How to Prorate Overtime Premium

You have the option to prorate overtime premium by day and/or week. This is useful when you send workers to multiple growers in the same week. Prorating the overtime will then split the overtime premium between all growers that employee worked for instead of all the overtime being charged to one grower.

Go to Payroll > Setup > Overtime Rules.

-

Open the OT Rule you would like to change to the prorate method.

You can choose to prorate by day, by week, or both:

-

In the For each day section, enter an amount in the Minimum Hours to Prorate. (You may not want to prorate on small line amounts. For example, you may not want to prorate to a line that is just a break line. In that case, you would simply enter a .5 in the Minimum Hours to Prorate entry. Then lines with .5 hours or less will not be prorated.)

-

If you would like to prorate by week, in the For the entire week section, select Pro-rate weekly overtime premium over entire week.

Enter an amount in the Minimum Hours to Prorate for the week.

-

Click Save.

Examples

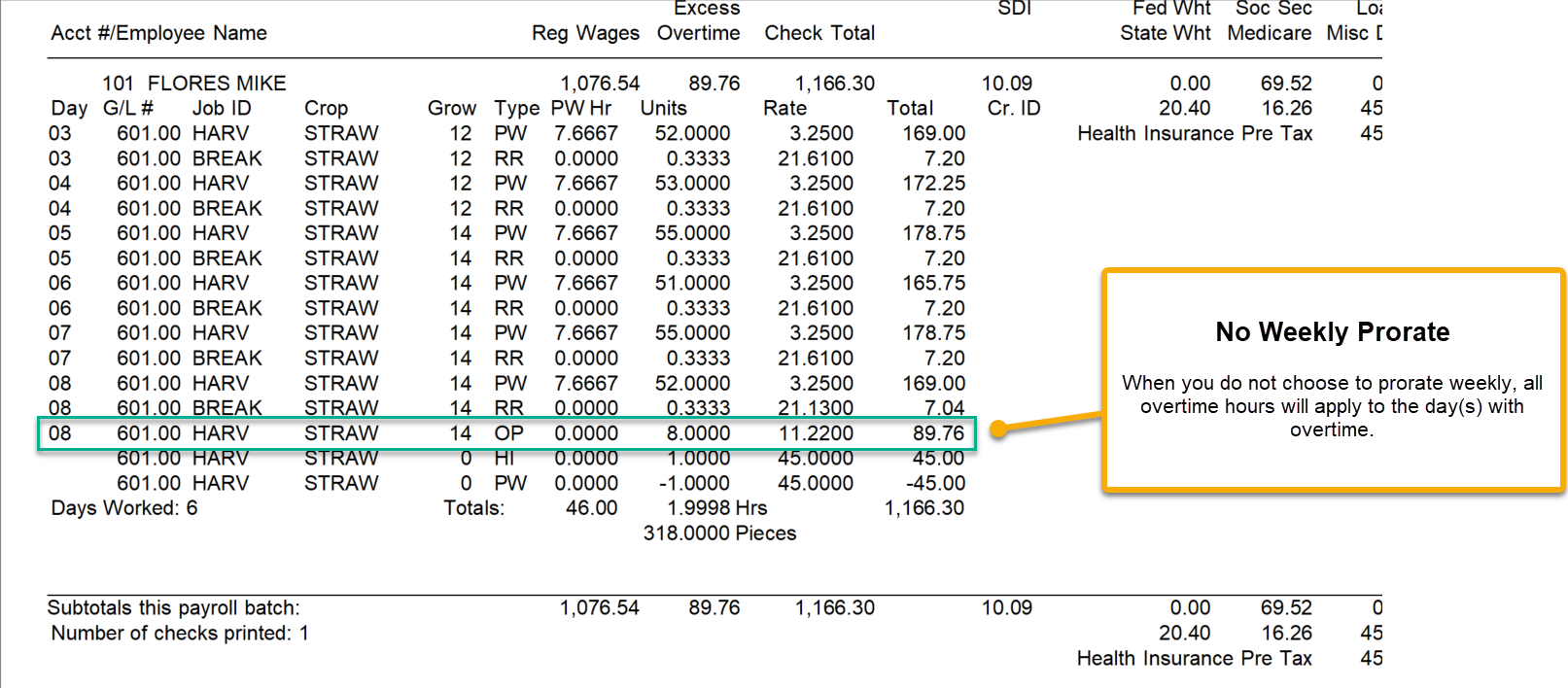

Example When you do not choose to prorate weekly, all overtime hours will apply to the day(s) with overtime.

