Printing Cash Basis Financial Reports While Operating on Accrual Basis

While operating on an accrual basis, financial reports can still be printed on a cash basis method. The program’s process for calculating account balances includes:

-

Retained Earnings: When closing entries are generated, the software posts both a closing entry for the profit/loss based on accrual and a second entry based on cash. When a balance sheet is printed based on cash basis, the program will pull from the cash closing entries.

-

A/R: For accounts receivable, the accrual basis system automatically records invoices as income for the year in which they are entered. When cash basis is used for accounts receivable, the program does the following: invoices billed in the prior year but paid in the current year are added into income for the current year; income for invoices that are unpaid as of the report date is subtracted.

-

A/P: For accounts payable, the accrual basis system automatically records invoices as expenses for the year in which they are entered. When cash basis is used for A/P, the program does the following: expenses that were invoiced in the prior year and paid in the current year are added into expenses for the current year; expenses for invoices that are unpaid as of the report date are subtracted.

Note For both A/R and A/P, the accrual balances on the Balance Sheet should zero out on a cash basis report.

-

Other Adjustments: If a general ledger (G/L) account has a cash basis account assigned, the program will also move any balance from the G/L account to the respective cash basis G/L account.

Example When running cash basis reports, a worker’s comp deposit posted to an asset account for prepaid expenses will be moved to the worker’s comp expense account.

Things to Know

In order print Cash Basis financial reports, transactions must first be generated using the Review Cash Basis Journal Transactions window.

Once the first transactions have been generated and you select Cash Basis on a financial report, the program will read from these transactions instead of adjusting balances during the report compilation process.

Cash Basis is available on most reports found in the General Ledger > Financial Reports menu.

Whenever you run cash basis financial reports, the program will re-generate cash basis transactions for the accounting records entered from the date your last fiscal year was closed to current. This can take time depending on how many transactions the program needs to generate. And if you are running several reports in a row, you may not want to wait for transactions to be generated for each report.

Therefore, there is a workaround to avoid this. This workaround should be used when (1) you are running multiple cash basis financial reports in a row; and (2) you are sure that no other users are posting anything else while you are running the financial reports.

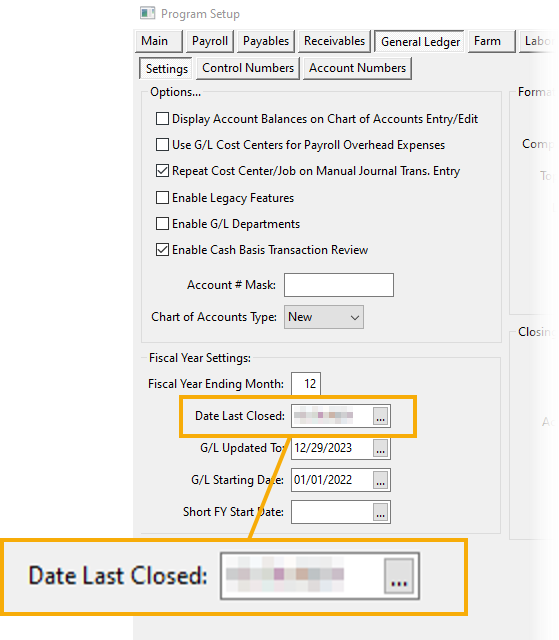

Go to Tools > Program Setup > General Ledger > Settings, and manually change the year in the Date Last Closed entry to the year for which you are running your reports. For example, if the date last closed is 12/31/2024 and you are running reports for 2025, the date should be changed to 12/31/2025.

Note When you are finished running the reports, make sure you go back to Tools > Program Setup > General Ledger > Settings and change the year for the Date Last Closed entry back to the actual last fiscal year closed. If you forget to do this and try to close the current fiscal year, the program will tell you that the year is already closed. If this happens, you can still go back and change the date and then proceed to close the current year.