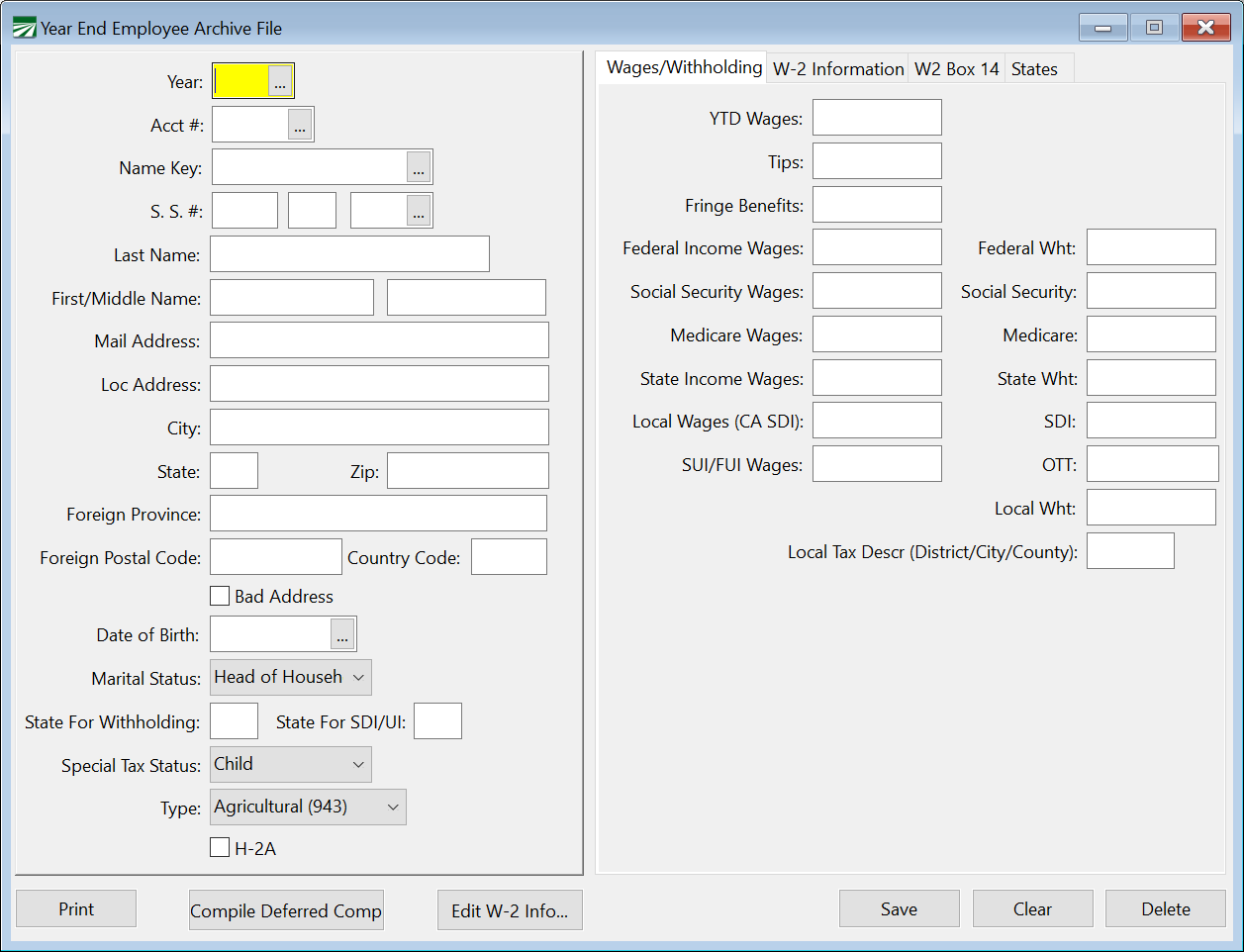

Edit YTD Employee Archive

At the end of the year, employee totals are moved to the YTD archive file. This archive file is used when printing W-2's. In addition to the YTD totals, there are several entries that are used for printing the correct information on W-2's for fringe benefits, deferred compensation, and other types of income. You may need to edit some of these fields to correctly report wages on your W-2s.