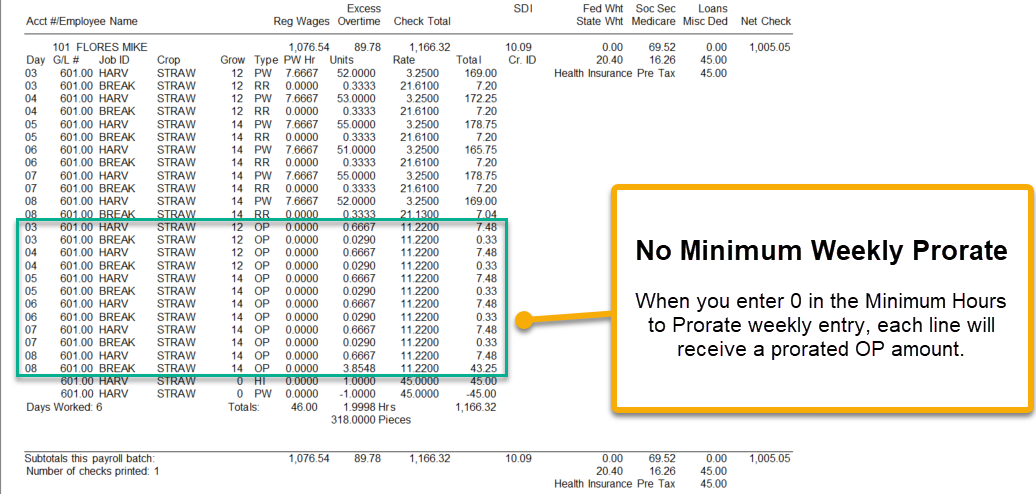

Example When you select Pro-rate weekly overtime premium over entire week and enter 0 in the Minimum Hours to Prorate weekly entry, each line will receive a prorated OP amount.

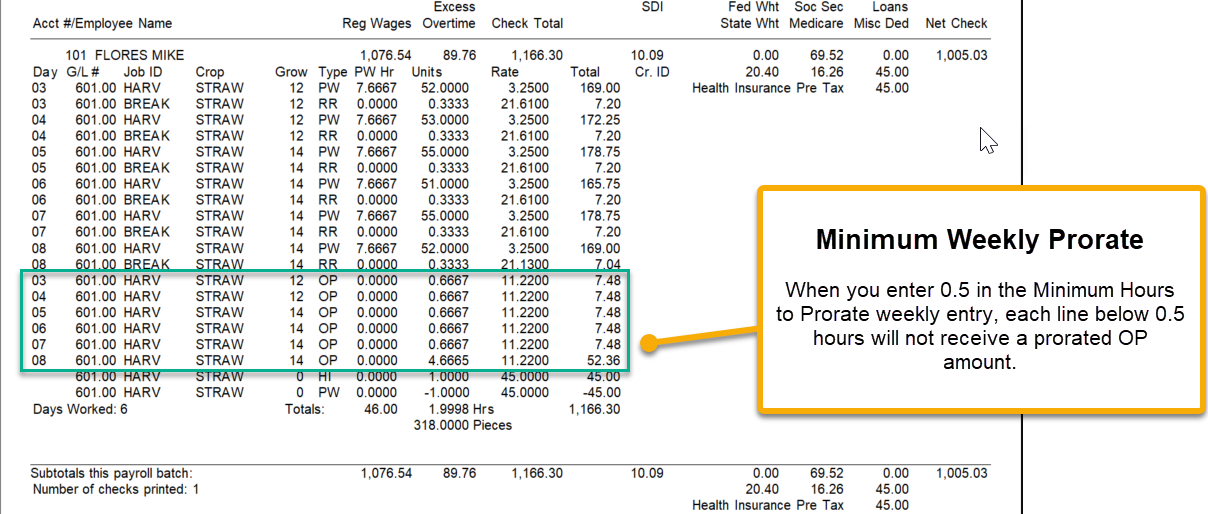

Example When you enter 0.5 in the Minimum Hours to Prorate weekly entry, each line below 0.5 hours will not receive a prorated OP amount.

