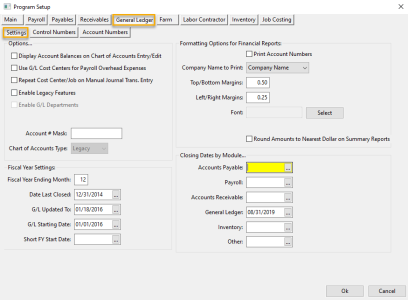

General Ledger Settings

Go to Tools > Program Setup > General Ledger > Settings.

Fiscal Year Settings

Fiscal Year Ending Month

This setting controls what the ending month is for your fiscal year.

Date Last Closed

This is the fiscal year ending date of the last fiscal year that has been closed. Once a fiscal year has been closed, the system will not allow changes on or prior to this date. A fiscal year can be re-opened by moving this date one year back.

Re-opening a fiscal year should be done carefully. When a fiscal year is re-opened, balances on accounts may be changed and any financial reports that may have been run earlier will now be out of date.

G/L Updated To

This date is maintained automatically by the system. It determines which transactions have valid running balances. Each transaction records the ending balance for the General Ledger account that it is posted to (including the amount of that transaction). Running balances on General Ledger transactions that are prior to this date will be valid.

G/L Starting Date

This date tells the system when it should start including transactions in account balances. In many cases it is necessary to post transactions prior to the starting date, but they should not be included in the running/total account balances.

For instance, checks that have not cleared the bank and that were issued prior to the starting date must be entered. In general, a starting balance is posted to Cash-in-Bank that includes these checks. But the A/P Bank Reconcilement needs individual transactions posted to the Cash-In-Bank accounts for you to select them as outstanding transactions. This means you need to have transactions entered prior to the starting date for bank reconcilement purposes only, and they should not affect the G/L account balances.

For cash basis reporting, it may be necessary to have open customer and vendor invoices posted to the G/L system prior to the G/L Starting Date. This is so that the cash basis conversion process can determine the correct income and expense accounts to post to for cash basis financial reports.

Short FY Start Date

The General Ledger system supports changing the fiscal period one time. The Fiscal Year Ending Month indicates the current ending month for your fiscal year. Normally the starting date of the fiscal year is the first of the month immediately following the last day of that month. This setting allows you to define a short fiscal year by entering

For more information refer to the Short Fiscal Year topic in the General Ledger documentation.

Account Numbers

401(k) Employer Contributions Expense