Plan Setup

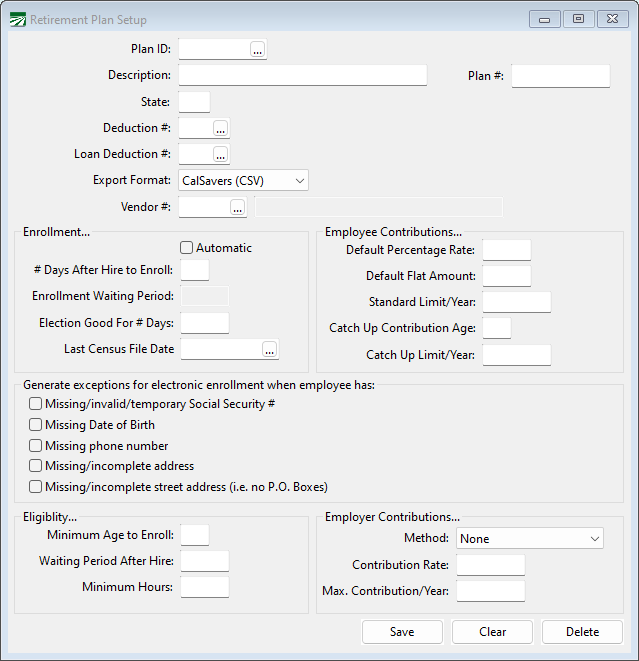

The Retirement Plan setup window is used to set up retirement plans. You’ll need to set up at least one Retirement Plan, and if you offer your employees a choice between multiple plans, you will need to enter all of them here.

Go to Retirement > Plan Setup.

Note Use the following links for assistance setting up specific plan types:

Plan ID

Enter a Plan ID. It is used to identify the plan and can be up to 8 characters.

Description

Enter a Description for this plan.

State

Enter the State for this plan.

Note If you have multi-state employees, then when you run the Employee Census the software will only include employees that have the same State for Withholding in their Employee File.

Deduction #

Select the Deduction # you set up for the plan.

Loan Deduction #

This may be used for retirement programs that allow for withdrawing funds as a loan.

Note Do not use the Loan Deduction # for state-run programs (CalSavers and OregonSaves).

Export Format

The Export formats you can choose from include:

-

CalSavers (CSV): We do not recommend using this format as it allows for errors to be uploaded to CalSavers.

-

CalSavers (XLSX): This is the format we recommend as it will not allow any errors/ incomplete records to be uploaded to CalSavers.

-

Empower Retirement (XLSX)

-

Payroll Deduction IRA (ACH)

-

T Rowe Price (XLSX)

-

Voya (XLSX)

Vendor #

Select the Vendor # you set up for the plan.

Enrollment

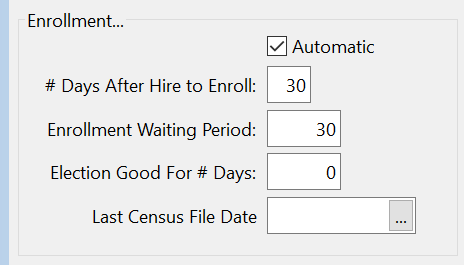

Under Enrollment:

-

Select Automatic to enroll employees automatically. This would be the case for CalSavers and OregonSaves. If you are setting up a plan that employees opt-in to, leave this setting deselected.

-

Enter # Days After Hire to Enroll. This prompt acts in a similar way to the New Hire Report reminder. The software will record when an Employee Census was last generated. If a census has not been created in 25 days since the last one, you will start receiving reminders that the Census should be generated.

This setting does not control employees that are included in the Census file, which will be covered inSee Topic: CalSavers/OregonSaves Census Export.

-

The Enrollment Waiting Period is the amount of days from when an employee is eligible to when they will start enrollment. For CalSavers/OregonSaves, once you have uploaded your census, the state program will send the employee(s) an enrollment package. The employee will be auto-enrolled after 30 days from this point if there is no action taken to opt-out.

By entering 30 days here, the program will calculate an initial Contribution Start Date when the retirement record is created. When importing your Employee Data (Contribution information), if a date is reported in column E – “Eligible for Contribution”, this date will be updated on the retirement record.

