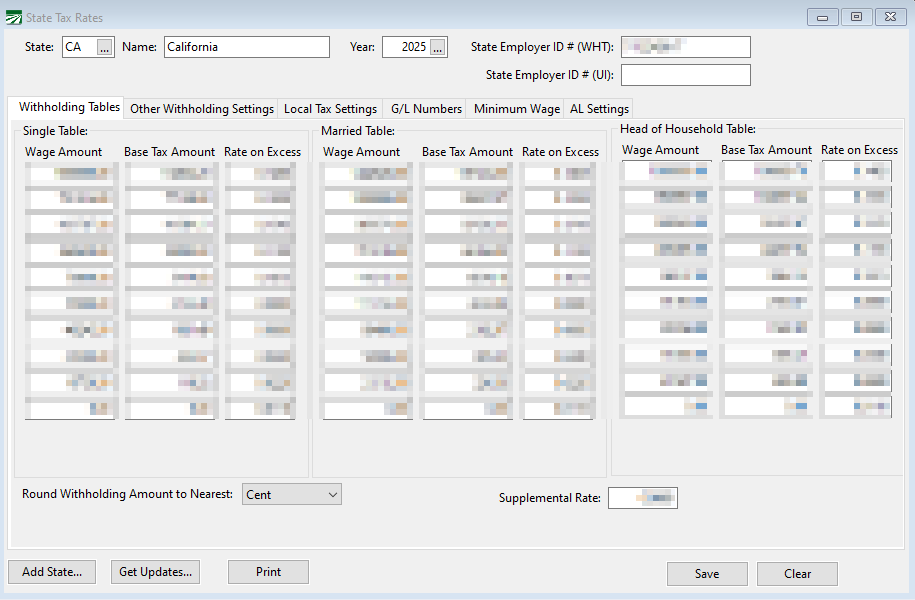

State Tax Rate Table

State Tax Rate Table Setup

The State Tax Rate file keeps track of state taxes for each year that you have payroll records. In addition, if your company employs workers in multiple states, this file can keep track of different tax rates and tables for each state.

Go to Payroll > Setup > State Tax Rate Tables.

State

Enter the two-letter postal abbreviation for the state. Click on the lookup button or press [F4] to get a list of entries in the state tax rate file.

Name

Type in the full name of the state here.

Year

Enter the year for the tax rates. Click on the lookup button or press [F4] to get a list of entries in the state tax rate file.

State Employer ID #

Enter your state employer ID number.

Withholding Tables

Single & Married Tables

The tax tables are based on the annual salary amounts. (When taxes need to be calculated, each employees pay cycle setting is used to convert these tables to a bi-weekly, weekly, monthly, etc. basis.)

Head of Household Table

Currently, not all states have a different standard deduction amount for Head of Household.

As of May 2024, Datatech Software includes the Head of Household Tax Rates Tables for the following states:

-

Alabama

-

California

-

Missouri

-

North Carolina

-

Wisconsin

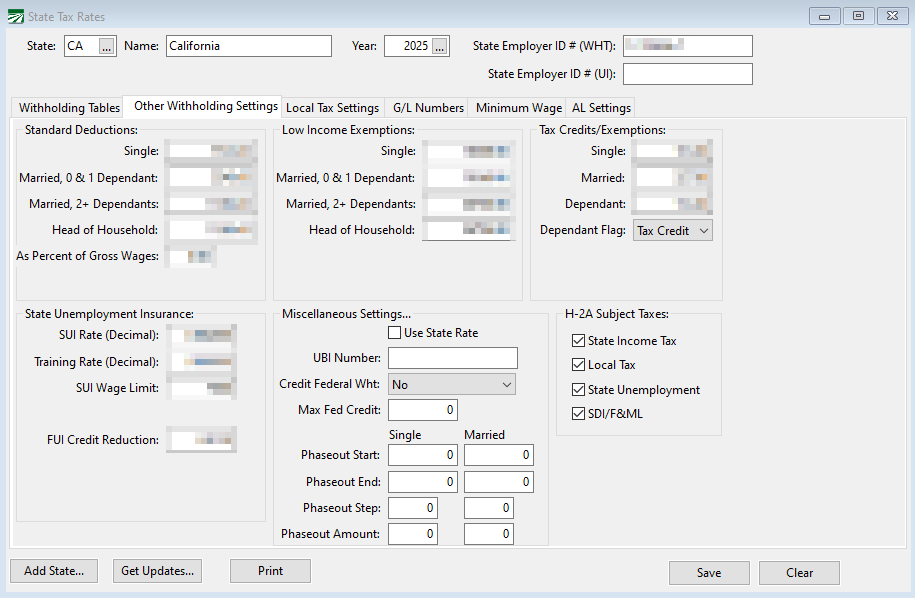

Other Withholding Settings

The Other Withholdings Settings tab contains additional information needed to calculate state withholding as well as the Low Income Exemptions, Tax Credits/ Exemptions, State Unemployment, Miscellaneous, and H-2A Subject Taxes.

