Unapplied Credits

Unapplied credits are used when a customer gives you a payment and there is no invoice to which the payment can be applied. This may be because the customer is making a prepayment on a future purchase or the payment may need to be applied to an order which has not been finalized yet.

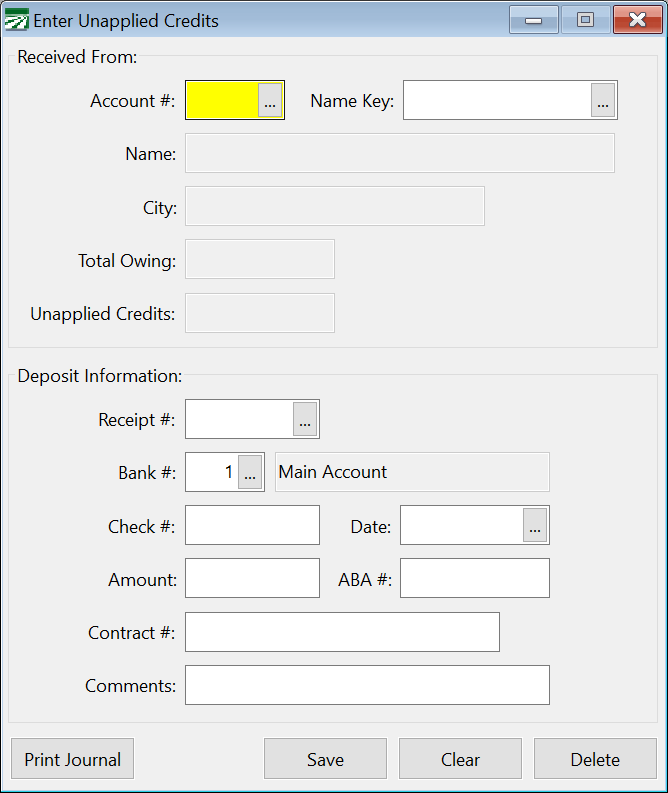

Go to Receivables > Cash Receipts > Unapplied Credits.

Account #/Name Key

Enter the customer's account number or name key, or use the lookup to select a customer account.

Receipt #

Bank #

This will default to your regular bank account for cash receipts, as entered on the Program Setup option. Change this if necessary.

Check #

Enter the check number for the payment.

Date

Enter the deposit date for this check.

Amount

Enter the amount of the check.

ABA #

Enter the number if you are using the Deposit Ticket option. (If you do not want this entry to appear on the deposit ticket, leave this entry blank.)

Comments

If applicable, enter comments for this payment.

Removing an Unapplied Credit

Eventually, you will need to apply an unapplied credit balance to an invoice. To do this, first enter an unapplied credit for a negative amount. This will take the amount off the customer's total unapplied credit balance. Then enter the payment amount like you normally would.

The combination of the negative unapplied credit transaction and the payment on the invoice results in no change to your cash in bank balance. At the same time, the invoice now has a payment and is no longer outstanding.