Linking Inventory in FarmFleet to Accounting

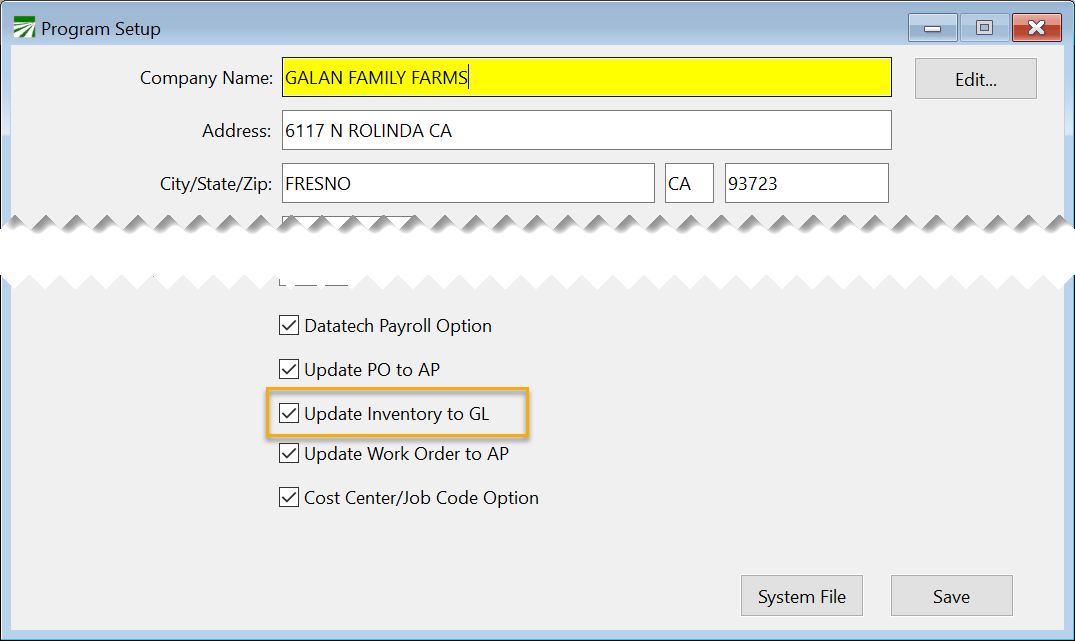

Inventory integration allows you to put the cost of a purchase order into a separate asset or expense account and then allocate cost to expenses (including cost accounting) when parts are used. To use this option, go to Tools > FarmFleet Program Setup and select Update Inventory to GL.

Setup

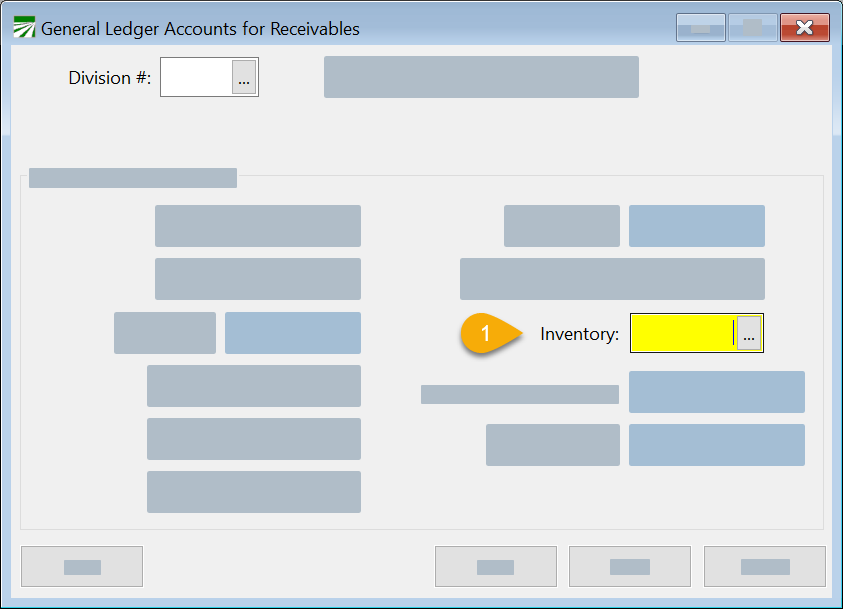

1. Go to File Maintenance > Setup > Sales Divisions. Enter the Inventory G/L account. If you are using Sales Divisions in your Datatech Accounting program, you can set up a new Division for Inventory. See Topic: Sales Divisions

Tip The most accurate way to account for inventory on hand would be to use an asset account. An asset account will carry over on your balance sheet year to year, so you always have a way of doing a physical count audit to your GL account balance. This is the recommended method.

