Archive YTD Employee Totals

The Archive Year to Date Employee Totals window is used to print your year-end reports (940, 943, W-2's) at any time. This process makes a copy of all employees' Year to Date (YTD) totals. Once the totals are archived, they can be clear for the next year's payroll.

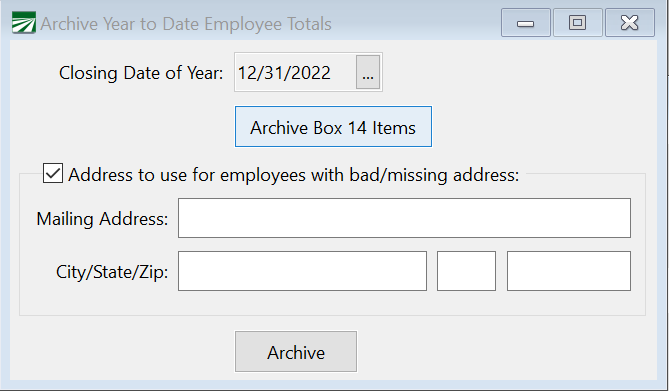

Go to Payroll > Year End Tax Reporting > Archive YTD Employee Totals.

-

Verify that the closing date of the year is correct. If you want to have the program automatically calculate entries for Box 14, complete the mapping before archiving.

-

If you select the box Address to use for employees with bad/missing address, you will be able to enter an address to substitute for employees that either have no address or who have been flagged as having a bad address.

-

Click Archive.

The names of the employees will be displayed as their totals are archived. When the process is completed, a message will be displayed showing how many employee accounts were archived.

Employer Pension Contributions

The software will compile the Employer Pension Contributions from the check records automatically when the archive is done. This will default to print in Box 14.

Currently, the software only handles employer pension contributions on pre-tax plans. If you would like to include employer pension contributions on a post-tax plan, you can manually update the contributions on the Edit W-2 Information window.

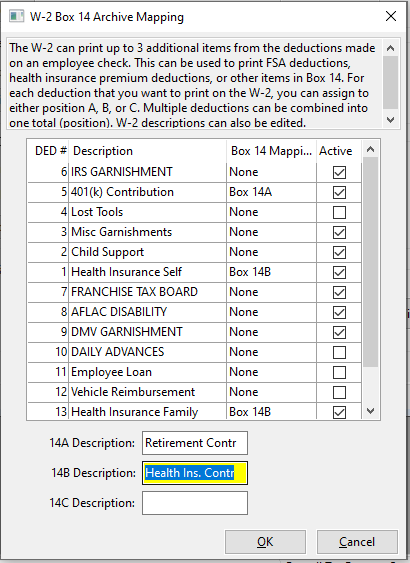

Box 14 Mapping

In addition to the Employer Pension Contributions, we have allocated 3 lines in Box 14 for printing optional information. These are coded as positions A, B, and C.

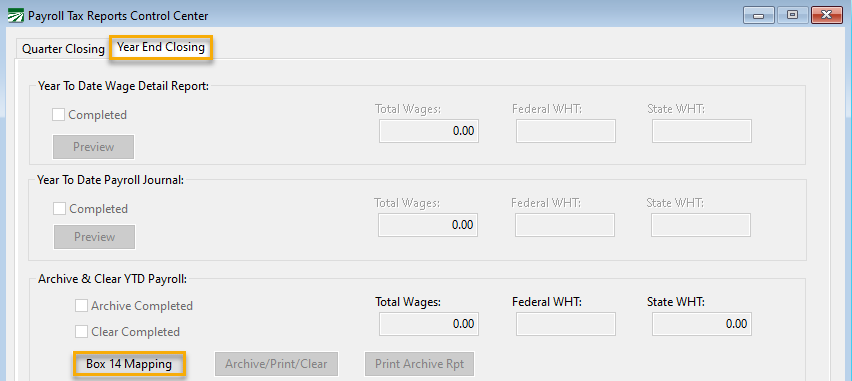

A button has been added to the Payroll Tax Reports Control Center > Year End Closing for Box 14 Mapping.

If you want to have the program automatically calculate entries for Box 14, complete the mapping before proceeding to Archive/Print/Clear/ step.

When you select Box 14 Mapping, a window will display your Miscellaneous Payroll Deductions:

For the deductions you would like included in Box 14, select the respective Mapping Box 14 A, B, or C. Then, enter the Descriptions for each category. The Description should be limited to 15 characters.

You may have multiple deductions assigned to the position. For example, you may allow employees to contribute to a 401k or ROTH IRA. As a Description, you may enter Retirement Contr and use this code for all deductions that are retirement contributions.

Another example would be printing the total of employees’ contributions to their health insurance. You may have a separate deduction for the self-coverage and one for spouse/family. You should select the same mapping for any deduction you want included in the total. The program will add any deductions assigned to the same code for one total amount to print on the W-2.

Since this information is compiled during the archive process, if you archive/clear without generating the data you would have to re-open Qtr 4/ 2020 and re-close to update the information automatically.

You may also manually enter information to print in Box 14. To do this, see Edit YTD Employee Archive.