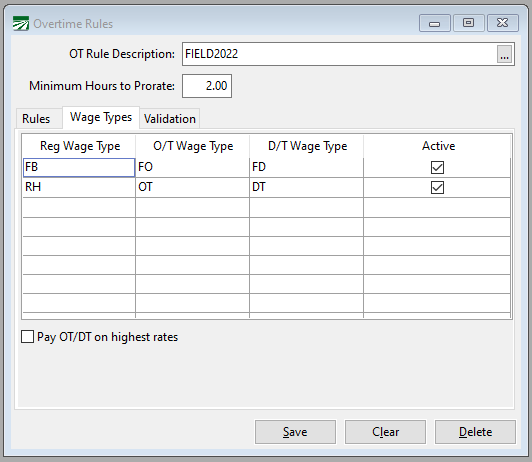

Overtime Rules: Wage Types Tab (Optional)

The Wage Types table allows you to link one Wage Type to a corresponding Overtime and Double-time code. This may be used if you have more than one overtime/double-time wage.

When the software applies overtime rules, it will look at the wage code used for the regular hours and use the linked overtime/double-time wages codes to calculate and create the additional lines.

You can also define wage types for flat sum bonuses and the overtime premium pay due (if needed) for the flat sum bonus.

Reg Wage Type

Enter the Wage Type that will be used for the wages.

O/T and D/T Wage Types

Enter the corresponding overtime and double-time wage codes you want the program to use when applying overtime.

Flat Sum Bonus

If you pay flat sum bonuses and have overtime on a payroll check, the flat sum bonus overtime premium is calculated separately using only the straight time hours. To accurately pay the overtime for flat sum bonuses, you will need to add specific wage types for the Flat Sum Bonus, Bonus Overtime Premium, and Bonus Double-time Premium. Then, enter the respective wage codes here.

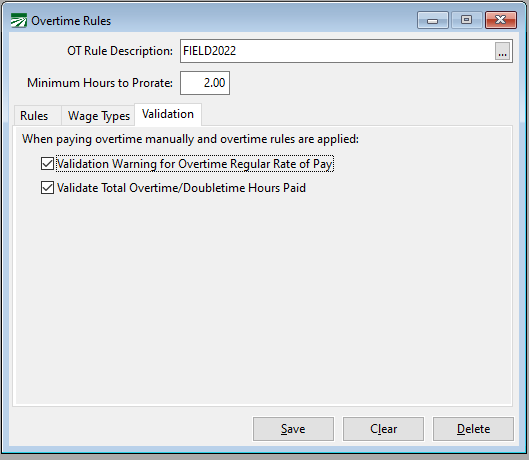

Validation

The Validation tab allows you to turn off warnings on the Daily Payroll Batch Report when you have manually entered OT and have selected to Calculate Overtime Premium. We recommend leaving these options on.

Define Wage Types to be used for Overtime

If you are using the standard Wage Types Datatech provides, they will already be linked in the Program Setup.