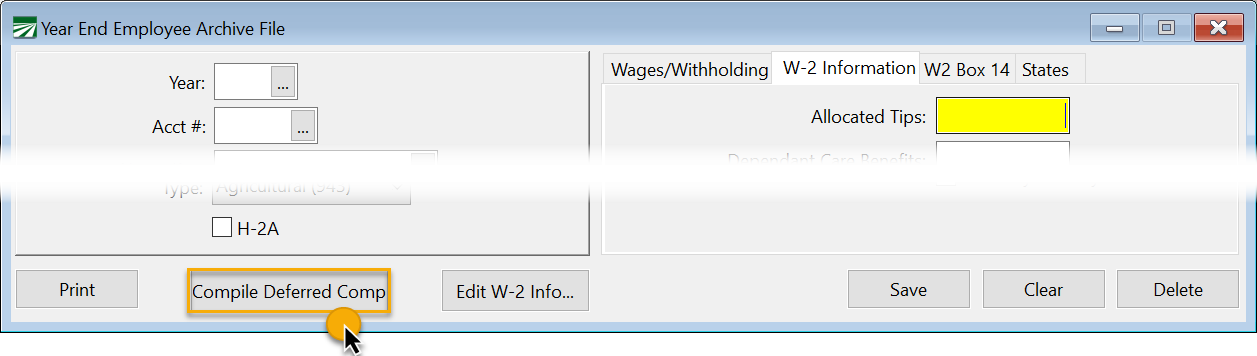

Go to Payroll > Year End Tax Reporting > Edit YTD Archive File.

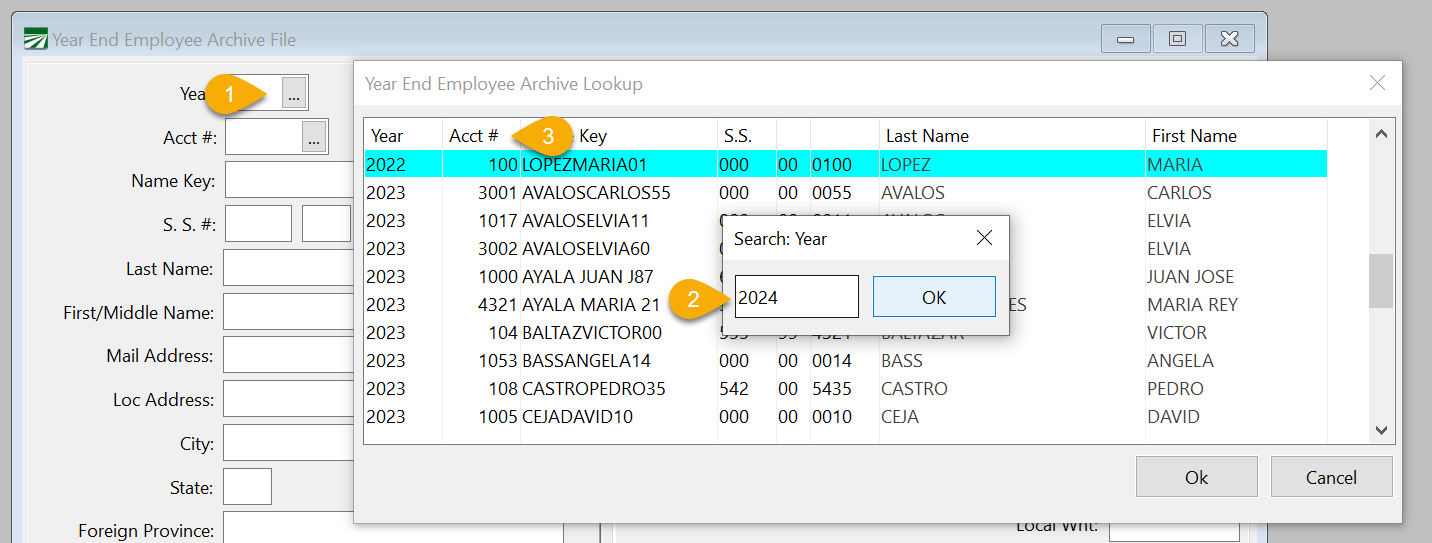

Year / Acct #

In order to access an archive record, follow these steps:

1. In the Year entry, click on the lookup button. This will open the Year End Employee Archive Lookup window. (Do not enter it manually, you must use the lookup window to select the year and employee account.

2. Enter the Year and click Ok.

3. Then, in the same window, select the employee's account, or click the Acct # header to enter the employees account number, click Ok.

Name and Address

If the name or address needs to be changed for the W-2, edit the information on this screen.

Warning Keep in mind that changes made to the name and address in the YTD Archive file does not update the main employee file. The main employee file must be changed separately.

Wages/Withholding Tab

The YTD totals from the employee accounts are saved here automatically by the program when you archive the YTD totals. You will not normally need to edit this information.

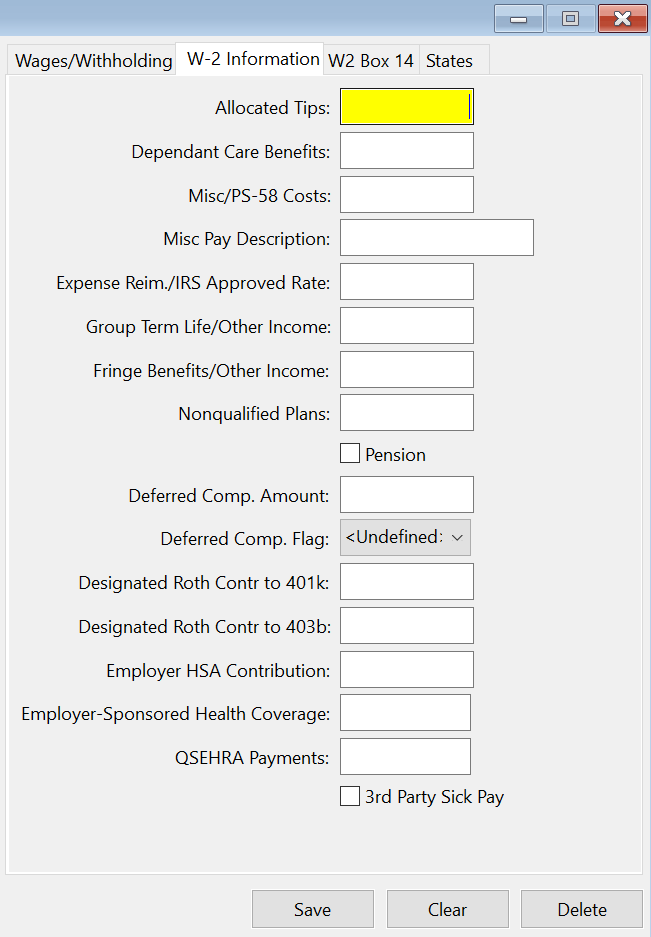

W-2 Information Tab

This tab page contains special entries for the W-2 for handling fringe benefits, deferred compensation, etc. For accurate W-2 reporting, be sure you read and understand the employer guide from the IRS that covers W-2 reporting.

Warning Reporting requirements, limits, etc. change from time to time. You must check current reporting IRS requirements each year to make sure you are in compliance. If you have any questions about W-2 reporting, please contact your accountant. Datatech support personnel cannot answer questions about your specific tax issues, but can only explain where to enter information for your W-2’s.

Tip If you need to edit the same information for multiple employees, you can use the Edit W-2 Info button. Whether you are using the window below or the grid entry screen, the descriptions of the entries that follow will be the same.