Standard Deductions

Single, Married, 0/1 Dependent, Married 2+ Dependents, Head of Household

Enter the amounts of the standard deductions for each filing status.

Low Income Exemptions

Single, Married, 0/1 Dependent, Married 2+ Dependent, Head of Household

Enter the amounts of the low income exemptions (if this is used for your state tax calculations) for each filing status.

Tax Credits / Exemptions

Single, Married, Dependent

Enter the amounts of the tax credit or exemption for this state.

Dependent Flag

Indicate whether these amounts are credits or exemptions by setting the Dependent Flag accordingly.

State Unemployment Insurance

SUI Rate (Decimal)

If your state taxes the employer for unemployment insurance, enter your rate here. Since this may vary from employer to employer, this rate is not included in Datatech's end-of-year tax updates. The rate should be entered as a decimal value, not a percentage. For instance, 5.4% would be entered as 0.054.

Training Rate (Decimal)

If there is an additional training tax besides the SUI rate, enter it here.

SUI Wage Limit

Enter the limit for unemployment wages for this state.

FUI Credit Reduction

When a FUI Credit Reduction rate is entered in the State Tax Rate Table, the 940 Form will automatically mark the Credit Reduction box, calculate the amount of credit reduction, and fill out the Schedule A (Multi-State Employer and Credit Reduction Information).

You can also have the program accrue liability for the FUI credit reduction and if you are a labor contractor, include the FUI credit reduction rate in the FUI tax billed to growers. These behaviors are controlled by settings in the Program Setup window.

For more detailed instructions, click here.

Employer ID SUI

Some states use a separate ID number used for SUI reporting. If you have a separate employer ID number and SUI ID numbers, enter the SUI number here and the employer ID number above.

This entry is used for Virginia (quarterly report) and North Carolina (quarterly electronic report).

Miscellaneous Settings

Use State Rate

Select this box if the state withholding tax is calculated as a percentage of the wages or federal withholding. (This method is used in Arizona.) This will enable the State Rate entry on the Employee setup window, where you can enter the percentage of federal withholding to withhold for the state withholding.

Credit Federal Wht

Select this box if the state tax calculation includes a credit for the amount of federal income tax withheld. (This is used for Oregon.)

Max Fed Credit

Enter the maximum credit (on an annual basis) for the federal income tax credit.

UBI Number

Enter the UBI number assigned to your company.

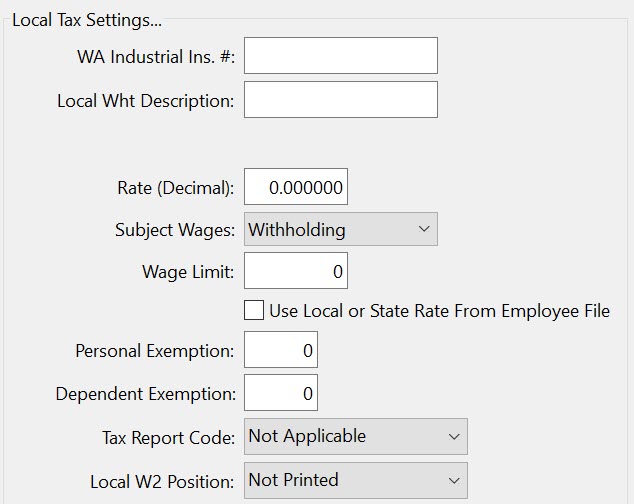

Local Tax Settings

State Disability Insurance / Paid Leave / Long Term Care

*”F&ML” is being used as a generic term for Paid Leave.

Description

Enter the description for the tax you are setting up. For example, Oregon’s Paid Leave tax would be PFL.

SDI/F&ML Tax Rate (Decimal)

Enter the total rate of the withholding tax as a decimal. The rate should be entered as a decimal, not a percentage. For instance, .5% would be entered as 0.005.

Note F&ML refers to Washington’s Family & Medical Leave, but also includes Paid Leave Oregon.

Wage Limit

Enter the wage limit for withholding this tax.

Catch Up Split

This option is no longer used.

F&ML Employee Share %

Enter the employee’s share of the rate as a percentage.

F&ML Employer Exempt

The Family & Medical Leave Employer Exempt option can be selected if you are exempt as an employer from paying the tax, but still need to collect the tax from employees.

Employee SDI Rate (Decimal)

Enter the employee SDI rate as a decimal.

Long Term Care Rate (Decimal)

If you are a Washington employer, enter the Long Term Care rate. This will begin July 2023.

YTD Calculation

Select this check box if the amounts that employees have had withheld for SDI/F&ML needs to be refunded. For example, a company may decide to use a private agency for paid leave and the employees need to be reimbursed for what they have already paid.