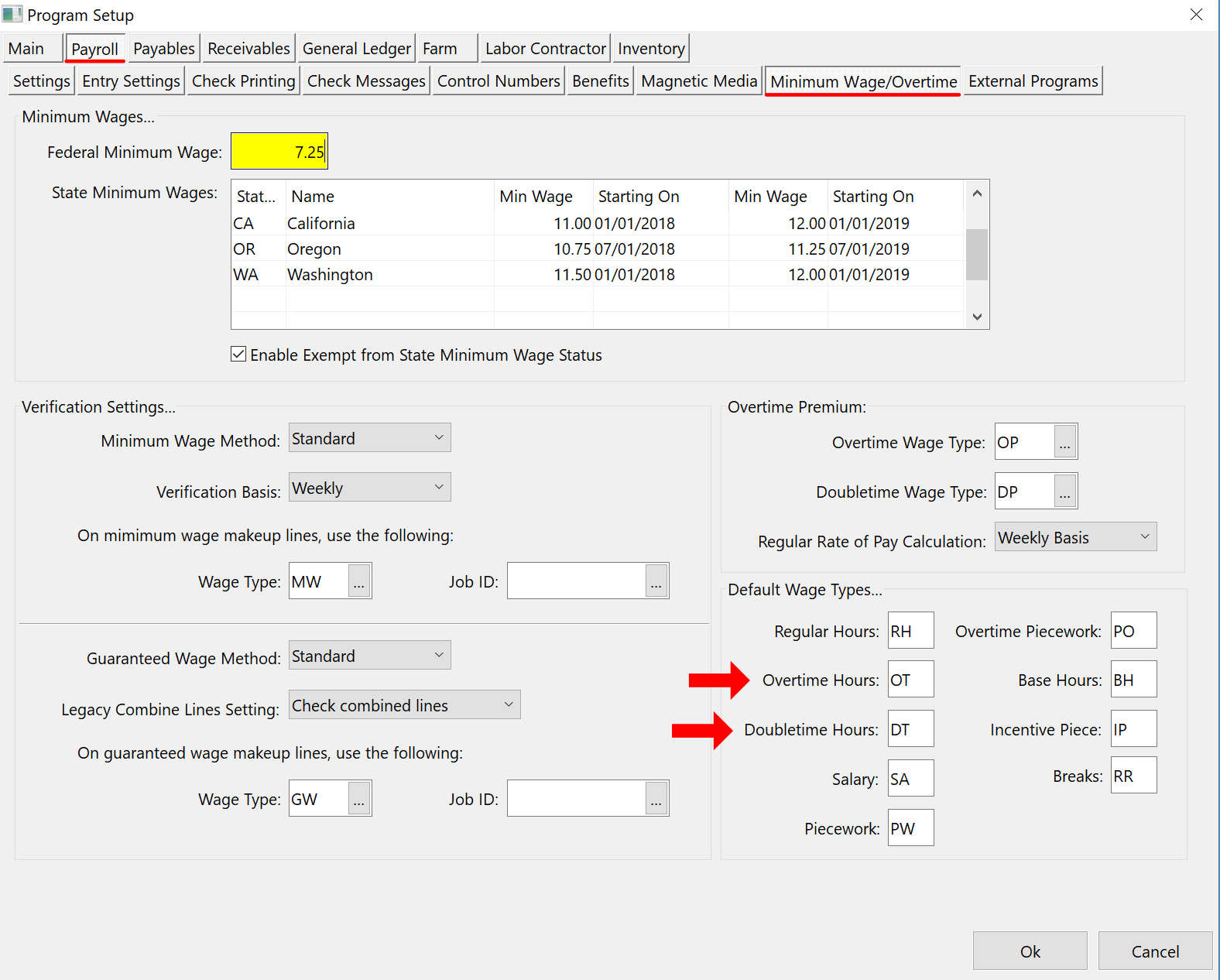

If you set up or imported your own codes from another software, you may need to edit the Wage Types the software will use when it creates overtime entries. To review and edit the wage types that will be used for overtime, go to Tools > Program Setup > Payroll tab > Minimum Wage/Overtime tab.

Straight Hourly Overtime

The first option is straight hourly overtime and double-time. For this, the software will use the Overtime and Double-time codes entered in the Default Wage Types section (unless you have defined codes in the Overtime Rules > Wage Types tab). This is shown in the following image:

