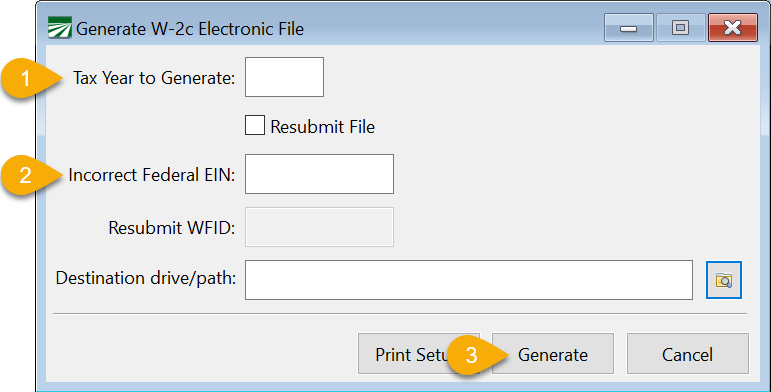

Generate W-2c Electronic Files

When W-2s are generated/printed, the program records the originally reported data. If totals are later edited or corrected, the program tracks both the original information and the updated entries. This window allows you to generate W-2C electronic files when wages were reported incorrectly or under the wrong Federal EIN.

Go to Payroll > Year End Tax Reporting > Generate W-2c Electronic Files.

Incorrect Information

To correct personal or financial information—such as names, Social Security numbers, wages, or tax details—follow the steps below to generate an electronic W-2c file.

-

Enter the Tax Year to Generate.

-

Click Generate.

-

Upload the generated W2REPORT file.

Incorrect Federal EIN

If wages were reported under an incorrect Federal EIN, you will need to generate two files:

-

The first file should use the incorrect EIN, with zero amounts entered in the corrected column.

-

The second file should use the correct EIN, with zero amounts entered in the original earnings column and the totals moved to the corrected column.

Warning Do not fix your EIN in Program Setup prior to generating the first corrected file. If you already have changed your EIN for payroll, you must temporarily change it back to the incorrect EIN. This will allow you to generate the right information for the corrected reports.

-

Enter the Tax Year to Generate.

-

Enter the Incorrect Federal EIN that was reported.

-

Click Generate.

-

Then, upload the resulting W2REPORT file and move or rename the first generated corrected file.

Warning When the second file is generated, it will overwrite the first file.

-

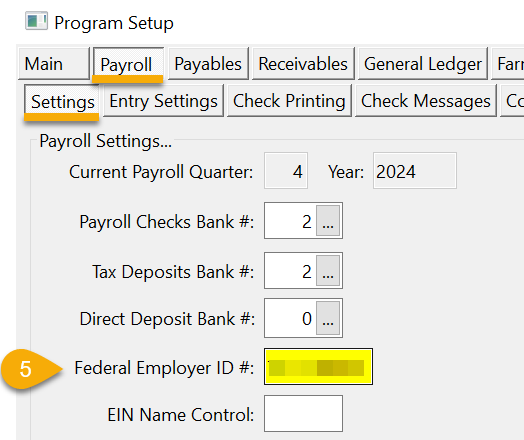

To generate the second file, go to Tools > Program Setup > Payroll > Settings > Federal Employer ID # entry and change this number to the correct Federal EIN. To save, click Ok and return to the Generate W-2c Electronic File.

-

Erase the Incorrect Federal EIN and generate the file as normal.

-

Upload the second generated corrected file.

Using Accuwage

The Social Security Administration has a program called “Accuwage” that will read the electronic file and verify that the format of the file is valid. Click here for more information on where to access Accuwage and how to use it.