Allocated Tips

The amount entered here will print in Box 8 on the W-2.

Dependent Care Benefits

See current IRS instructions for reporting Dependent Care Benefits in Box 10.

Misc/PS-58 Costs

Misc Pay Description

The amount and description that you enter here will print in Box 14 (Other) on the W-2.

Expense Reim/IRS Appr Rate

Reimbursement of employee business expenses in excess of rates allowed by the IRS must be included in Box 1, 3 and 5. This excess reimbursement is fully taxable, but is not listed separately. However, the amount of the reimbursement which does meet IRS guidelines, which IS NOT taxable, must be listed in Box 12. To do this, enter the amount in the Expense Reim/IRS Appr Rate entry.

Note If you have any employees with Allocated Tips, Dependent Care Benefits, PS-58 Costs or Expense Reimbursements, you must enter this information in the employee archive file by editing each employee’s information. For more information on reporting of any of these items, consult the IRS instructions for W-2’s or check with your accountant.

Group Term Life/Other Income

Premiums on group term life insurance in excess of $50,000 are taxable as income and must be reported in Boxes 1, 3 and 5. In addition, this amount must be listed in Box 17. To do this, enter the amount of the premium in the Group Term Life/Other Income entry.

Fringe Benefits/Other Taxable Payments

If you have defined other income wage types, you may need to edit the employee archive file to print the other income amounts in the correct boxes. Other income may include such items as:

-

Non-cash compensation, such as company use of auto and meals.

-

Reimbursement of employee business expenses in excess of rates allowed by the IRS

-

Premiums on group term life insurance in excess of $50,000

The IRS requires different treatment for each of the above items though they are all fully taxable. This requires editing the employee archive file.

Non-cash compensation, including personal use of company auto and meals, in considered a Fringe Benefit. In addition to adding this amount to wages in Box 1, 3 and 5 (Taxable Wages, Social Security Wages, and Medicare Wages), the amount must be printed in Box 14. This is done by entering the amount for these items in the Fringe Benefits/Other Income entry.

Tip Before you close the year, if you have any fringe benefits to report, such as excess auto reimbursements or personal use of a company vehicle, be sure to include these on the last payroll check for the year as a fringe benefit. This will record the income and deduct the appropriate FICA taxes. You can adjust income tax withholding as necessary. If you want to pay the FICA tax for the employee, you can add to the gross wages with an amount entered as a bonus or piecework.

Remember: When you pay a fringe benefit on a check, you are not actually paying the employee the amount. You are recording the amount as income paid, and deducting taxes from whatever other payment is included on the check.

You cannot issue a check for fringe benefits only!

Nonqualified Plans

The amount entered here will print in box 11 on the W-2.

Pension, Deferred Comp Amt, Deferred Comp Flag

See the Pension Plans section that follows if you have a pension plan.

Designated Roth Contributions to 401k:

If you have a 401k plan that includes Roth contributions, consult IRS rules for reporting.

Tip If your Miscellaneous Deductions are already set up with the Roth Retirement Type, the program will automatically update these amounts when archiving. If your Miscellaneous Deduction does not include the Roth Code, add the code first. Then, use the "Compile Roth 401(k)" button in the Edit Additional W-2 Information window to update amounts for all employees.

Designated Roth Contributions to 403b:

If you have a 403b plan that includes Roth contributions, consult IRS rules for reporting.

Employer HSA Contribution

If you have contributed to employee Health Savings Accounts, enter the amount contributed for each employee, including any amounts deferred by employees under a Section 125 cafeteria plan. Consult IRS rules for more information.

Employer-Sponsored Health Coverage

Enter the amount, if any, of any payments made by you for employee health coverage. Consult IRS rules to see what should be included, and whether or not your company is subject to reporting. For more information, see the IRS Form W-2 reporting of employer-sponsored health coverage page.

Remember, some of the above items must be entered on a payroll check to properly record them as Other Income and deduct FICA and Federal Income Tax (and state taxes, if applicable). Once this has been done, the above editing will identify and distribute the Other Income to the correct boxes on the W-2.