Note By default, this check box will not be selected for WA and OR.

Transit Tax

Rate (Decimal)

Enter the Transit Tax rate as a decimal.

Description

Enter OTT for Oregon Transit Tax.

Start Date

The start date for the Oregon Transit Tax was July 1, 2018.

County

Enter your county here.

Local Tax Settings...

WA Industrial Ins. #

Washington employers can enter your Washington L&I ID for reporting. You do not need to enter any more information in this section of the Local Tax Settings tab.

Note The rate for Washington L&I is not entered in this section. The rate is determined by the commodity that the employee is working in (e.g. vines vs. trees vs. row crops, etc…) The rate is entered under the Washington Industrial Insurance Rates table and that rate is calculated based on the hours worked, not based on wages with a wage limit cutoff.

The rest of the entries in this section are usually supplied by Datatech based on your state. Be careful when changing these entries as it can change withholding amounts.

Local Wht Description

This entry is used for states dealing with percentage-based tax. You can enter a description here that will appear on the batch check entry window and on the employee check stub.

Rate (Decimal)

This entry is based on wages and will be multiplied by wages and not hours. It must be entered as a decimal.

Note If you are using different state rates, you cannot use this entry. You will need to use the Use State Rate from Employee File box and the State Rate entry found on the employee's file under the Deductions tab.

Wage Limit

You MUST enter a wage limit when you have entered a rate in the Rate (Decimal) entry. If there is no limit entered, the program will not calculate taxes to be withheld.

Use State Rate from Employee File

If your employees are from multiple areas with different state rates, select this box. You will need to enter the rate in their Employee's file > Deductions tab > Local Tax Rate (Decimal)entry.

Worker’s Benefit Fund

Employer Rate

Enter the employer’s rate for the WBF.

Employee Rate

Enter the employee’s rate for the WBF.

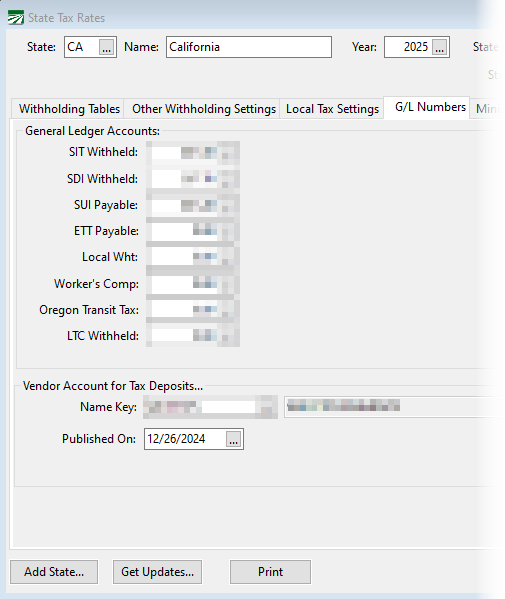

G/L Numbers

Worker’s Comp

Enter the General Ledger liability accounts for each of these payroll taxes. Each tax must have its own general ledger account. Press [F4] or click on the lookup button to get a General Ledger account selection list.

Not all account numbers are required. If you do not enter an account for the ETT Payable, then any training tax accrued will be include with the SUI amount and posted to the SUI Payable account.

If you do not have any local withholding, it is not necessary to enter an account number. Examples of local withholding are the Worker’s Benefit Fund tax in Oregon and the L&I tax in Washington.

The Worker’s Comp account is not required either. If you do not enter an account number here, then the Worker’s Comp Payable account will be used that is entered in Tools > Program Setup > General Ledger > Account Numbers. Enter an account here only if you are a multi-state employer and you want to accrue worker’s comp insurance separately for each state.

Name Key

Enter the vendor’s name key to write state tax deposit checks. (e.g. the Employment Development Department in California, or the appropriate agency in your state.)

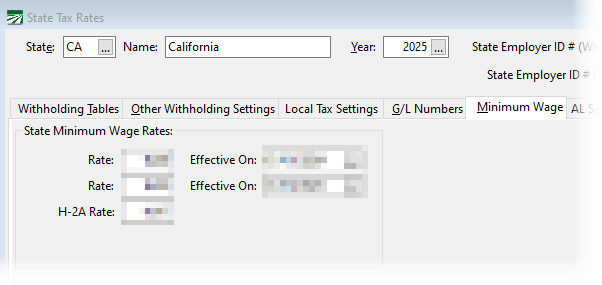

Minimum Wage

State Minimum Wage Rates

Rate / Effective On

Enter the states minimum wage and its effective date. The higher of the state minimum wage or the federal minimum wage (entered in the Program Setup window) will be used during the piecework verification process.

H-2A

Enter the minimum wage that applies to H-2A workers. (This rate will normally be included with year-end updates.)