-

Election Good for # Days is not used at this time.

-

Last Census File Date will store the last date the export was generated. The software will check that the census has been run at least every 30 days to update the date stored here.

Employee Contributions

The state-run programs fall under ROTH IRA Contribution limits set by the IRS. See https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits for current contribution limits.

Note Datatech does not update these parameters automatically, and different types of plans may have different limits. As the IRS updates limits annually, you will need to adjust these settings accordingly.

If you are setting up a 401(k) or other retirement plan, check with your plan provider for the respective contribution limits of your plan.

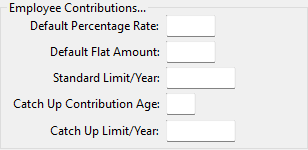

Under Employee Contributions:

-

Enter the Default Percentage Rate for the plan. For example, the default rate for CalSavers is 5%.

-

Enter the Default Flat Amount for the plan.

-

For Standard Limit/Year, enter the annual maximum contribution an employee can have withheld for the plan. The software will stop contributions if they have met this limit.

-

If the plan allows for employees over a certain age to contribute a higher amount, enter that age and respective amount under Catch Up Contribution Age & Catch Up Limit/ Year.

For example in 2023 the maximum ROTH contribution an employee under 50 can make is $6,500. Employees over 50 can contribute $7,500.

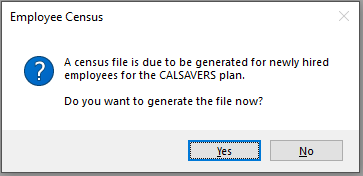

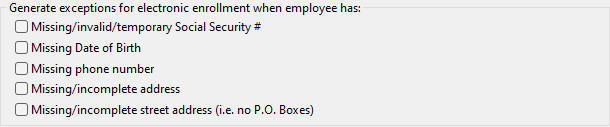

Under Generate Exceptions for Electronic Enrollment when Employee has, select any exceptions for enrollment such as:

-

Missing/invalid/temporary Social Security #

-

Missing Date of Birth

-

Missing phone number

-

Missing/ incomplete address

-

Missing/incomplete street address (i.e. no P.O. Boxes)

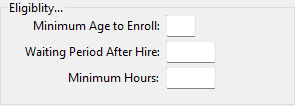

Eligibility

-

Enter the Minimum Age to Enroll. For most retirement plans, this is 18. However, be sure to check your specific plan since it can vary.

-

The Waiting Period After Hire and Minimum Hours settings are not used for state run plans since all employees are eligible to participate.

These settings may be used for other retirement plans that have eligibility requirements, i.e. length of employment and an hour requirement. The employees must meet these requirements in order to be eligible to participate in the program.

Employer Contributions

Select the Method used for calculating the employer contribution:

-

% of Deduction: This will calculate a percent of what the employee contributed.

Example If an employer matched 50% of the employee’s contribution, and the employee had $40 withheld, the employer contribution would be $20.

-

% of Wages: This setting will calculate based on the IRA/401(K) wages.

Example If you are contributing 2% of employees’ wages and the employee earned $600, the employer contribution would be $12, regardless of what/or if the employee contributed.

Note Most Wage Types in your payroll software will be included as IRA/401(k) wages. Some customers may have used wage types for non-wages (such as reimbursements) and these should not have the IRA/401(K) Wages selected. You may want to review your Wage Types if this situation applies to you.

To review your Wage Types, in Winfarm go to Payroll > Setup > Wage Types.

-

% of Wages/Match: This setting will also calculate based of a percentage of wages, but only if the employee has contributed. This would be used if the employer contributes a set percentage, but only if the employee also contributes.

-

Match Up to % of Salary

-

None - No employer contribution.

-

Nonelective %

Contribution Rate

Enter the Contribution Rate.

Maximum Contribution/Year

If applicable enter the maximum dollar amount the employer will contribute. For example, if you contribute a percentage, but no more than $3,000 per employee/per year, enter 3,000 here.

Save/Delete/Clear

-

Click Save to save the plan or changes to the plan

-

Click Delete to delete the plan (if not used yet)

-

Click Clear to clear the window without making any changes