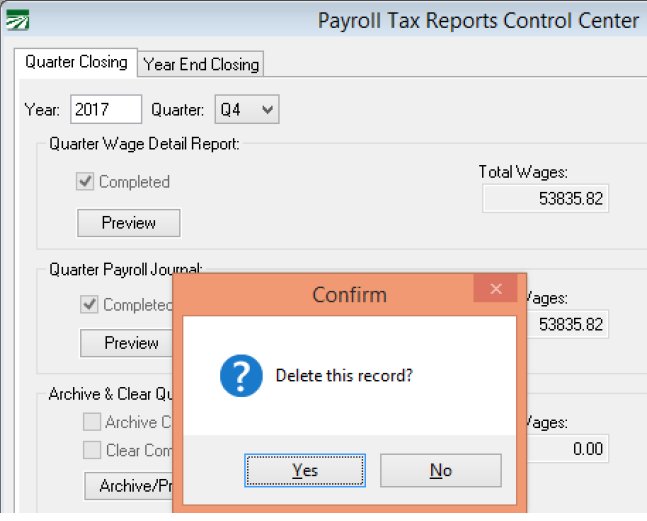

Re-closing through the Payroll Tax Reports Control Center

If you have re-opened the Quarter/Year and want to re-close through the Payroll Tax Reports Control Center. Enter the Year & Quarter to re-close. Press the Shift key and F2. Select Yes to Delete the closing record and you can run through the closing again.

Note: If you have made corrections to do a W-2C, see topic Print W-2Cs.

Warning DO NOT re-archive, as this over-writes the originally reported totals, necessary for generating a W-2C.

Note For Year End Adjustments that need to be reported on a W-2C, do not use the Closing process, see topic, Edit YTD Employee Archive.