After entering all W-2 information, including pension information as noted on the next page, you can print a report to check totals.

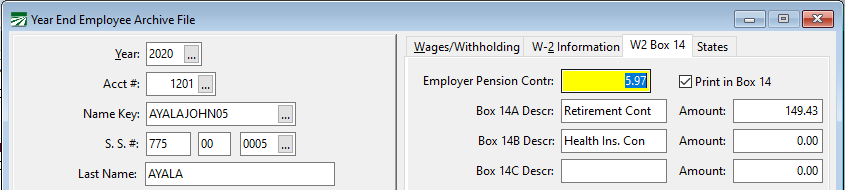

W-2 Box 14

You may also manually enter information to print in Box 14. Click the W2 Box 14 tab to view any compiled information and/or add any additional data.

Employer Pension Contr

During the YTD archive process, the software will compile the Employer Pension Contributions from check records. (Contributions will update from either the Payroll or the HR system, whichever is in use.) This will default to print in Box 14.

If you do not want employer contributions to print in Box 14, deselect the Print in Box 14 check box.

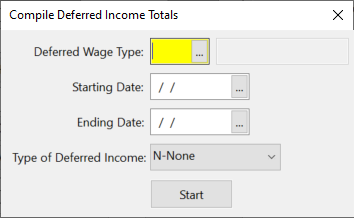

Compile Deferred Comp (Pension Plans)

If you have employees with deferred compensation, that information needs to be added to the YTD archive file before printing W-2’s or generating the federal electronic file.

Note This button is only used when you have not set up your Wage Types using the W-2 Code, Box 12 entry. If you have properly set up your wage types, this process will have been done automatically when YTD totals were archived.

If you did not set up your wage types using the W-2 Code, Box 12 entry, then using this option will update your wage types as they are entered in the Compile Deferred Income Totals window.

Employee pension contributions, which are based on salary reduction, are usually only taxable for FICA. 401K plans are usually set up in this manner.

In addition to the amount of contributions being entered in Boxes 3 and 5, the type of plan must also be identified. There are three items which must be edited using this option. They are:

1.Pension Checkbox: Select this box.

2. Deferred Compensation: Select the type of deferred compensation plan. Each plan has a letter code assigned to it which is printed on the W-2:

-

D for Section 401(k) plans

-

E for Section 403(b) plans

-

F for Section 408(k) plans

-

G for Section 457 plans

-

H for Section 501(c) plans

-

S for Section 408(p) plans

3. Deferred Compensation Amount: This is the amount that the employee deferred during the year from his/her wages.

The easiest way to compile this information is to click Compile Deferred Comp.

The program will ask for the Deferred Wage Type that you are using for the deferred compensation, the Starting and Ending Dates for the tax year, and the Type of Deferred Income. Click Start.

Note If you are unsure of the plan type, consult your accountant or the IRS W-2 instructions. Datatech is unable to advise you on your deferred income type.

The program will then compile the amounts that each employee has deferred, enter them in the archive file, and set the correct deferred compensation plan type.

On the Archive File window, select an employee that is on this pension plan. Click on the W-2 Information tab. Confirm that the Pension box is checked, there is an amount in the Deferred Comp Amount box, and that the Deferred Comp Flag is set to the deferred income type. The amounts will now be correctly reported on W-2's.

Note If you are using the Other Income Wage Type for Deferred Compensation, you cannot enter any other type of income using this wage type. The program must assume that all wages entered in Other Income are wages deferred and will so classify them in Box 12 of the W-2.

Note If your employees are covered by a pension plan, but they do not defer wages, you must still select the Pension checkbox for each employee covered but select "None" for the Deferred Compensation Flag.

Edit W-2 Info... (Multiple Employees)

You can use the Edit Additional W-2 Information window to edit multiple employees in a grid, instead of one at a time.

See Topic: Edit Additional W-2 Information