Warning If you need to use the cash basis method, you have the option to assign an expense account in the Cash Basis Acct entry on the inventory account in your accounting software. (Go to General Ledger > Chart of Accounts > and after selecting the Account #, enter the Cash Basis Acct.)This will transfer the balance from the inventory account to the expense account in financial reports.

If you choose to use an expense account, please note that these accounts restart each year. As a result, your financial reports may not align with your physical inventory counts.

Since this method can lead to discrepancies, it should be reviewed with your accountant before proceeding. Please note that we do not recommend this approach.

2. Go to File Maintenance > Parts. Here you can set up your inventory items.

-

Add the Sales Division to this inventory item. Then, when you are entering Purchase Orders, the AP invoice created will post to the inventory account. Work Orders will reduce the inventory account for the product used.

-

Click Save.

3. Go to File Maintenance > Asset Types. Set up the G/L # PM (Scheduled Service) and the G/L# Rep (Repair/Replacement). (Additionally, you can set up Job IDs for PM and Rep if you are using cost accounting.) When Parts are entered on a Work Order, these G/L and Job IDs will be used for the expense transaction created.

4. For Cost Accounting setup, see topic: Linking Cost Accounting to FarmFleet.

Workflow

Create AP Invoice from Purchase Order

-

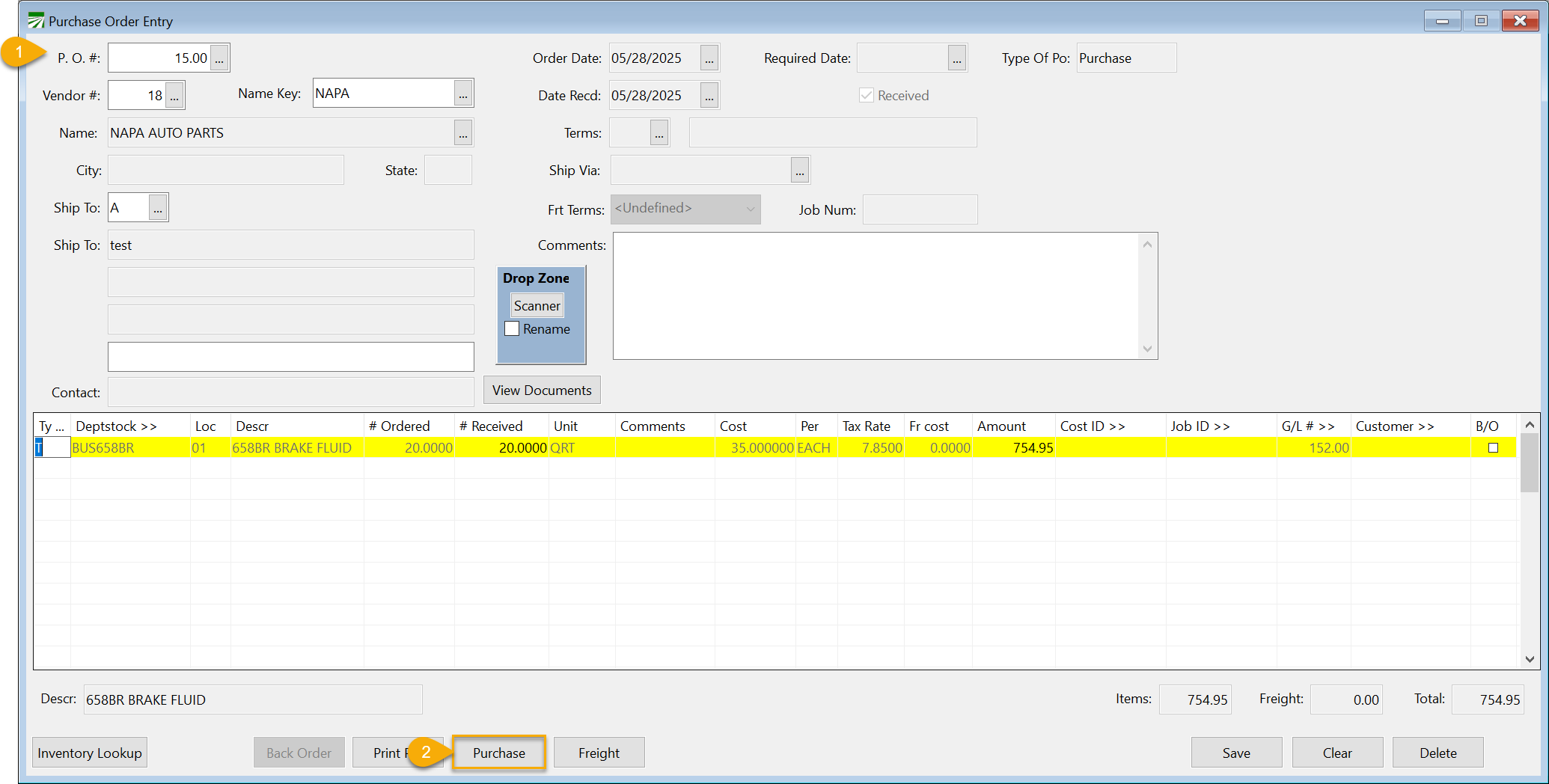

Start with a Purchase Order to add products to your inventory. Go to Data Entry > Purchase Orders > Purchase Order Entry.

-

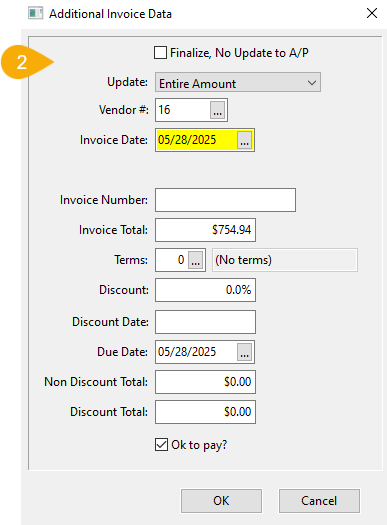

Once finished entering your order, click Purchase. Then select Yes to Finalize and update AP. Next, set the

-

Invoice Date

-

Invoice Number

-

If the sales tax calculation has created a slightly different total, you can adjust it in the Invoice Total entry.

-

Complete any other necessary information and click Ok. This will create your AP Invoice.

-

-

To see the created invoice, switch to your accounting software and go to Payables > Invoices.

-

Enter the Account # and Invoice #. (The P.O. # will match the P.O. # from your FarmFleet program.)

