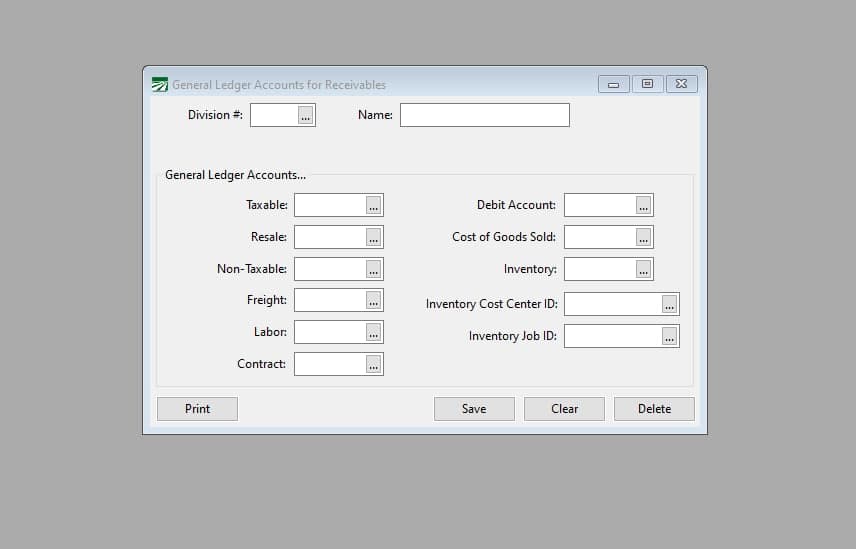

G/L Account Table

The Accounts Receivable system uses divisions to determine what General Ledger accounts income should be updated to. Usually, division 1 and possibly others, are reserved for produce sales, and are entered from the account table window that you access from Accounts Receivable

However, for the materials inventory module, we need to define a G/L Account to credit for materials inventory usage, or for other costs that are defined in the inventory parts file.

For instance, in addition to materials, you may set up an inventory part for labor costs, cooling facility or other direct costs. The amount charged to the product is offset by a corresponding credit. This table defines those G/L Accounts.

For each sales division you need to use, just enter one G/L account, for Inventory. That is the only account that will be used by the program.

To set up the divisions, go to Materials Inventory > Setup > G/L Account Table.

(Do not use the option on the Receivable Utilities menu).

Division #

Each division must have a unique number, from 1 to 99. You will use this number when entering line items on orders and invoices.

Name

Enter a name for this division.

Department (Special Setting)

If you are using Departments codes in your G/L setup, an entry for a Department code will appear on this window. Enter the Department code.

General Ledger Accounts

Enter a G/L Account for Inventory.

Example of G/L Account Entries:

Div Description Inventory

2 Materials 1500 (Materials Inventory Asset Account)

3 Labor 5500 (Packing Labor Expense)

4 Packing O/H 5600 (Packing facility Expense)