Generate W-2 Electronic File

If you have more than 250 employees, you are required to submit your year-to-date wage report electronically instead of using paper W-2 forms. The Electronic File option generates the file needed to report your annual wages to the Social Security Administration.

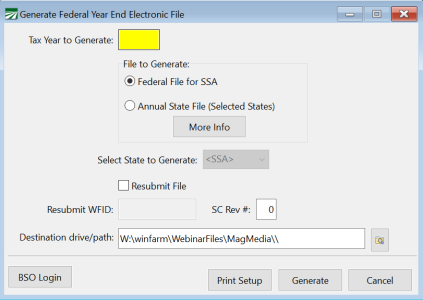

Go to Payroll > Year End Tax Reporting > Generate W-2 Electronic Files.

-

Enter the Tax Year to Generate.

-

Select the File to Generate, either

-

Federal File for SSA

or Annual State File (Selected States)

-

If you selected Annual State File, select the state to generate.

-

-

-

If you are resubmitting a file, select Resubmit File and enter the Resubmit WFID.

-

Enter the SC Rev #.

-

Click Generate.

Generate Year End Electronic File Reference

Go to Payroll > Year End Tax Reporting > Generate W-2 Electronic File.

Tax Year

Enter the tax year that you are reporting. When you enter the year, the Destination drive/path will be generated automatically for you.

File to Generate

Select either Federal File for SSA, or Annual State File. The Annual State File is used ONLY for submission to certain states, and the file must not be used for the SSA.

Select State to Generate

Enter the two-letter abbreviation for the state file you are generating. As of December 2012, three state files are supported: Arizona (AZ), Georgia (GA) and Oregon (OR).

Resubmit File

If there was a problem with your original submission, select this box to indicate that you are resubmitting the electronic file.

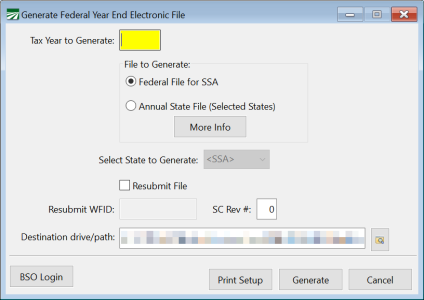

Destination drive/path

This will be automatically generated by the program. We recommend using the default path, but you can change it if necessary.

Print Setup

Click this button to select the default printer.

Generate

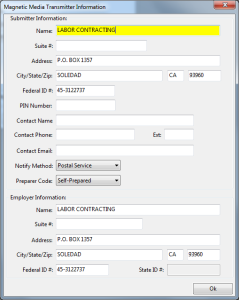

Click this button to start generating the file. Before the file is generated, the program will display the following window for you to enter your employer and submission information:

After entering and verifying the information, click the Ok button to continue.

After the file has been generated, a preview window will open listing the totals for the wage report file.

The wage report file will be named W2REPORT.TXT and it will be compressed into a file called W2REPORT.ZIP. You can upload the ZIP file to the Social Security Administration’s web site. The upload time will be shorted because the information has been compressed.

You can click on the BSO Login button at the bottom left corner of the window to open your web browser and go directly to the BSO login page.

Once you have logged in, you can upload your annual wage report file.

Using Accuwage

The Social Security Administration has a program called “Accuwage” that will read the electronic file and verify that the format of the file is valid. Click here for more information on where to access Accuwage and how to use it.