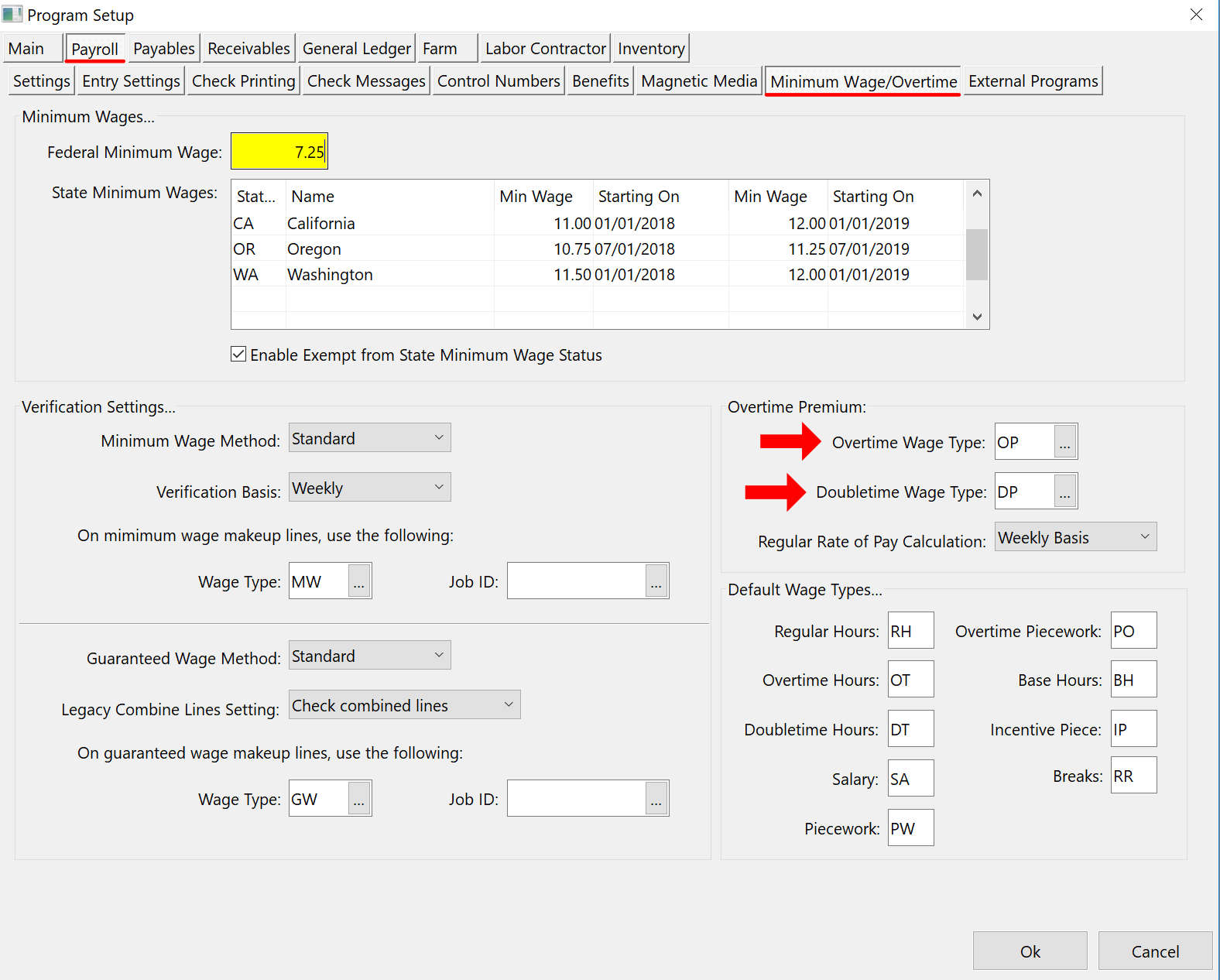

Overtime Premium

The second option is Overtime Premium for when there is more than one pay rate for the work week. The standard wage codes for this section are OP (Overtime Premium) and DP (Double-time Premium).

If you are not using the basic wage codes Datatech set up, you will need to assign a wage code used for Overtime Premium. Go to Payroll > Setup > Wage Types.

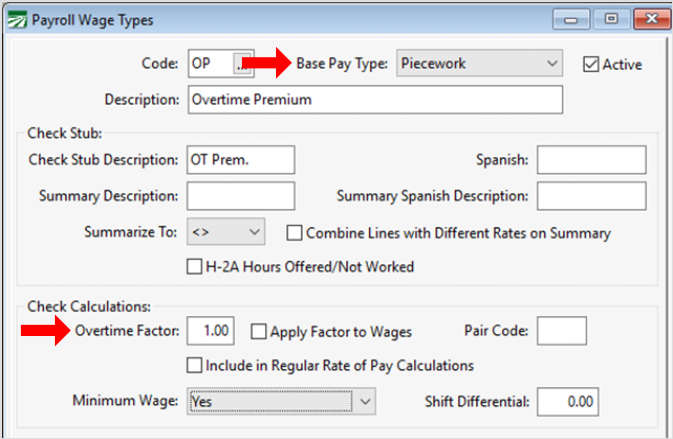

Both the Overtime and Double-time Premium should be set as follows:

-

Base Pay Type: Piecework

-

Overtime Factor: 1.00