Tax Liability Report

Tax Liability Report Overview

The Tax Liability Report provides detailed information on your Federal and State payroll tax liabilities. This is needed because the IRS, as well as the State of California, requires that you make periodic deposits of payroll taxes when the amounts reach a certain limit.

When you file Federal Form 941 (Regular) or Form 943 (Agricultural), you must report your tax liability for each month. If taxes exceed certain limits, then the tax liability for each of eight periods within each month.

This report will provide the breakdown you need by these eight periods for each month.

This report may be printed for any period within a calendar year. Normally you would print this report at the end of each quarter if you have Regular employees reportable on Form 941. The report will print all three months of the quarter.

For Agricultural employees, reportable on Form 943, print this report at the end of the year for all twelve months of the year.

Note Due to the rounding of amounts on each check, the totals on this report will not match tax calculations done on the total taxable wages (such as on the Wage & Tax Summary Report.)

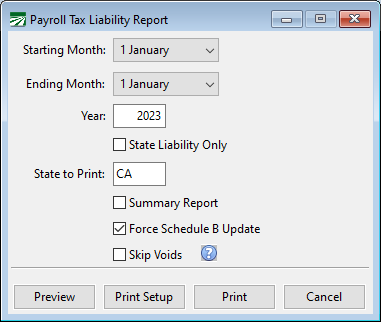

Go to Payroll > Reports > Tax Liability Report.

Starting Month / Ending Month

Select the months you want this report to include. One page will be printed for each month.

Year

Select the calendar year you want to print the report for.