-

Work Order

-

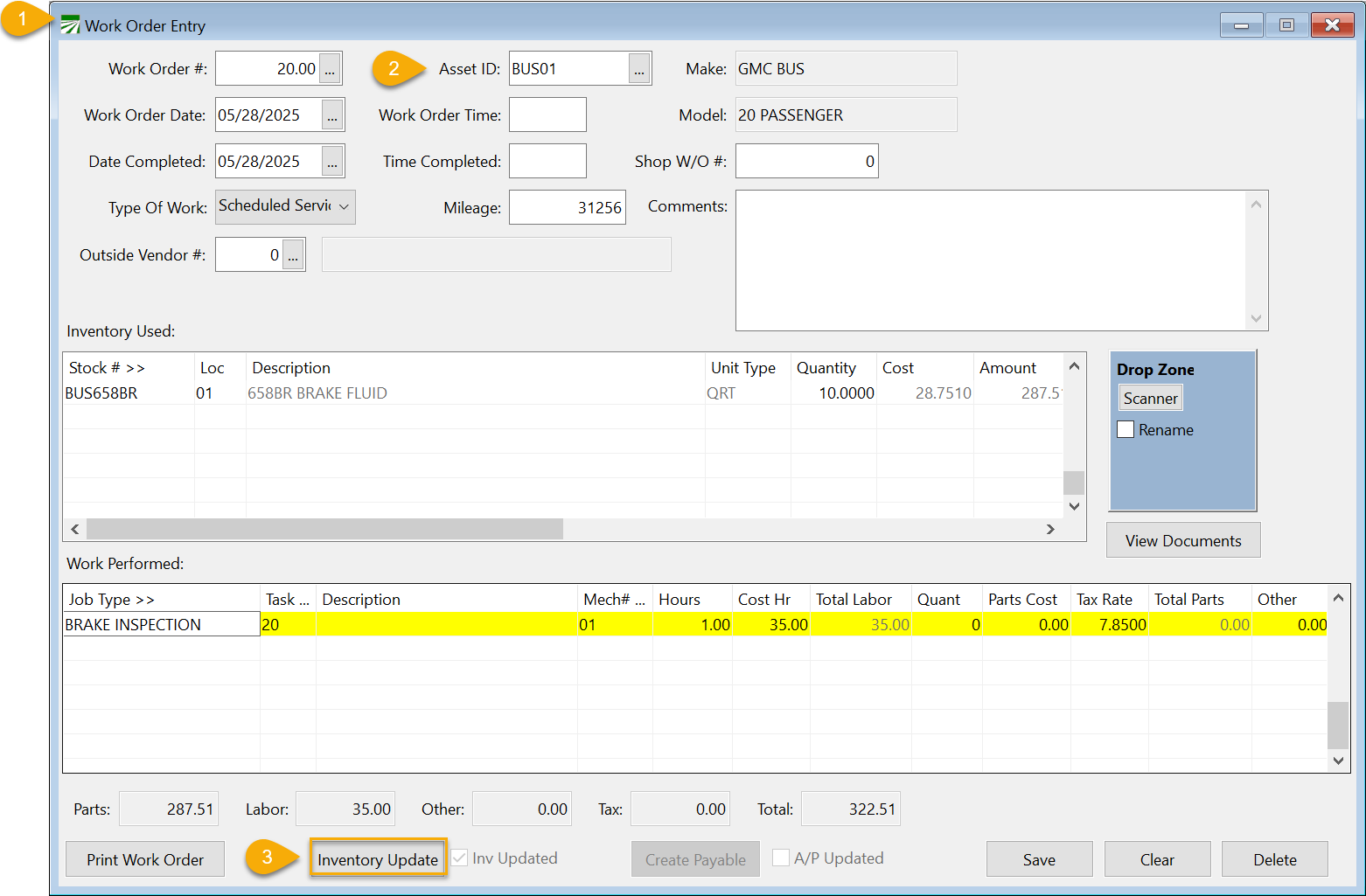

Now that we have the product in inventory, we can start the Work Order. Go to Data Entry > Work Order Entry.

-

Enter the Asset ID, along with any other necessary information.

-

As you enter the Quantity of the Inventory Used, each line will average the cost of the 'purchase' costs.

Example Maybe some filters were purchased at $25 each and others at $30, the cost will be averaged on the line.

-

-

Once you have finished entering your Work Order, click Inventory Update.

-

Click Yes to confirm updating the inventory cost to the GL.

Note This is just the parts cost, it does not include labor. Labor will be cost through payroll for in-house mechanics.

-

-

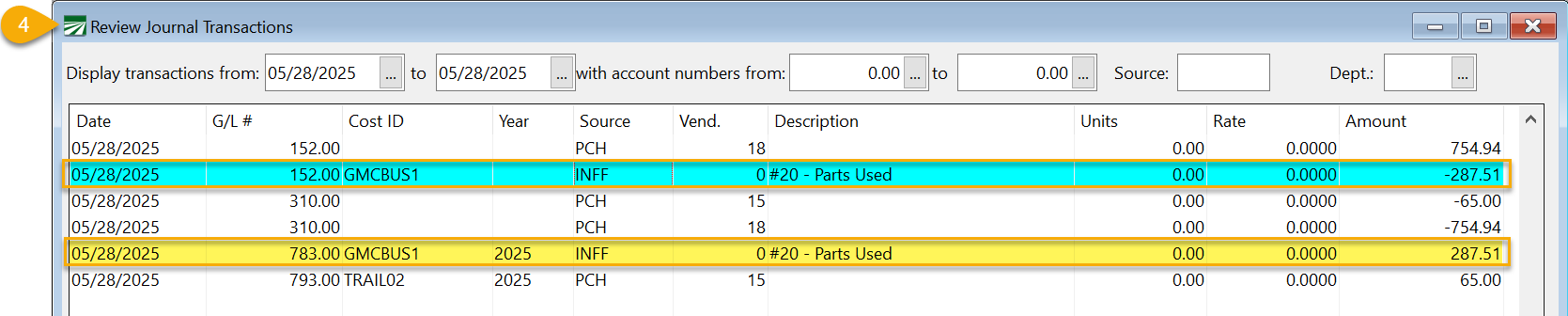

To now see the transaction, we can go to General Ledger > Transactions > Review Journal Transactions. The Source used for Work Orders from FarmFleet is INFF. You will be able to see the parts used coming out of inventory and you will be able to see the expense line that has the expense for the parts used.